Grow your loan book

NestEgg’s cutting-edge technology helps credit unions scale faster, smarter, and fairer. With our Decision Engine, Loan Matching and Broker Platform we’re redefining how responsible lenders approve loans, attract borrowers, and expand their reach.

Inclusive lending

NestEgg is delighted to be a silver sponsor of the 2025 ABCUL conference in Leeds.

Credit unions need to convert website visitors into accepted loans and accelerate loan processing.

Our software increases loan-take up by 40%, automates decisions for same day turnaround and delivers data-driven insights to enhance lending strategies.

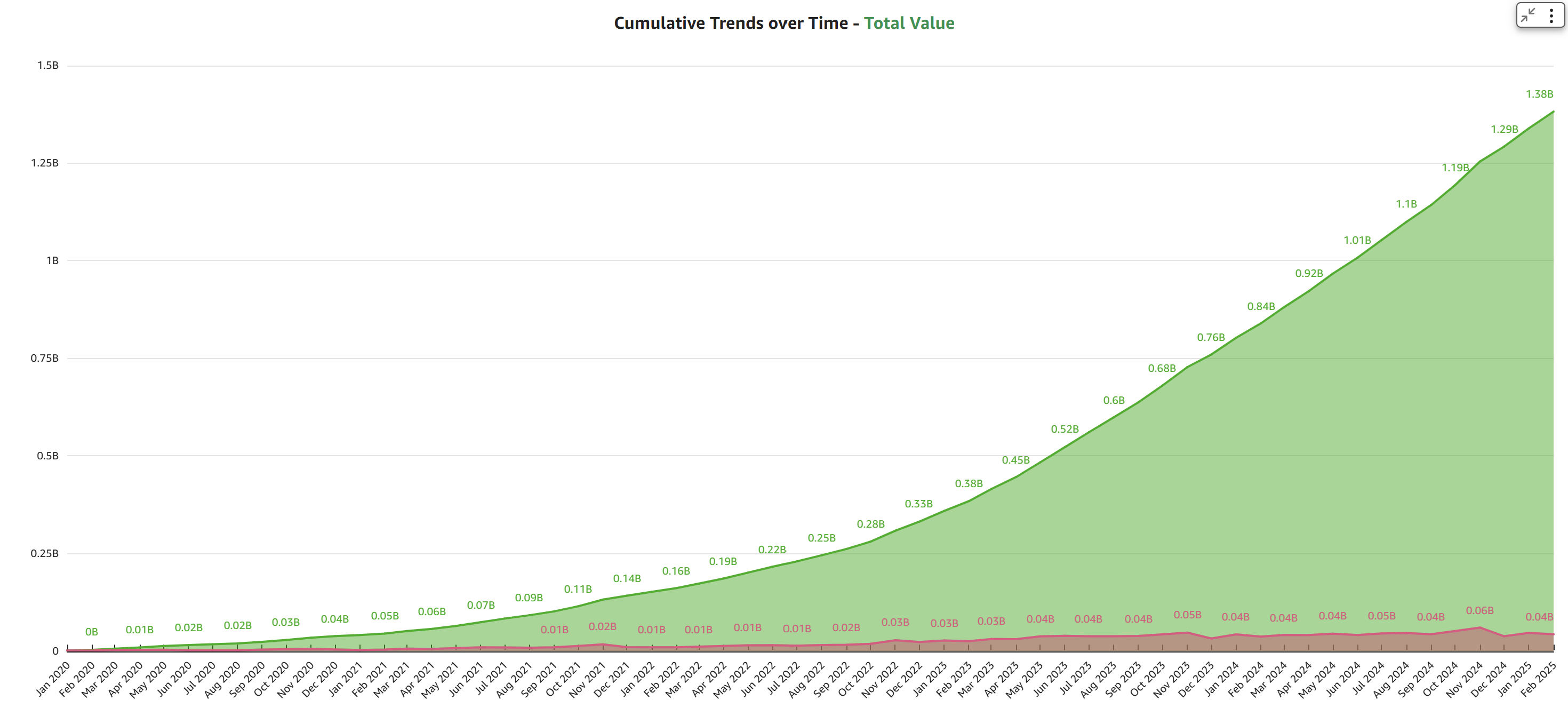

Over £1.5bn of loans assessed so far

Don't take our word for it...

Our use of NestEgg has proved invaluable in assessing the affordability of any loan offer we make to a member and provides us with a tool to support the member by “nudging” them into better budgeting , helping them increase their credit score and providing a step on the path to financial stability.

Eileen Halligan, CEO Central Liverpool Credit Union

The Decision Engine

The NestEgg Decision Engine enables rapid loan book growth with quicker turnaround of fairer credit decisions and lower bad debt rates.

The broker platform

NestEgg provides one place for people to check whether they are eligible to join and qualify for loans from responsible lenders across the UK.

The platform provides soft credit checks and runs customised decision rules to see if the borrower meets your criteria to be accepted. If so, they can submit an application with one click.

To maximise take-up NestEgg receives referrals from decline applicants from banks across the UK

Loan Matching

Loan Matching makes it easier for people to apply online for credit union loans. Loan Matching includes a highly configurable set of application forms, optimised for high conversion rates.