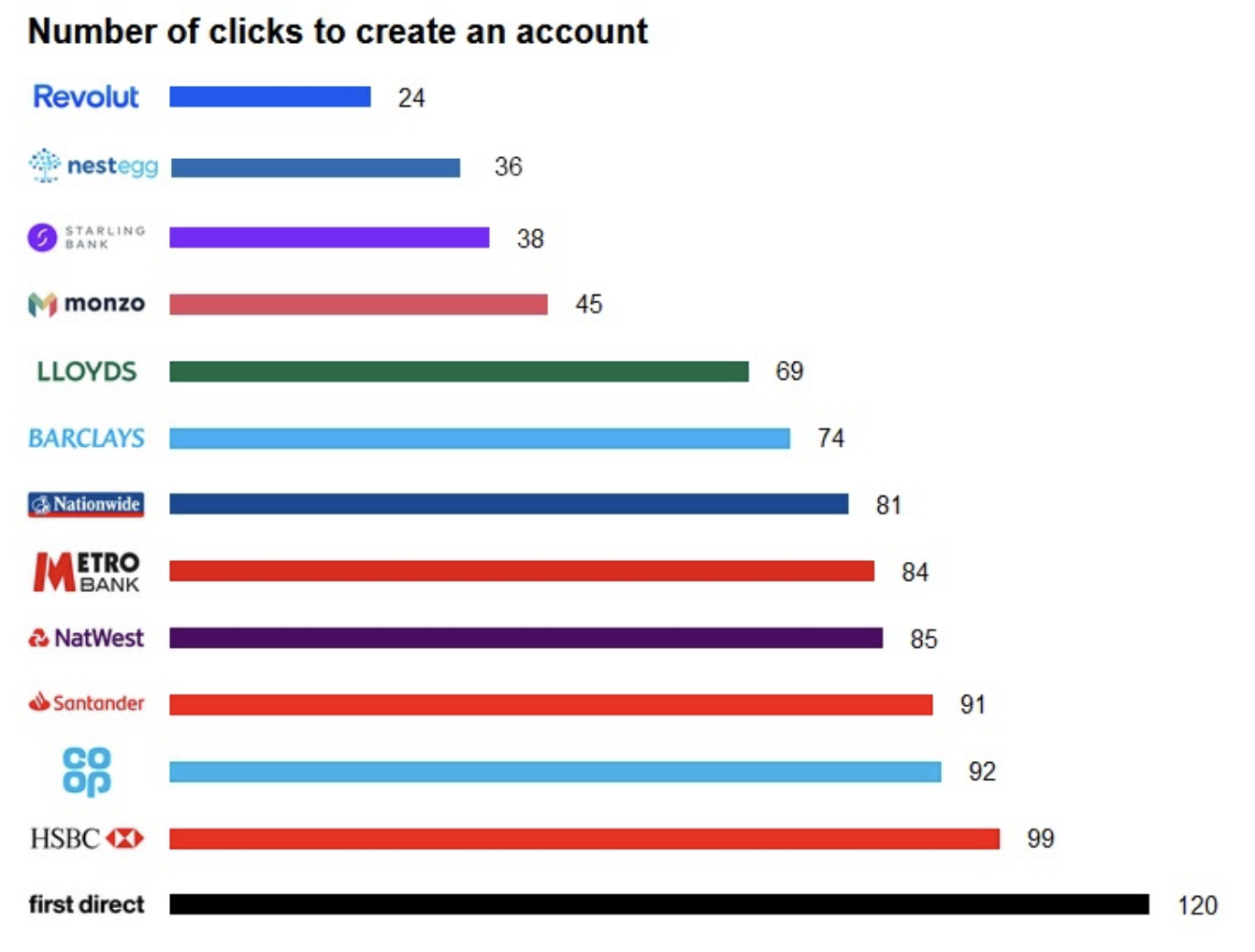

It's not easy getting people to visit your website. Don't make them jump through hoops to apply for a loan.

What happens when you ask someone who's just ordered something off Amazon with a single-click to fill out a long-winded form? Or, download a PDF, print it, fill it in, find an envelope, buy a stamp and post it?

Of course, they give up and go somewhere else!

For those applicants that can be bothered, it's time-consuming & error-prone for your team to re-key their data into your credit-checking, ID, CRM & core banking systems. Everyone loses!

Ready to find out more?

Schedule a call to discuss how the NestEgg Broker Platform can benefit your credit union

How does it work?

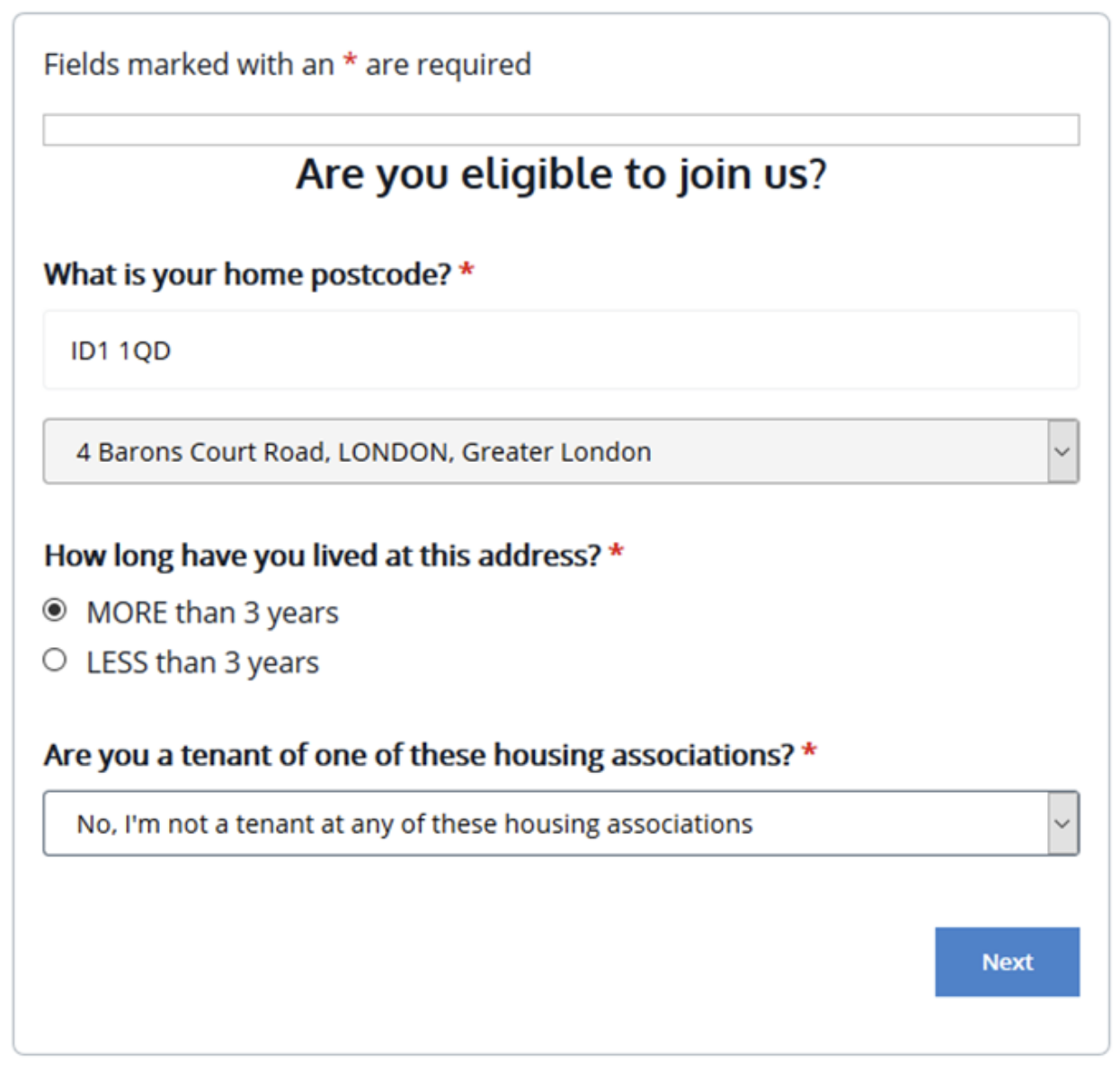

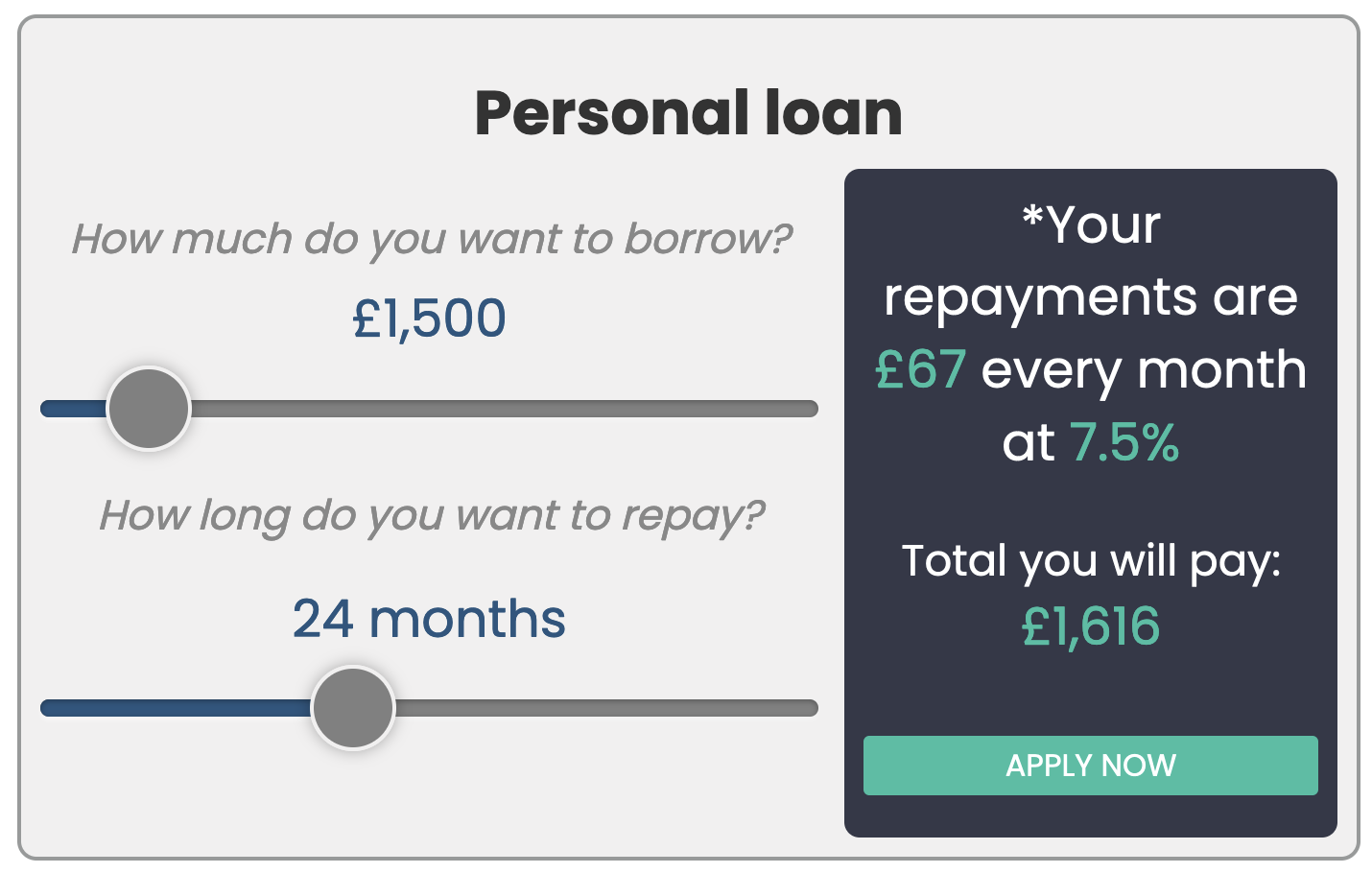

The NestEgg Workflow is a set of easy to use online application forms. Designed to make applying to take out a loan, join your organisation, or open a savings account as easy as possible.

Applicants can even apply to join and take out a loan all in one go. All with a minimum of time and hassle.

Workflow gathers the information needed for credit and identity assessment, and sends it directly to NestEgg’s decision engine. Seamlessly. Your team gets notified by email as new applications roll in.... ready for you to assess in the NestEgg dashboard.

Don't take our word for it...

Wolverhampton City Credit Union went live on Workflow in January 2021. By May, the number of applications for loans more than doubled compared to the previous year. Over the same period, the value of loan applications almost tripled.

Fewer than 5% of loans now arrive face to face. The average age of a borrower fell from 34 to 28 during the first half of 2021.

Join & borrow in one go

Research suggests 1 in 3 people abandon an online purchase because it requires them to sign up for an account first. Despite this, credit unions tend to force applicants to become a member before they can be considered for a loan.

Aside from people deterring people from applying altogether, this leads to dormant accounts for declined borrowers and additional insurance, operating and ID checking costs.

NestEgg Workflow makes it effortless for people to join & borrow at the same time. This includes common bond and ID checks.

Ready to find out more?

Schedule a call to discuss how the NestEgg Broker Platform can benefit your credit union