As we head from London to the North West to Manchester for the ABCUL conference, NestEgg has compared the data from lending decisions made in these areas. This is to help credit unions make data driven decisions.

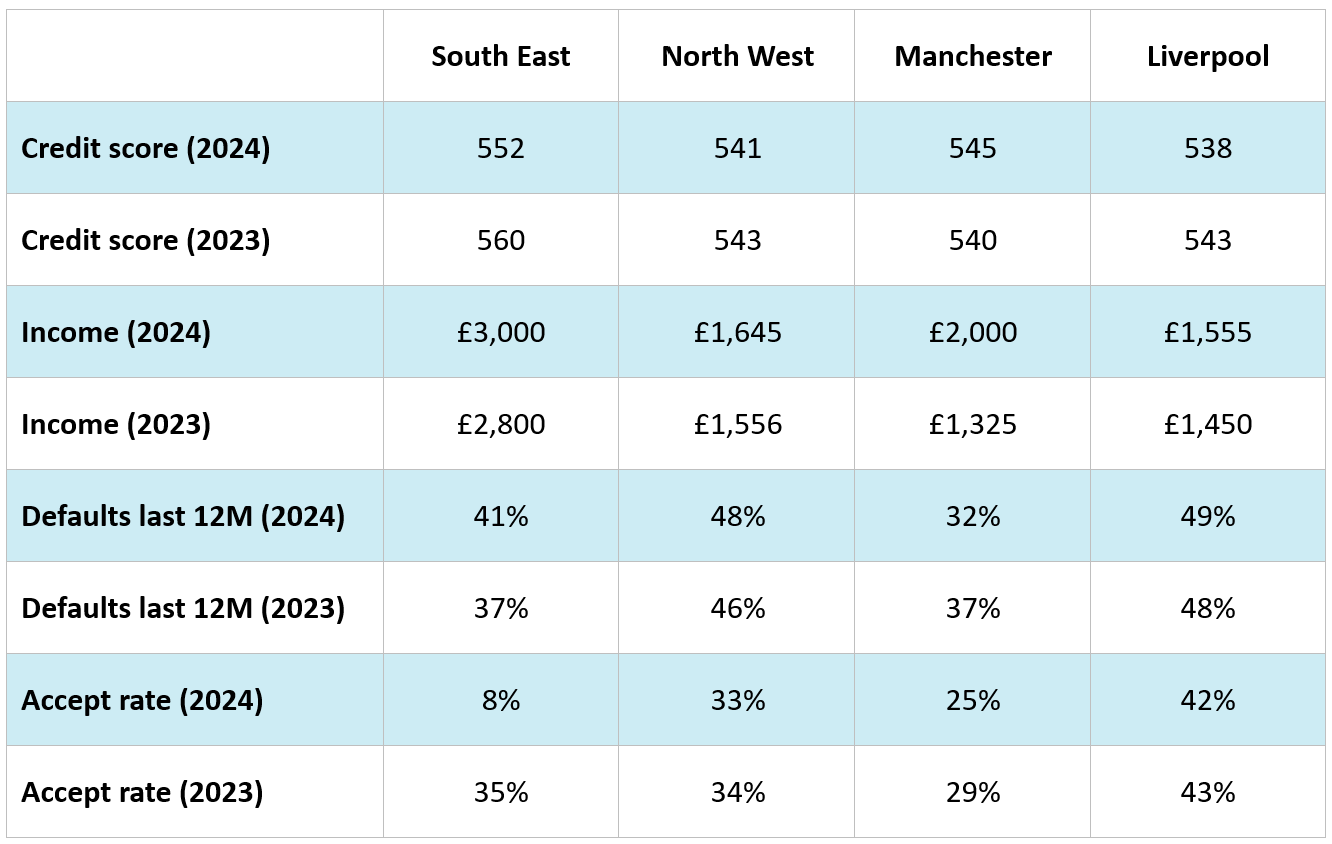

Overall, lending risk in the North West is higher than the South East (including London).

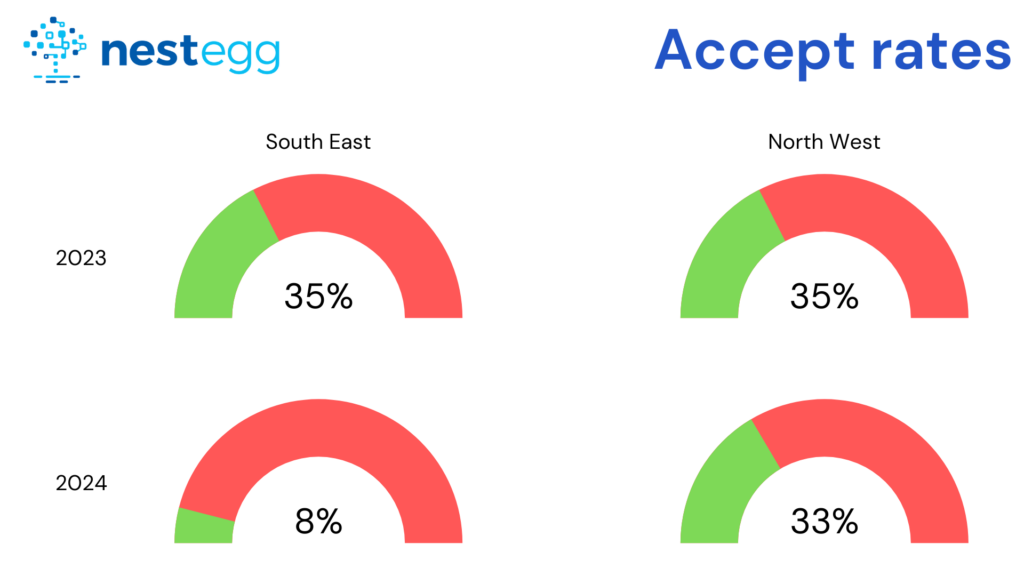

Despite higher incomes (£3,000 vs £1,700), the accept rate in the South East is much lower and has fallen considerably in the last 12 months.

Mortgages in the South East are twice as high compared to North West. That may help explain why the average amount of loan requested was 25% higher in the South East.

Borrowers living in the North West tend to have a higher rate of defaults (47%) compared to borrowers in the South East (41%) and a slightly higher proportion of CCJs. Where an applicant has a credit card they tend to be close to their limit regardless of where they live.

Of course, regions aren’t homogeneous zones. If we break down the North West, applicants in Manchester are earning nearly £500 more than those in Liverpool. Average loan application values are higher than Liverpool and overall indebtedness greater compared to Manchester.

Overall, there’s been a deterioration in credit score and accept rates. Defaults are up and affordability down. Normally this means that the cost of granting loans will rise, because you’re also paying for declines. However soft credit checks can be a more affordable route to managing a growing decline rate.

This is just a small snapshot of the analytical capabilities of the NestEgg Decision Engine. Come by our stand at #ABCUL2024 to find out more.

This is just a small snapshot of the analytical capabilities of the NestEgg Decision Engine. Come by our stand at #ABCUL2024 to find out more.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.