NestEgg’s decision engine now enables users to compare default balances.

Defaults, especially recent ones, are a predictor of bad debt. But responsible lenders like to give the benefit of the doubt.

A loan might be justified if there’s evidence that an applicant is making an attempt to pay down defaults.

The reverse – where defaults continue to mount up – makes a decline more likely.

To help you make the distinction between these different scenarios NestEgg’s decision engine shows you the original default balance as well as the current balance.

Because of this, you can see whether an applicant’s situation, in relation to their defaults, is improving or getting worse. As a result it is easier to know when to accept or decline a loan application from someone with an adverse credit history.

This is one of dozens of new features that are being released to our decision engine every month.

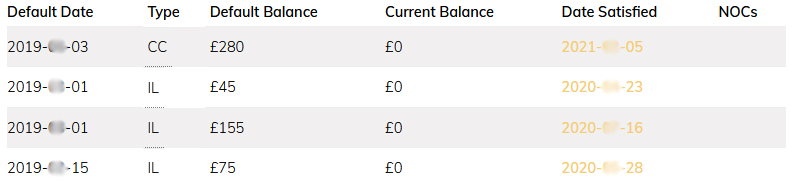

There are good defaults

When a default has been repaid in full it is marked as satisfied. In this example all the accounts have been cleared and the current balances are all zero.

In such a case, a loans officer may be inclined to accept a loan. However, it is worth noting that if an applicant completes a form of insolvency such as bankruptcy, a Debt Relief Order or Individual Voluntary Arrangement, the defaults should also be marked as satisfied. If the dates of satisfaction are the same or close together, it is more likely that there has been some form of insolvency in the past.

Additionally, a satisfied debt may have been partially satisfied by way of a ‘full and final settlement’. These clear part of the outstanding balance on the basis that the remainder will be written off.

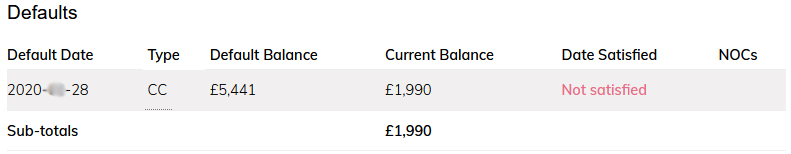

In the example below the default balance is higher than the current balance on a credit card. This shows that the applicant is making an effort to pay off the defaulted account. Again this may be reason to accept rather than decline a loan.

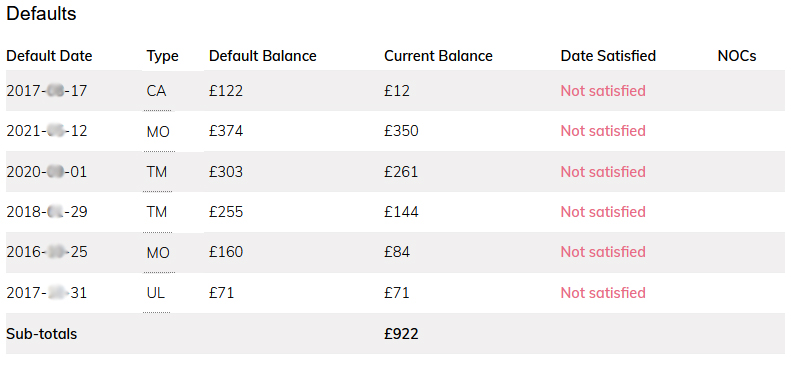

In the next example, whilst there are a large number of defaults, there’s evidence that the balances are being paid down. In fact, all but one account has a current balance lower than the default balance. Once again, this loan might be accepted rather than declined.

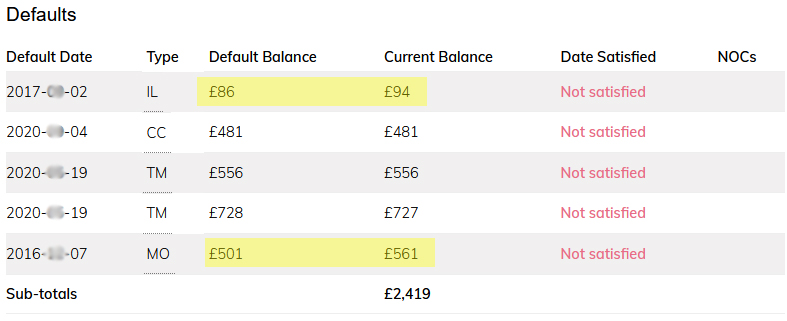

And there are bad defaults

In the example below there are five defaulted accounts. The two highlighted accounts have current balances that are higher than the default balance. In these circumstances the applicant has incurred additional charges or the balance is increasing for some other reason, e.g. an ongoing commitment to pay for gas or electricity; there can be a default but the supply hasn’t been cut off. As the situation is getting worse, the loan is more likely to be declined. A referral to money advice might be appropriate.

Next steps

Find out how NestEgg can help you say ‘yes’ to more of the right applicants and grow your loan book. Book a demo or contact us for a strategy discussion.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.