Ahead of FREE webinar on 3 December, we’ve taken an initial look at Covid-19 changes to credit score and missed payments.

30% of 500 credit union members surveyed told us their financial situation had worsened since Covid-19.

Step Change found 28% of adults experienced a negative change in circumstances. Similarly, the Resolution Foundation discovered that 23% of working-age adults reported their household income in the summer to be lower than in February.

On this basis, millions of people will be unable to pay their debts. Consequently, there’ll be a huge increases in demand for money advice.

Despite this, credit scores are rising, but so are missed payments. We explore this paradox and what this means for credit risk and earlier intervention for money advice.

Measuring financial health

For the purpose of this analysis, we’ve used anonymised, aggregated data from 17,000 loan applications. These were made to a sample of three credit unions between 23 February and 19 November. This data enables us to assess Covid-19 changes to credit score and missed payments.

Data provided below is a portfolio view. As such, the graphs track different people over time. Lenders can assess overall loan book risk using this portfolio view. Lending policy and bad debt assumptions can be adjusted accordingly. For the information below we’ve relied on credit bureau data.

The NestEgg Decision Engine uses Financial Health Indicators (FHIs) to assess credit risk.

FHIs are made up of risk categories. They include credit score, indebtedness, missed payments, defaults and legal action. Categories are allocated a red, amber or green status based on risk. These contribute to an overall financial health score.

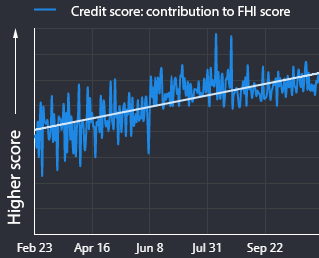

Credit scores have been on the rise

The chart below shows how improved credit scores have made an increasing contribution to an overall financial health score. Credit scores have been rising during the pandemic.

This might seem counter-intuitive, but can be explained (see below).

However, the effectiveness of credit score in providing a realistic view of credit risk should be questioned. This is because the proportion of borrowers with missed payments is rising.

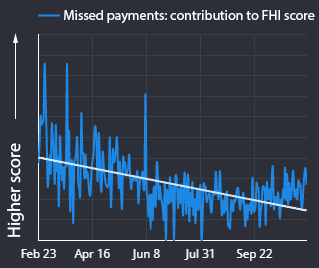

More missed payments

The second chart shows the contribution to financial health scores made by positive data about missed payments. The downward trend shows fewer positive data points. In other words, the number of missed payments is increasing. Step Change estimate that there are one million more people who have fallen into arrears or borrowed to make ends meet. 12% missed loan or credit card repayments. This is in line with our estimates.

The real situation is worse. Payment holidays do not show as missed payments. Because of this, the current payment status remains static. As payment holidays end, we can expect millions of accounts to go into arrears.

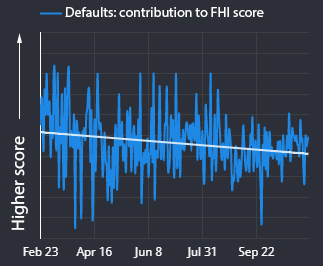

Delayed defaults

This third chart shows the contribution of positive data by defaults to a financial health score.

Applicants with no defaults score highest. This chart shows a fall in the number of people with no defaults. Consequently, financial health scores are falling because the number of defaulted accounts is slowly rising.

Defaults are not usually reported until six months of consecutive missed payments. Moreover, defaults are typically reported when the relationship between lender and borrower has broken down.

Lenders are understandably reluctant to default accounts during a pandemic. This is especially the case given payment holidays and FCA pressure to support borrowers. Because of this, the normal six-month delay between initial missed payment and default is getting longer.

Triggers for money advice

Payment holidays will work for those who have a reasonable prospect of returning to work. But if unemployment is still rising in the Summer (when payment holidays are scheduled to end), it will be much longer before many are able to get back on their feet.

Once defaults start, collections activity becomes more intense. Legal action might commence. These are trigger points for money advice.

NestEgg’s Financial Health Indicators provide a continuum of financial stress.

Aligning these to provide an automated trigger for money advice helps applicants seek help earlier. This is important because the gap between the event causing financial difficulty (loss of income) and the trigger for money advice (defaults / legal action) has never been so long.

In fact someone taking a six-month repayment holiday in July 2020 might not be defaulted on an account until almost one year later.

We want to talk to money advice providers and stakeholders about how to implement this. Contact us.

Back to credit scores

Credit scores have increased because fewer people made credit applications. Credit searches for loans reduce score. Repayment holidays mean that the true level of missed payments is underestimated. And these are now being extended. Additionally, there can be a 6 weeks until missed payments are reported.

Credit card debt is getting paid down. Balances fell 5% over the summer. Secondly, fewer lower income households are breaching limits. Thirdly, voter registration took place over the summer. Consequently, more people registered to vote. This has a positive impact on credit score.

Together these factors have protected credit scores – for now.

Credit score lags negative repayment data. But there are signs this is changing. Whilst those on incomes under £1,200 have seem credit score rise, people with a monthly income of £1,500 remain stable. However, in the last two months applicants with incomes over £2k have seen a 10% reduction in credit score.

Join our webinar

We’ll be looking beyond Covid-19 changes to credit score and missed payments during a one-hour webinar on Thursday 3rd December at 10am.

Open Banking is powering our affordability assessment based on the 50/30/20 budgeting rule. Spending trends will be reviewed. Survey data from lenders and borrowers will be shared to understand the impact of Covid-19 on individuals and lending businesses.

Anyone working to promote responsible finance can join the webinar.

Please register your interest in the short form below…

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.