Stay on top of your decisions for borrowers & savers

The NestEgg dashboard is where you manage decisions for borrowers and savers - for both new and existing customers / members. While the NestEgg decision engine makes automated recommendations, the dashboard puts you firmly in the driving seat. The dashboard helps you focus on the key risk factors so you can make the right call. Every time. It runs in any modern browser like Chrome, Firefox for Edge so you can use it from anywhere.

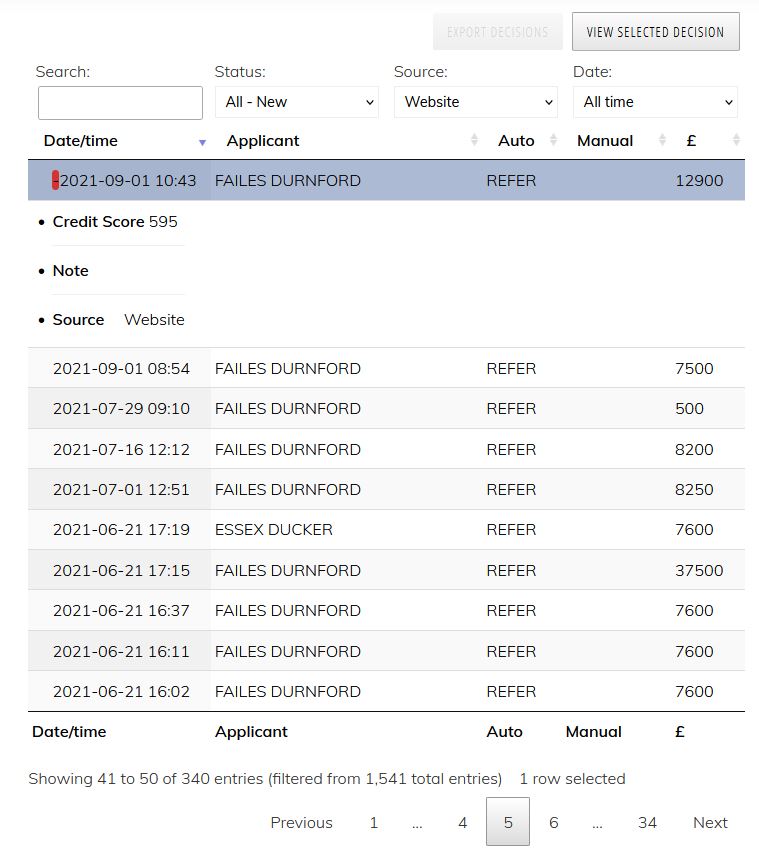

Prioritise decisions to fit your workflow

Prioritise decisions, by sorting them by date/time, applicant name, automated or manual, loan value or credit score. Decisions can also be filtered by status (new, accept, decline, ID only), the source (website, dashboard, app), date ranges and more.

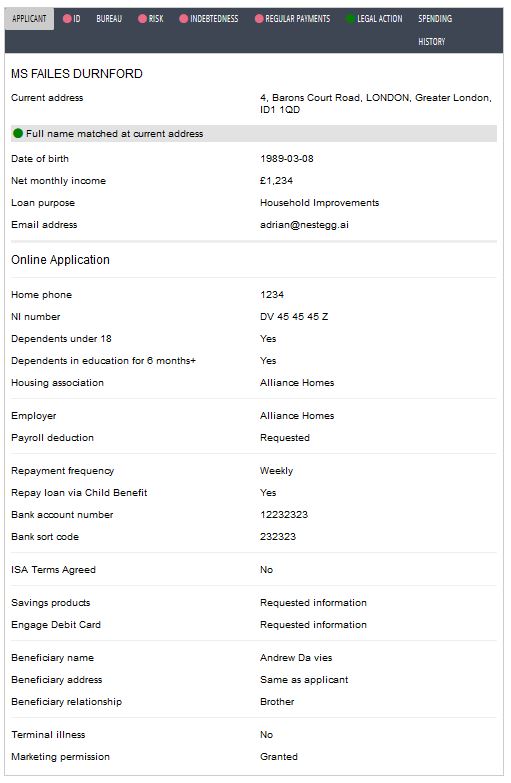

Understand an applicant

An at a glance view of the applicant. The dashboard provides the applicant’s name, address and date of birth together with details of the loan and any, additional information is displayed according to your requirements. This can include email address, place of work, bank account details, health declarations, etc.

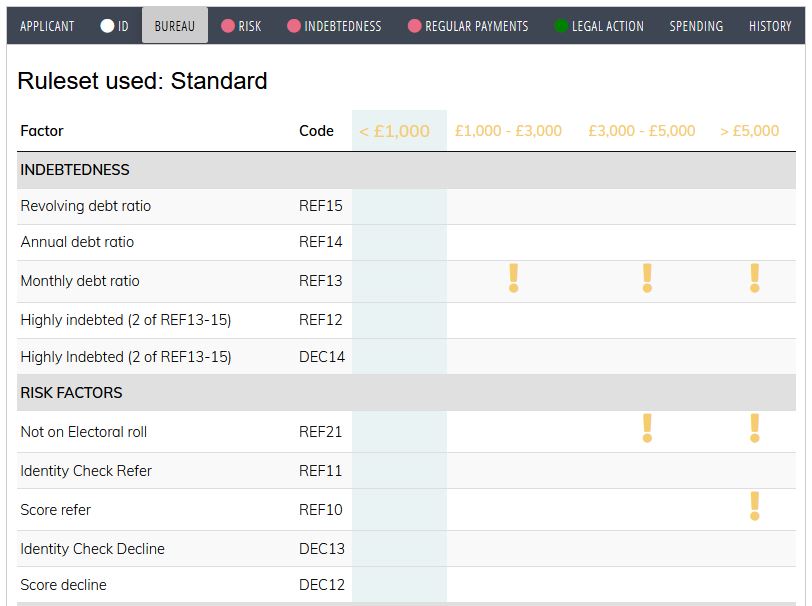

Scan decision rule breakers

Zoom in on the decision rule issues that matter most and see why loans are accepted, referred or declined according to your decision rules. An automated alternative offer is provided for applicants declined for a higher amount.

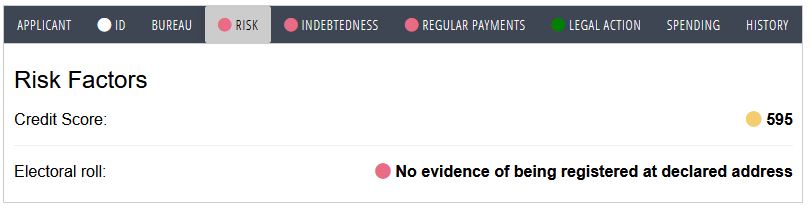

Evaluate risk factors

Effortlessly evaluate the risk of an application by viewing the TransUnion credit score and details about registration on the electoral roll.

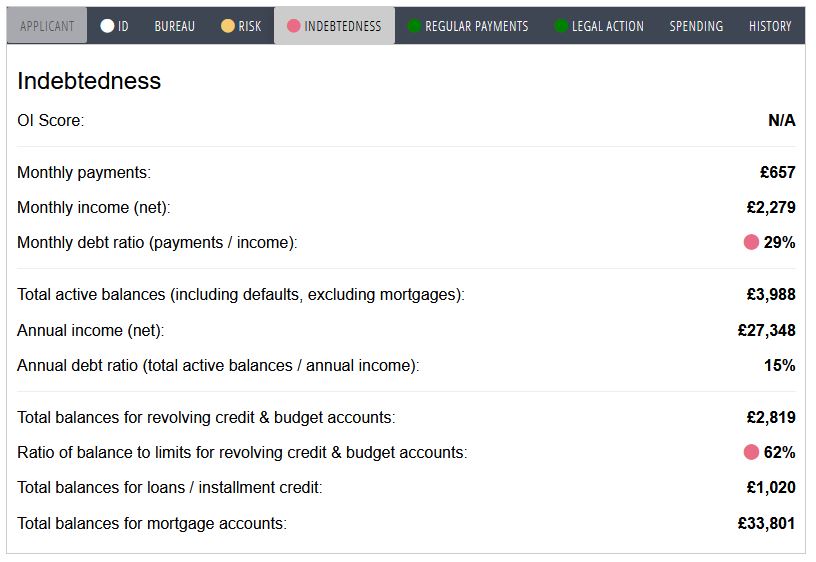

Get a grip on affordability

Better understand affordability by viewing the amount an individual owes, displayed in the form of three debt ratios.

Debt ratios are a useful way to assess whether an applicant is over-indebted. Ratios are based on the value of monthly payments to monthly income and total indebtedness compared to annual income. The decision engine also returns information about the ratio of balances to limits on revolving credit agreements, including overdrafts and credit cards.

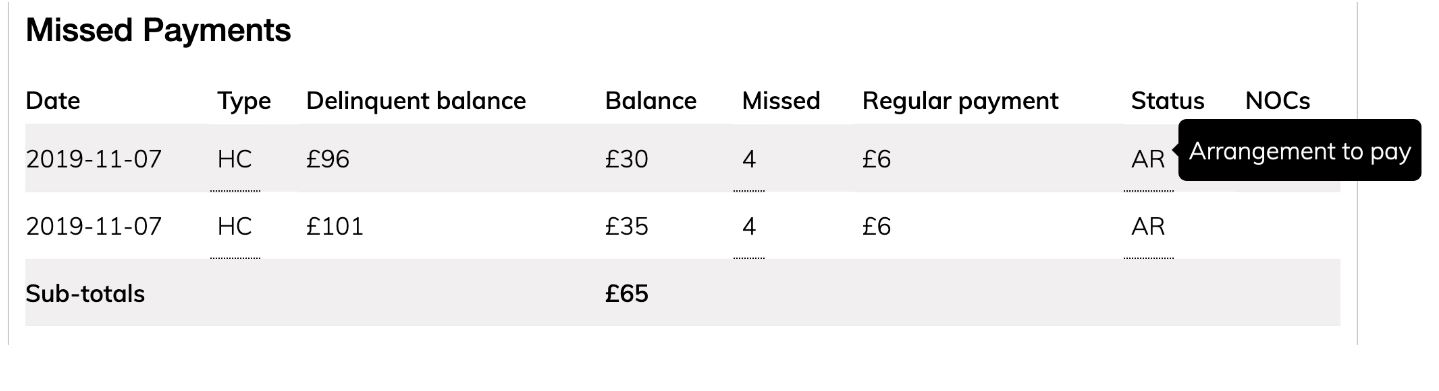

Check out repayment history

Take the long view with six years' repayment history for the applicant. Information is presented in three tables: defaults, missed payments and current commitments.

Ready to find out more?

Schedule a demo to see whether the Decision Engine is right for you

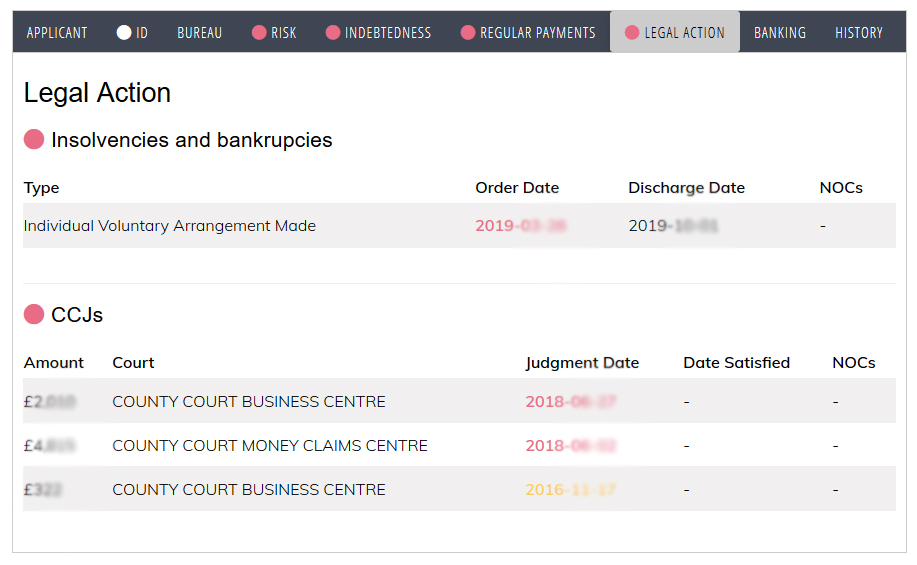

Spot legal action

Directly view information on County Court Judgments (CCJ) and forms of insolvency. This includes order and judgments dates with discharge date from insolvency and details of any CCJs that have been satisfied.

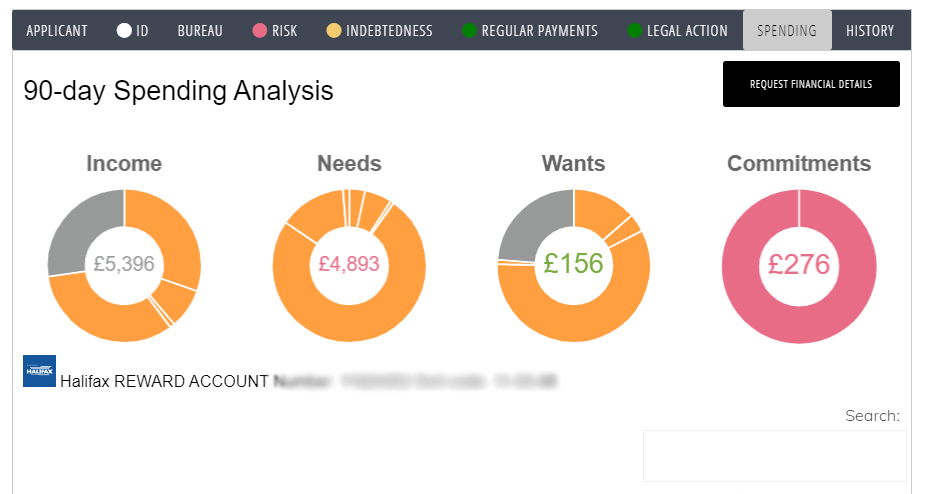

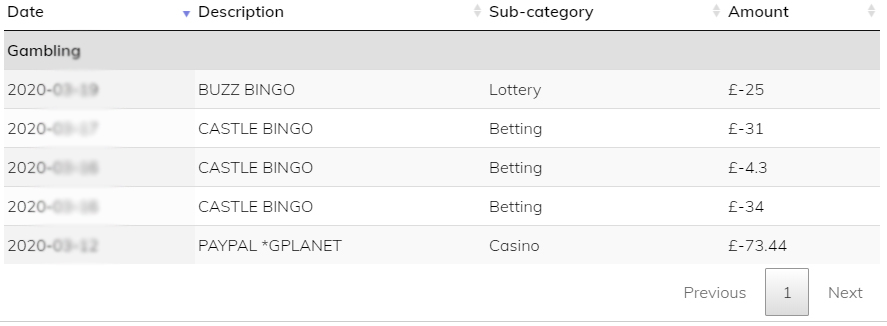

Detect spending anomalies

A simple spending review based on the last 90 days' transactions using Open Banking. These are handily shown as income and then needs, wants and commitments in line with the 50/30/20 budgeting rule.

Warning signs like excessive gambling or reliance on high-cost credit are clearly highlighted.