For borrowers who are conscious of their credit scores, soft credit checks offer a practical and appealing solution. This process allows individuals to determine their likelihood of loan approval without negatively impacting their credit score (unlike hard credit checks). This is particularly beneficial for those with variable-rate financial products, such as mortgages, where even a slight change in credit score could increase monthly payments on other loans or financial services.

Driving higher accept rates

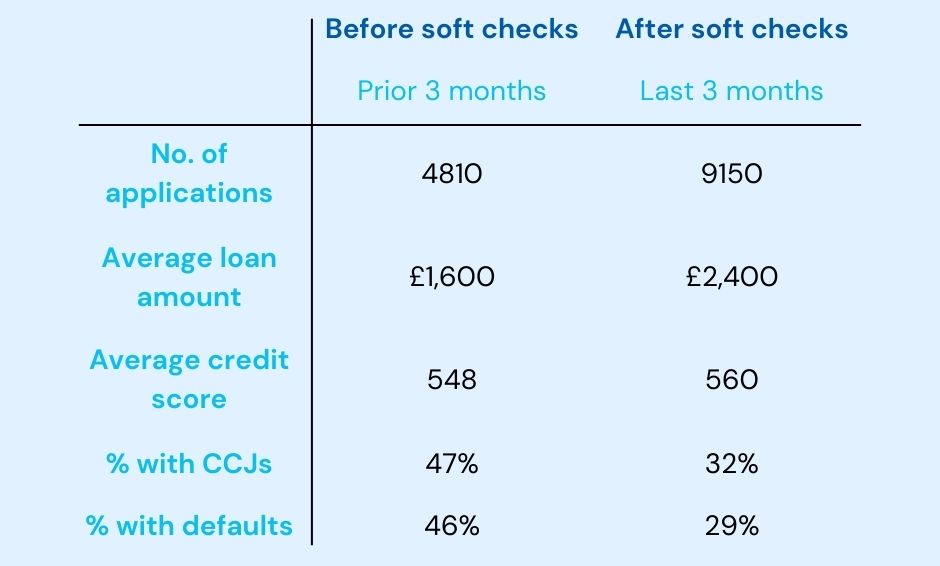

Given these advantages, it’s no surprise that soft credit checks are driving a significant increase in new loan applications. In some cases, since introducing soft credit checks, loan volumes have risen by as much as 70%. For lenders, this also provides a cost-effective way to pre-screen applicants, with 1 in 3 potential borrowers being filtered out before they fully apply, reducing the number of declined applications later in the process.

Reducing risk

By using soft credit checks as an initial screening tool, lenders can significantly reduce the risk associated with loan approvals. Applicants who pass through a soft credit check tend to have higher credit scores, and the percentage of applicants with County Court Judgments (CCJs) or recent defaults decreases considerably. On average, loan applications from these borrowers are £800 higher than those without the benefit of soft checks.

Increased engagement with borrowers

Furthermore, applicants who proceed to a hard credit check after a successful soft credit screening are almost twice as likely to connect to Open Banking or submit follow-up documentation. Knowing they have a better chance of approval encourages borrowers to complete the application process, leading to fewer withdrawn applications and a smoother experience for both the lender and the borrower.

To find out how NestEgg can help your credit union maximise lending – get in touch

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.