Transform your lending with inclusive & configurable credit decisions based on financial health.

The NestEgg decision engine combines relevant data from credit reference agencies, applicant bank accounts and your own repayment and savings history records into automated, fair and transparent credit recommendations.

Being able to zoom in on positive, negative and risk signals with a few clicks, lets you turn-around full and fair consumer lending assessments in double-quick time.

Inclusive lending

Traditional approaches to credit assessment, built in the 1980s, struggle with loan applications from people with increasingly complex financial lives.

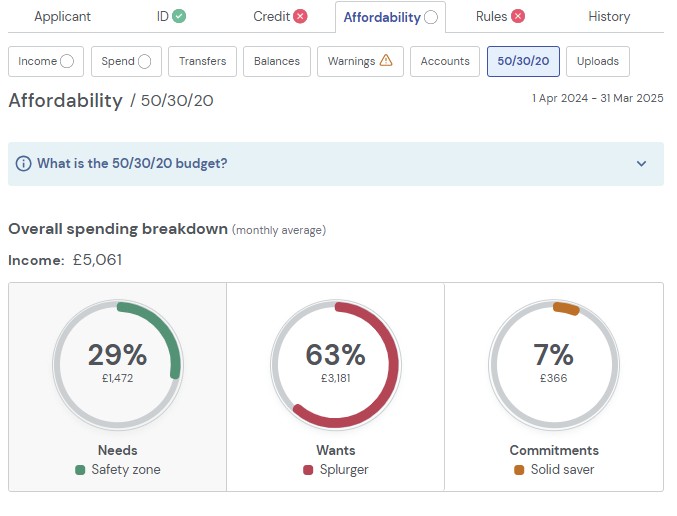

Assessing credit risk today demands a far more nuanced approach than a quick look at a credit score, missed payments & a bunch of bank statements.

NestEgg's decision engine leads to better decisions because it is based on financial health: a holistic view covering risk, indebtedness, missed payments, legal action, spending patterns, and more.

Co-designed from the ground-up with responsible lenders, the NestEgg decision engine ensures applicants get the fairest possible hearing.

Don't take our word for it...

"Our use of NestEgg has proved invaluable in assessing the affordability of any loan offer we make to a member and provides us with a tool to support the member by “nudging” them into better budgeting, helping them increase their credit score and providing a step on the path to financial stability."

Eileen Halligan, CEO, Central Liverpool Credit Union

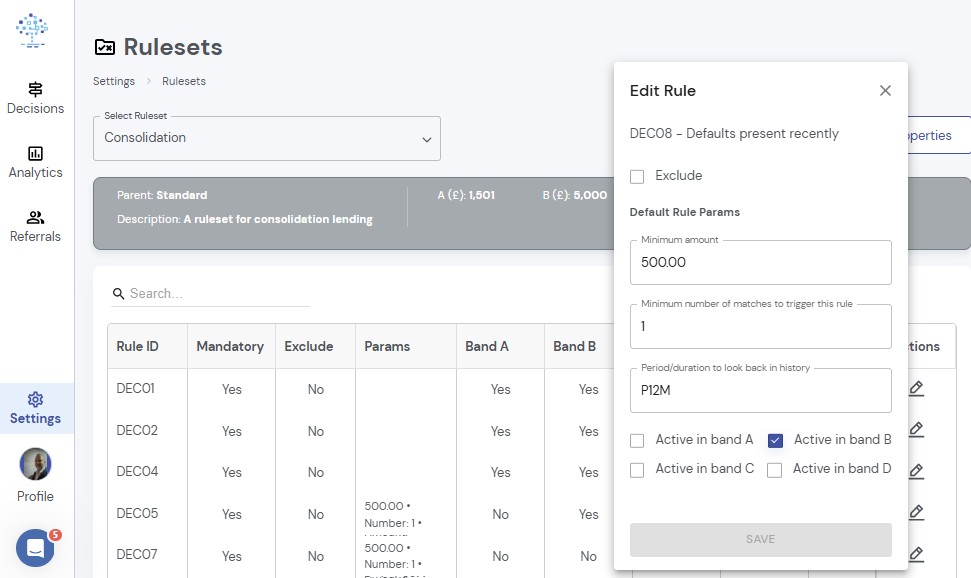

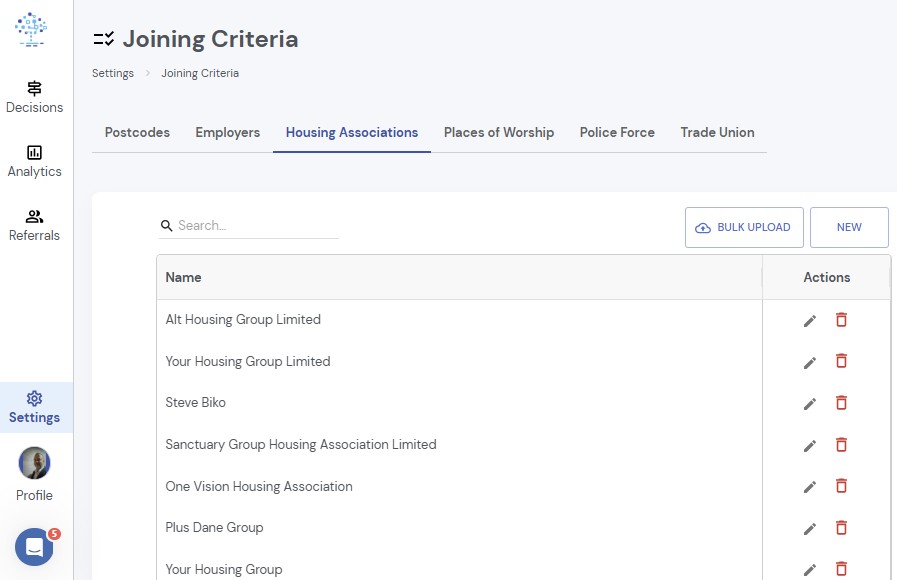

Configurable rules

It’s hard to automate lending policy. Too many applications are declined because borrowers have had financial difficulty in the past. Many lenders are struggling with decision engines where the ability to adjust rules is limited, expensive and time-consuming. Others are overwhelmed with systems that are so flexible, it can be difficult to know where to start.

NestEgg decision engine rules can be adjusted in minutes to meet your specific accept criteria and modified as you go.

Individual rules can be excluded, overriden or new ones added. We help you anticipate the impact of changing rules, making recommendations based on the £100m of loan applications assessed in 2021.

Easily align rules with your risk appetite, cater for new products (e.g. revolving credit, consolidation and car loans) and be able to react quickly to changes in the market.

Don't take our word for it...

"NestEgg has made the successful launch of our new online retail store service possible. NestEgg also gives us complete control and flexibility over our lending parameters. We know we can manage credit risk at any stage of the product life-cycle and adapt our settings within NestEgg to suit our risk appetite. NestEgg have been superb partners to work with.”

Mark White, Chief Executive Officer – Smart Money Community Bank Cymru

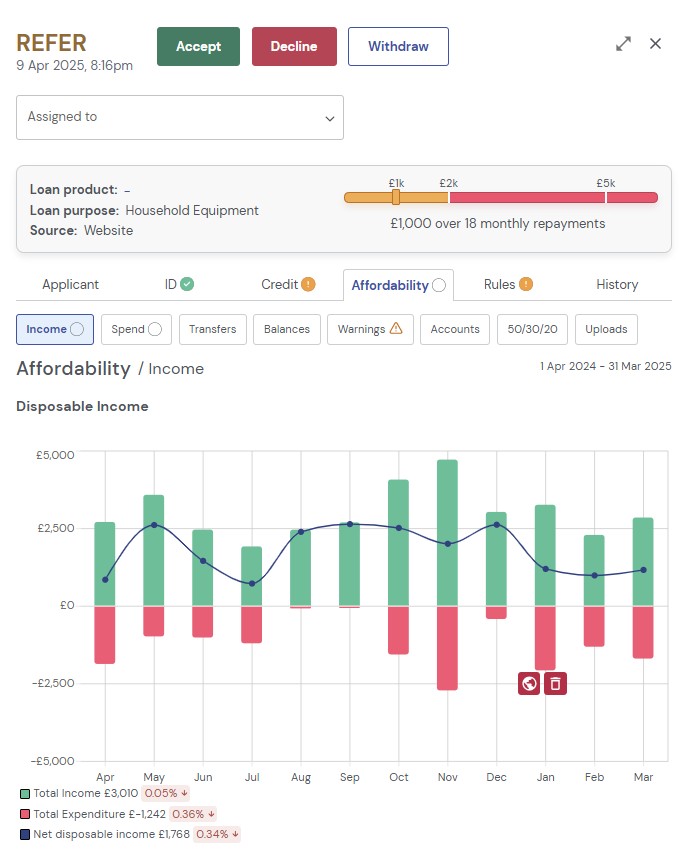

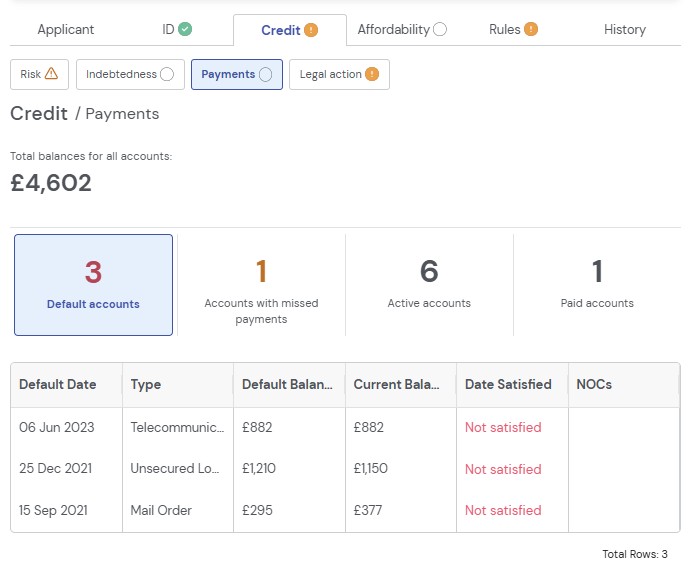

Clear & transparent

Credit assessment can be a black box for applicants and lenders alike. Loans officers often get bogged down with over-detailed credit reports or with hundreds of open banking transactions. The wood cannot be seen for the trees. Consequently, it takes longer to make the right decisions.

NestEgg surfaces the information that matters most. Risk factors can be drilled-into & assessed at a glance.

Clarity of information enables fair, fast and consistent lending decisions.

Faster turnaround

Your customers' online expectations are dictated by Amazon, Uber and Netflix. A quick glance at a typical lenders website makes it painfully obvious that lenders are struggling to keep up.

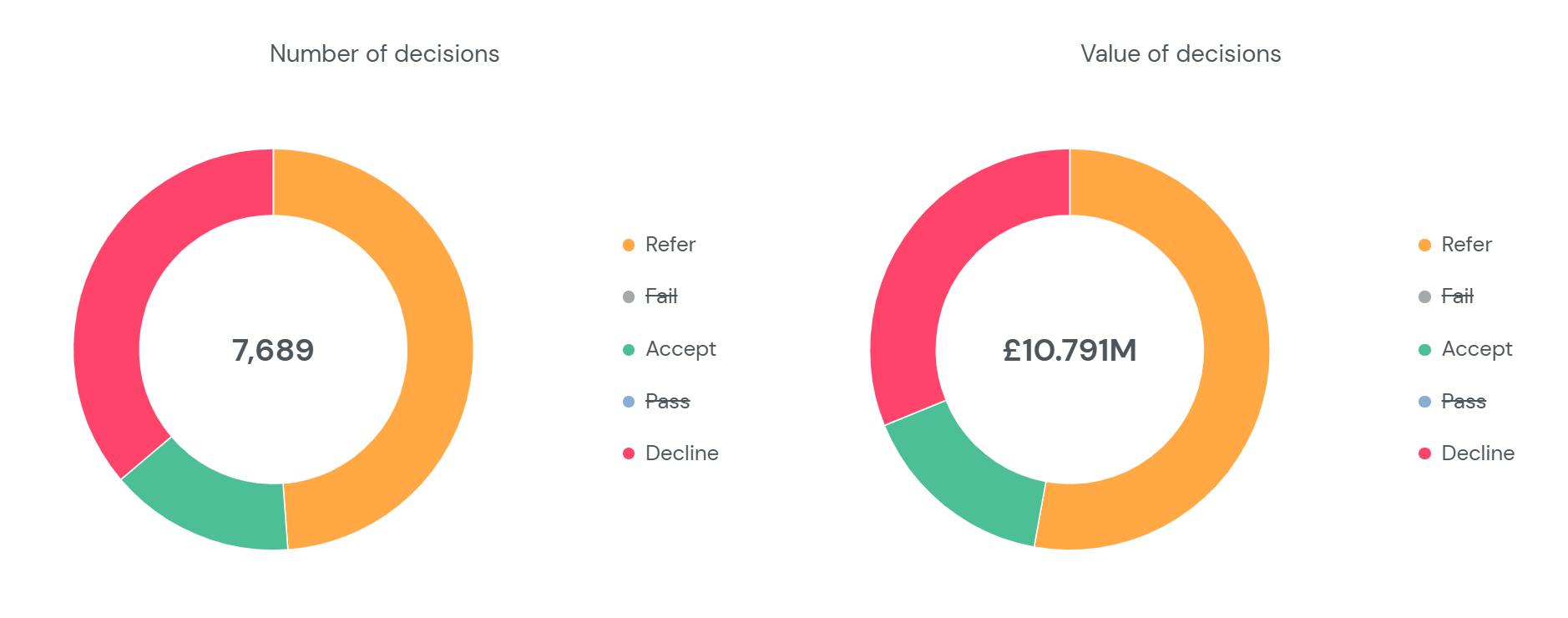

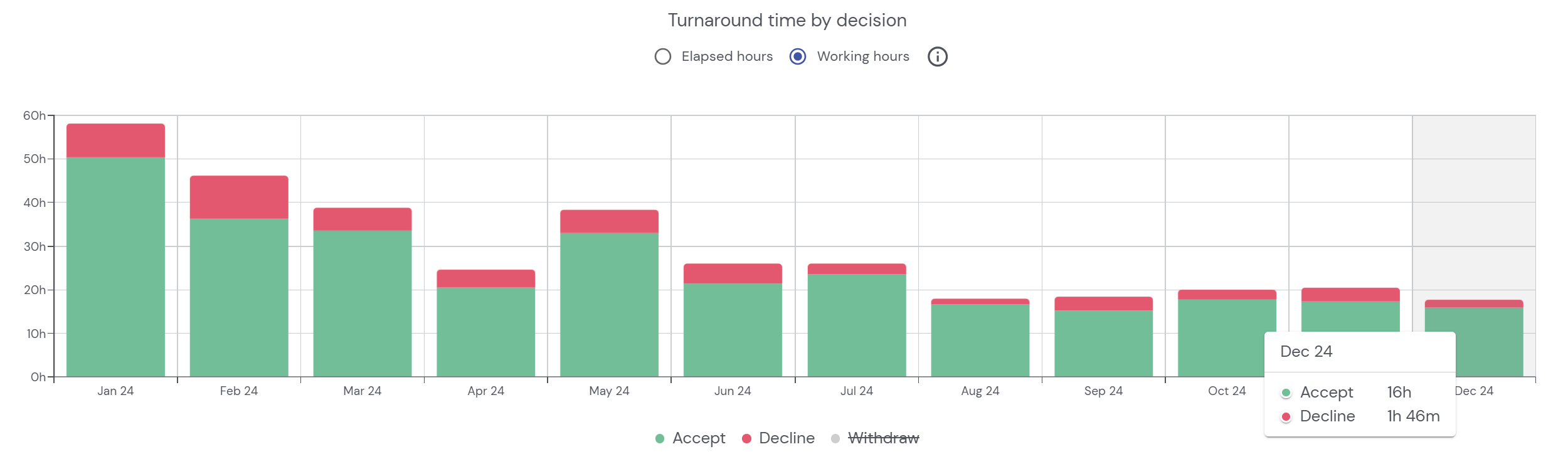

NestEgg’s decision engine makes near-instantaneous, fair and detailed decisions, configured to the level of automation you desire.

If six in ten applications are auto-accepted, that frees up significant time for referred applications and additional member service.

Better outcomes

The people affordable lenders are trying to attract can be higher risk and bad rates could be too high without the right decisioning tools.

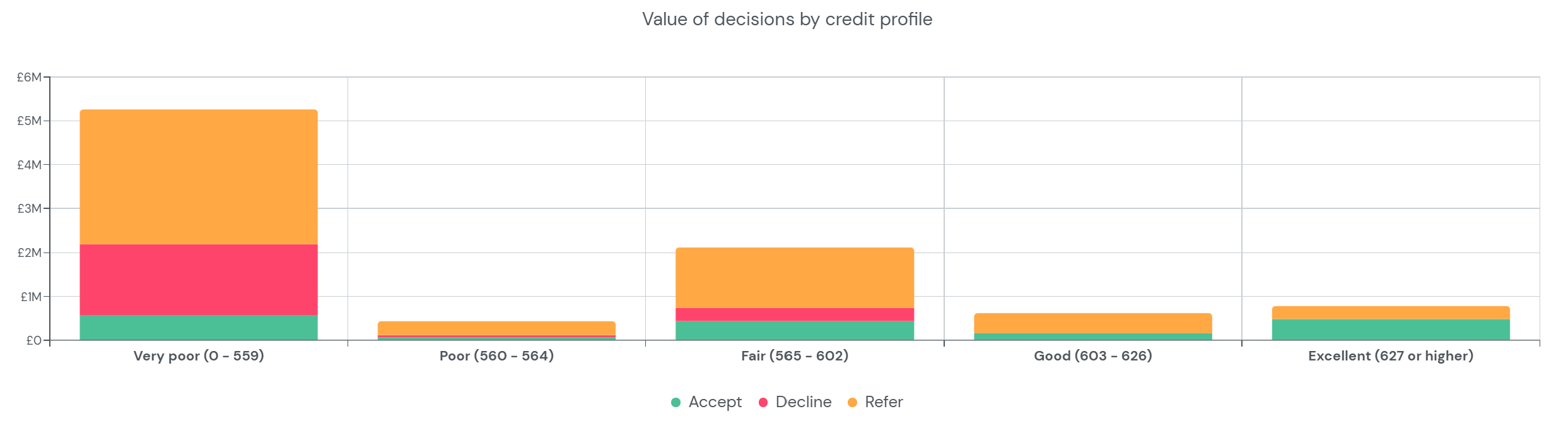

Different decision rules can be applied to different value loans to align with your delinquency targets for your overall portfolio.

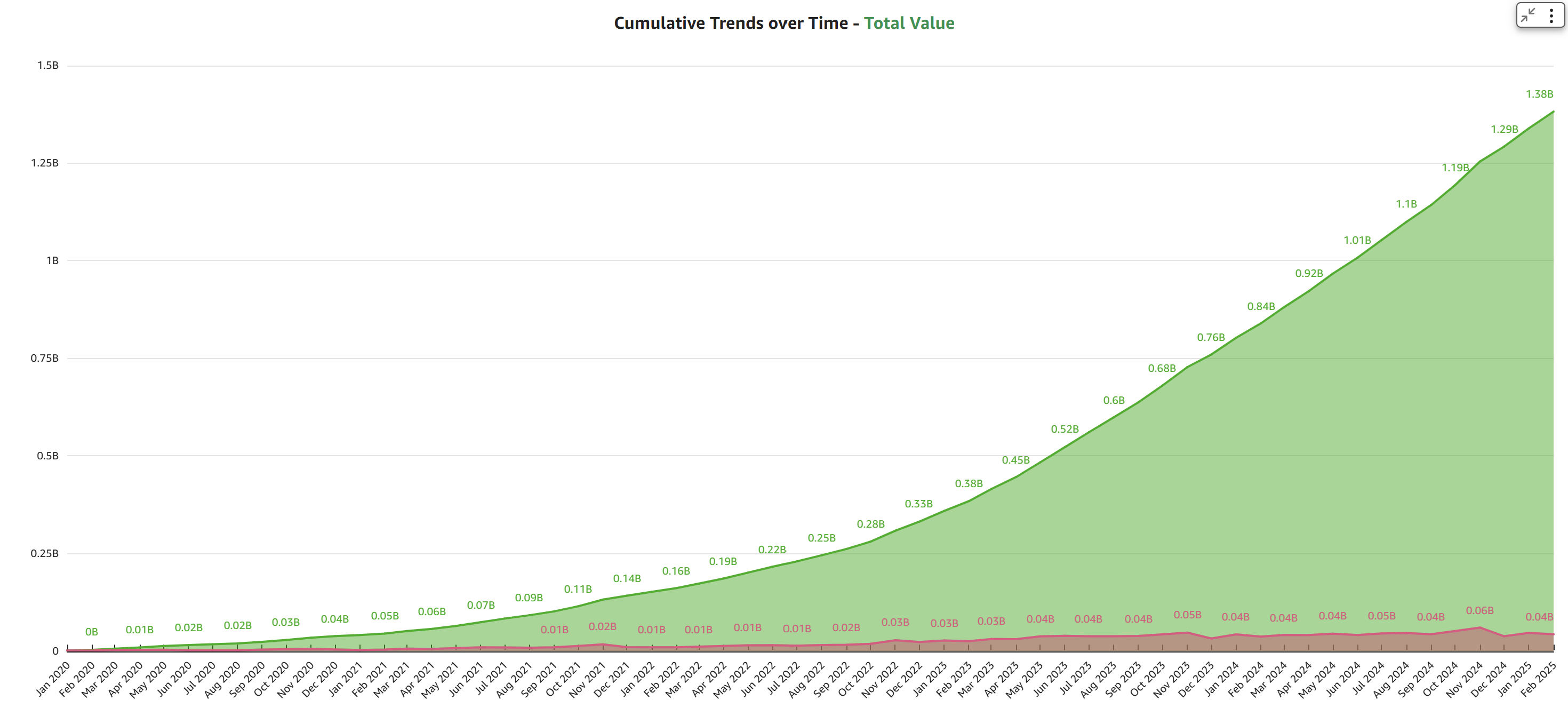

The NestEgg decision engine is based on experience with more than £100m of loans assessed in 2021.

This means you can grow your loan book without a corresponding increase in bad debt as fewer borrowers are over-indebted.

Dharminder Dhaliwal, Business & Finance Manager - Castle & Crystal Credit Union

Read the case study

See how Central Liverpool Credit Union help reduce the vulnerability of their members, 90% of whom come from the top 20% most disadvantaged areas in the UK.

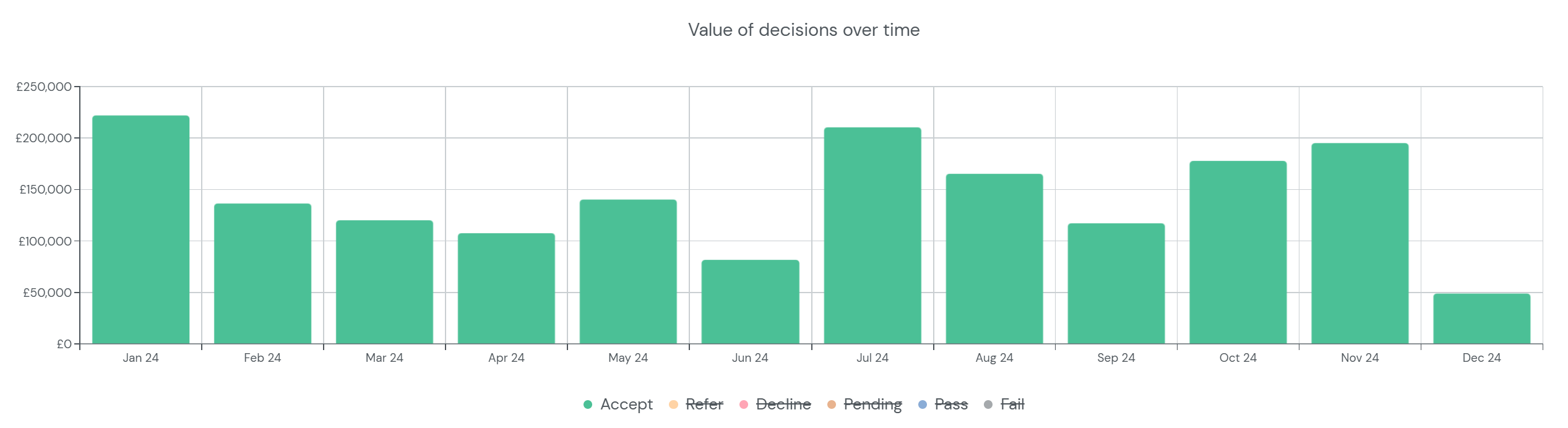

Actionable insights

Improve your lending strategy and understand more about your loan portfolio with 'at a glance' insights from analytics directly within the Decision Engine dashboard.

Fits your ecosystem

The traditional approach of technology in the responsible lending sector is one of closed 'jack-of-all trades' systems intended to lock out the competition and lock you in.

The NestEgg decision engine was designed from the ground-up to blend into the responsible lending ecosystem as seamlessly as possible. Mix and match with whatever online loan origination websites & apps you use already. Feed-in to your CRM & email marketing systems. Plug-in to your favourite core system.

As for the commercials, simply get started on a monthly subscription. Stay for as long as you want and upgrade your plan as you grow. Pay-as-you-go. If it turns out it's not for you then simply give a month's notice and no hard feelings. No lock-ins!