There are good missed payments.

That might sound counter-intuitive. No one wants to see missed payments on a credit file. But a more careful look at the data can reveal an applicant getting back on track. There are missed payments but things are improving. An accept. Not a decline.

For what many lenders consider to be an automatic decline, on closer inspection even recent missed payments don’t have to mean a ‘no’.

NestEgg’s decision engine helps responsible lenders distinguish between situations that are improving and when it is getting worse. The former could be an accept. The latter a decline and possible referral to money advice.

This functionality is offered in addition to our decline to accept service.

Overview

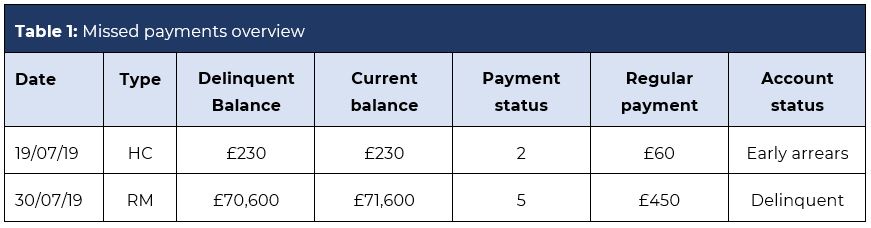

The NestEgg dashboard provides a summary table of missed payments:

- The first column provides the date the account became delinquent.

- Type refers to the kind of account, in this example, Home Credit and a Residential Mortgage.

- The Delinquent balance is the amount outstanding when the account missed its first payment and the current balance is the most recently reported amount owing. If it is the same as the delinquent balance, no attempt has been made to repay (a possible decline). If the balance is less, payments are being made (a possible accept).

- The payment status shows the number of missed payments. Account status shows flags, e.g. when an arrangement to pay has been agreed, if there’s sustained delinquency or a Debt Management Plan in place.

- The Regular payment is the amount that was due under the agreement. This may be an important consideration for any assessment of affordability. If the account is in sustained delinquency, the applicant is likely to be struggling to make the regular payment. Can they afford the loan they have applied for?

In the example above the arrears are increasing on the mortgage as interest is still being applied. Home Credit is a front-loaded agreement and so the balance is static. It’s not gone down. No attempt has been made to pay down the debt.

There are good missed payments

The table enables a Loans Officer to identify when a member is making an effort to repay a loan. Applications that are returned because of missed payments can be turned to an accept, because – overall – the applicant’s situation is improving.

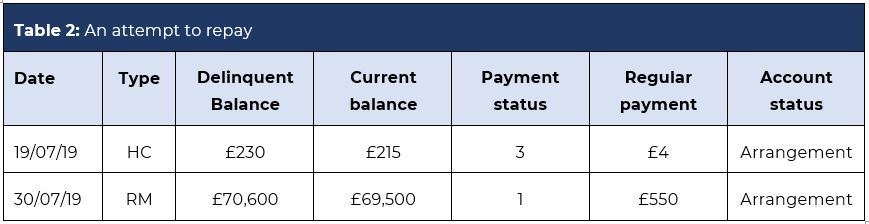

The table below shows a real case where there are missed payments but the position, overall is getting better.

The balances are less than the delinquent balance which shows that payments are being made. The status shows an arrangement is in place. The payment status on the mortgage is now 1 missed payment. Home Credit remains three behind. That’s not surprising given the debtor has probably prioritised repayment of their mortgage.

It’s worth noting that the Home Credit agreement is being repaid at £1 per week, which might indicate an informal token repayment plan. However, no Debt Management Plan is in place.

But past performance isn’t necessarily an indicator of future behaviour.

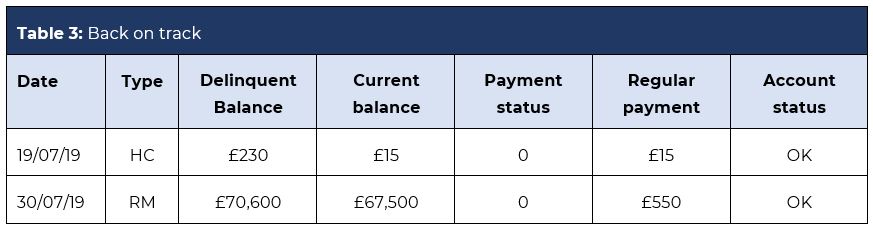

Below is an applicant that has paid off all of their arrears. The NestEgg decisions dashboard provides this information so that the history is visible. But in the case a Loan officer may be more inclined to grant a loan, even compared to someone with no missed payments. After all this applicant has been through a difficult patch and shown their intention to repay, even in difficult times.

In the example above, the balances are less than the delinquent balance which shows that payments are being made. The payment status is 0, which shows that there are no longer any missed payments. The account status is a self-explanatory, ‘OK’.

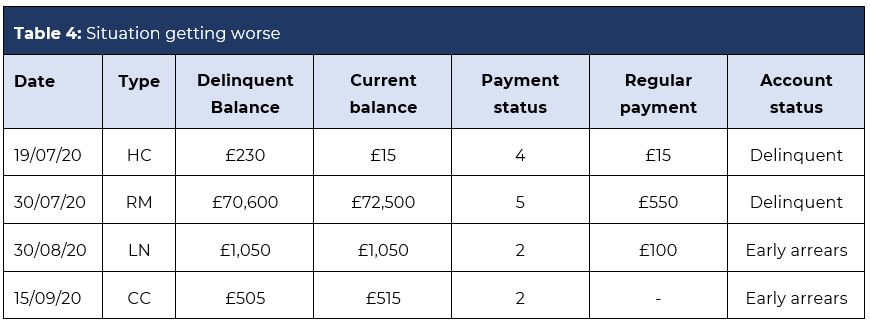

But, of course, there are bad missed payments

There will be missed payments that aren’t improving. The case below shows recent missed payments. A Current Account Turnover estimate shows that the income has fallen in the last three months. This is confirmed by Open Banking which shows the applicant has been furloughed.

A feature-rich decision engine

Missed payments are one of a number of powerful features in the NestEgg decision engine.

Decisions are tailored to meet your needs. Choose from sets of rules, including CCJs, defaults, missed payments, indebtedness and credit scores.

Open Banking provides a Financial Health Indicator using the 50/30/20 budgeting rule. Alerts are provided for gambling, high cost credit, bounced payments, debt collectors etc.

Affordability assessments are carried out, returning an indebtedness score and confirming applicant’s income and any changes in the last 3 months (important for spotting furloughed workers).

Alternative offers are automated. For example, an application for £5,000 might be delined but is accepted at £2,000

Decline to accept: Our decision engine knows why a loan is declined. Specific and relevant tips are sent to a declined applicant. They can take the required actions to visibly improve their credit profile and be accepted for a loan next time.

Front and back end integrations are available Hook up your own application forms or use NestEgg’s Decision Workflow. An open API enables integration with your core banking platform.

Get in touch to fix a demo.

Alternatively, sign-up to our email newsletter below 👇 to get lending and other insights.

And don’t forget to follow us on LinkedIn

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.