In September NestEgg processed one loan application every 10 minutes. This anonymised data set provides new insights into Covid-19’s impact on lower income borrowers.

The pandemic is hitting around 1/3 of credit union members badly. But this isn’t yet showing in the credit data – there’s a lag that lenders need to be aware of.

We examined 17,000 loan decisions made since lockdown, but nothing beats speaking to people. Interestingly the credit data and peoples lived experience are out of sync.

We’ve been looking at credit bureau data was reviewed over two periods with the latter ongoing:

- Protected period: 6 months since lockdown

- Intervention period: from 23 September

Last week alone, we received responses from 500 borrowers, telling us how Coronavirus was affecting their financial wellbeing. This initial cohort of borrowers were drawn from the Midlands and Merseyside.

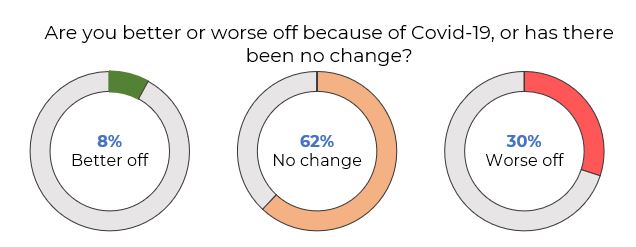

We asked borrowers to self-evaluate themselves in relation to credit scores, missed payments and credit card limit use. This is an initial subset of 500 people (out of 7,000) whose financial health we’re aiming to improve during the FCA Sandbox.

1 in 3 borrowers are worse off (and rising)

Given that the average income for respondents was £1,400 per month, it was no surprise to hear that just 8% of people were better off since lockdown. 62% had seen no change (yet).

The situation had worsened for 30% of respondents. 70% of the latter group were working.

Throughout the summer months, the top two enquiries to Citizens Advice related to being furloughed and redundancy. The problem of job losses and, resulting reductions in earned income, is only increasing. In fact, almost 2,500 people a day reported they had become redundant between June and August.

Struggling to pay bills

39% of respondents told us they were struggling to pay bills and loans. However, this rose to 55% for those whose situation had worsened due to Covid-19. The correlation between Covid-19’s adverse financial impact of and a struggle to make payments is not surprising.

Citizens Advice has found that 37% of people who have seen their income fall are nearly 9 times as likely to have fallen behind on a bill compared to those who haven’t.

But when we looked at the credit data to understand the proportion of people who had missed 2 or more payments in the last 12 months (during the protected period) we found that 1 in 4 had at least one default. Interestingly, since 23 September this has fell to 16%.

The reduction is, in part, due to borrowers taking repayment holidays which are preventing defaults that would otherwise occur.

Furthermore, many missed payments are hidden. Citizens Advice estimates that 6 million UK adults have fallen behind on at least one household bill during the pandemic. This includes 2.8m on council tax and 1.2m on rent. Neither of which appear on credit reports.

So, is Open Banking the solution? Partly. More on that below.

Using credit cards

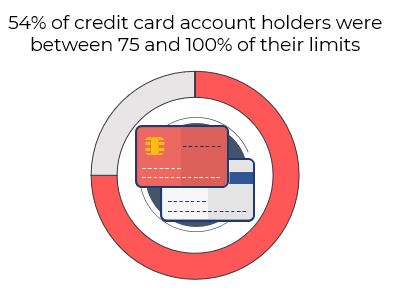

1 in 5 told us that they tended to be at their credit card and overdraft limits. This rose to one third for those who have seen a reduction in income due to Covid-19.

In fact, between 23 March and 22 September, 54% of credit card account holders were between 75 and 100% of their limits. This rose 63% between 23 September and 26 October.

In fact, between 23 March and 22 September, 54% of credit card account holders were between 75 and 100% of their limits. This rose 63% between 23 September and 26 October.

The evidence suggests that whilst waiting for tax credits or work, credit cards and overdrafts fund essential purchases.

Whilst figures from the Bank of England showed record repayment of credit card during the early phase of the pandemic, this trend isn’t uniform. Our data shows that the average income of people utilising up to 25% of their credit cards was £1,900 per month. This compared to an average income of £1,400 for people using between 75% and 100% of their limits.

Step Change Debt Charity saw a 7% increase in clients with credit card debt in August 2020, compared to 2019.

Credit score

57% of people ranked their credit score as poor. This rose to 68% for those who had seen their situation deteriorate because of Covid-19.

Since lockdown credit scores have actually improved. Payment holidays, fewer credit searches and – for most – reduced credit card spending are all factors that drive up a credit score. 85% of loan applicants had a poor credit score (under 580) in the six months after lockdown. Since 23 September, that fell slightly to 83%.

What does all this mean?

- We need to be cautious with credit data, recognising a lag between payment difficulties and these being reported. Payment holidays are delaying an inevitable rise in defaults. However the inherent delays in credit data don’t necessitate a dash for Open Banking solutions in isolation.

- The transactional data provided through Open Banking may give a more up to date view of income and expenditure, but credit data remains essential. Balances, debt ratios and missed payments can be seen with certainty rather than relying on an Open Banking algorithm to guess what’s going on.

- Those with reduced incomes are growing their credit card balances. Because of this, lenders need to be careful with loan applications for credit card consolidation. Over time fewer borrowers will be able to afford such loans in the long-run. Resetting credit card balances, might only delay an inevitable return to limits as cards are used to fund basic expenditure.

- Workers are faring worse than those whose principle income is tax credits and benefits. For many community credit unions, it’s business as usual for most borrowers (although potential cuts to tax credits are on the horizon). Attached shares provide some security. Unfortunately it seems likely that around one in five working borrowers will soon struggle to repay.

Flattening the arrears curve

These 500 respondents were a small subset of a wider group of lower-income borrowers who are testing and feeding back on our tips and advice for better financial health.

Delivered through email and / or mobile app, the tips help borrowers keep their finances on track and avoid the costly mistakes associated with Covid-19. This complements our decline to accept service.

Our evidence shows that borrowers’ problems start with loss of income. Whilst waiting for tax credits or work, credit cards and overdrafts fund essential purchases. With reduced incomes, it’s hard to make credit repayments. Arrears result. Credit scores tumble. Legal action may commence. It’s almost impossible to get credit from mainstream lenders. Consequently, more people will turn to high cost credit. Because of this any loans already made are less likely to be repaid.

Our email tips service keeps lenders in touch with borrowers. This is especially important for those who may have gone quiet since taking a repayment holiday. Better still, the email tips service is FREE of charge.

Any responsible lender can send these tips by email to their users and we’ll help them keep on top of their finances and avoid the backward steps of Covid outlined above.

Next steps

We’re one month into what we term the ‘intervention’ period. We’re continuing to survey 100s of affordable credit users to understand Covid-19’s impact on lower income borrowers…. and find the best ways to support them during the pandemic.

If all this sounds interesting, join us on one-hour webinar on Thursday 3rd December at 10am. We’ll explore the latest findings and share tactics to minimise bad debt and keep the loan book growing, including how our tips service can help. The webinar is open to anyone working to promote responsible finance, including lenders, policy makers, funders and researchers.

Please register your interest in the short form below…

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.