Open Banking has revolutionised credit assessment. It provides more up to date information. Open Banking reveals spending patterns that are absent from credit data.

However, Open Banking can only offer proxies. You can’t be certain that a bounced direct debit means that the loan repayment will be missed. Open Banking can’t tell you overall balances on an applicant’s debts. And, of course, not everyone is willing to connect their account in the first place. This is why the NestEgg Decision Engine provides access to Open Banking data alongside information from credit reference agencies. Seeing the two datasets side by side, in one User Interface, gives an even better, more rounded picture of an applicant. Furthermore, NestEgg is constantly delivering new features for Open banking. Here we also outline some of the key features.

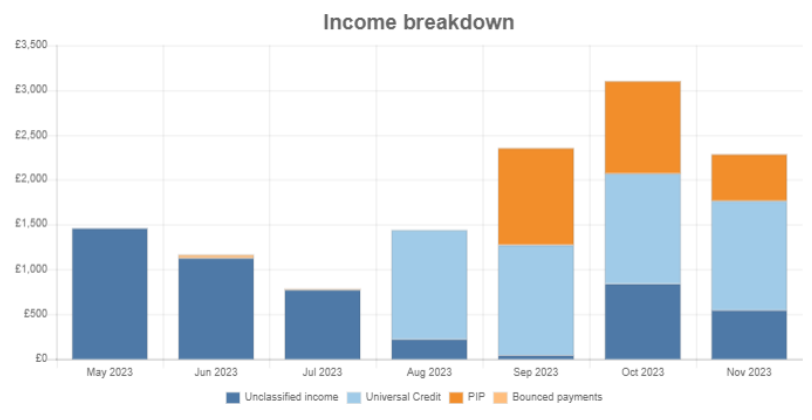

Income trends over time

Verifying income is useful. However, being able to view trends in earnings and benefits over time is even better. In the example below, an applicant has moved from paid work and started receiving disability related benefits. This may mean changes to affordability:

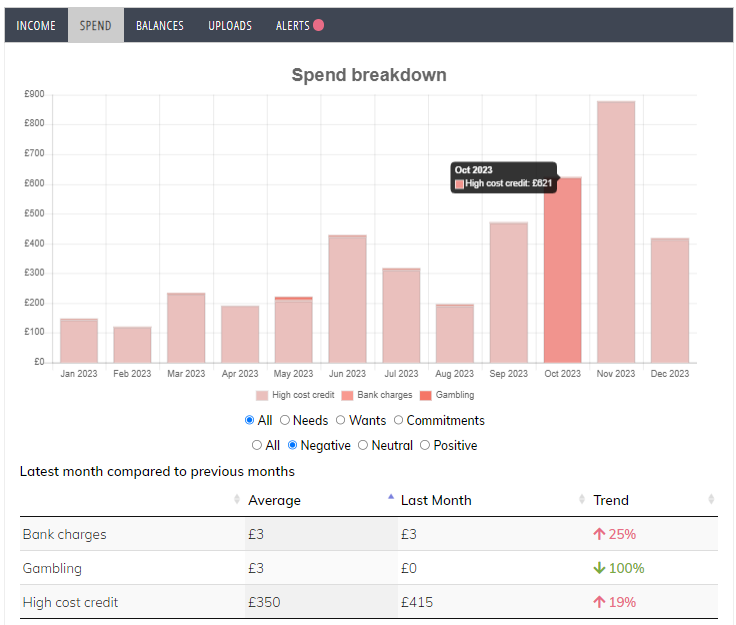

Expenditure trends over time

Measuring spending changes over time and comparing with income makes it easier to assess whether someone is living within their means. In the example below, over recent months, expenses have increased faster than income:

One of the key things Loans Officers look out for is gambling spend. At a click it’s possible to view all the ‘negative’ discretionary spending, including gambling and high cost credit:

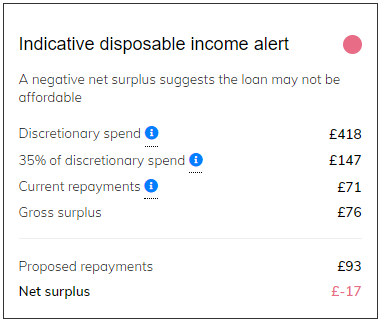

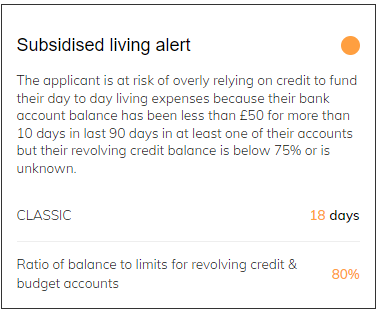

Alerts

For quicker credit assessment, NestEgg has been building new alerts that combine Open Banking and credit data.

A disposable income alert identifies when the proposed loan repayment may not be affordable. Open Banking calculates discretionary spending, allocating a portion for loan repayments. The Decision Engine combines this with credit bureau data, deducting existing credit repayments from disposable income to evaluate whether the loan is affordable.

A subsidised living alert identifies when an applicant may be relying on credit to pay for day to day living costs. NestEgg does this by using Open Banking to display an alert when the applicant’s current account has a low balance (e.g. under £50) for more than e.g. 10 days. A secondary alert is provided if the applicant also has a high balance on their credit card. The implication is that the applicant is using credit to buy groceries and other day to day living costs. Therefore the loan isn’t affordable.

Self-categorisation

One of the biggest challenges with Open Banking is the lack of categorisation. If transactions aren’t allocated correctly, affordability assessments won’t be accurate. Local knowledge, such as Loan Officers knowing local employers and shops, improves income and spending categorisation. To put this expertise to best use, NestEgg has introduced Open Banking self-categorisation. Individual users of the NestEgg Decision Engine can now allocate bank account transactions to a category of income or spend. As a result the quality of open banking information used for credit assessment improves. With 200+ loans officers across 40+ lenders, categorisation will be unrivaled.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.