Features

Maximising growth and efficiency: the power of NestEgg’s analytics

Last week marked a major milestone for NestEgg Decision Engine users, with the release of powerful lending analytics tools. These insights provide credit unions with deeper data-driven decision-making capabilities, ensuring stronger financial performance, optimised marketing efforts, and improved risk management. Are you growing? Understanding loan book growth is essential when reviewing financial performance and adjusting…

Read MoreCredit union lending upgraded: smarter decisions, faster growth

This February and March, NestEgg is rolling out a major upgrade to its scalable Decision Engine, bringing 50 credit unions onto the latest and most advanced version of our award-winning platform. With this enhancement, lenders will benefit from even smarter, faster, and more powerful lending decisions—delivering greater efficiency and impact. NestEgg offers a scalable Decision…

Read MoreNew features for 2024

NestEgg has had a very busy 2024 so far. Not only has the launch of our award-winning Broker Platform been a success, but we’ve also been announcing lots of new features for our partner lenders. Here is a roundup of the latest releases. Some have been made available in the last couple of months and a…

Read MoreFeature Spotlight: credit score reasons

Credit scores are complex three-digit numbers that can baffle even the most experienced loan officer. Because of this, the NestEgg Decision Engine explains the main factors that are driving an applicant’s credit score. Listing out credit score reasons makes it faster to find and focus on the problems with an application. In the example below…

Read MoreNew features for the Decision Engine

December has been a bumper month for new features for NestEgg’s Decision Engine. Here we describe how we’re using Open Banking and recent search history to further improve loan assessment. Open Banking self-categorisation One of the biggest challenges with Open Banking is the lack of categorisation. If transactions aren’t allocated correctly, affordability assessments won’t be…

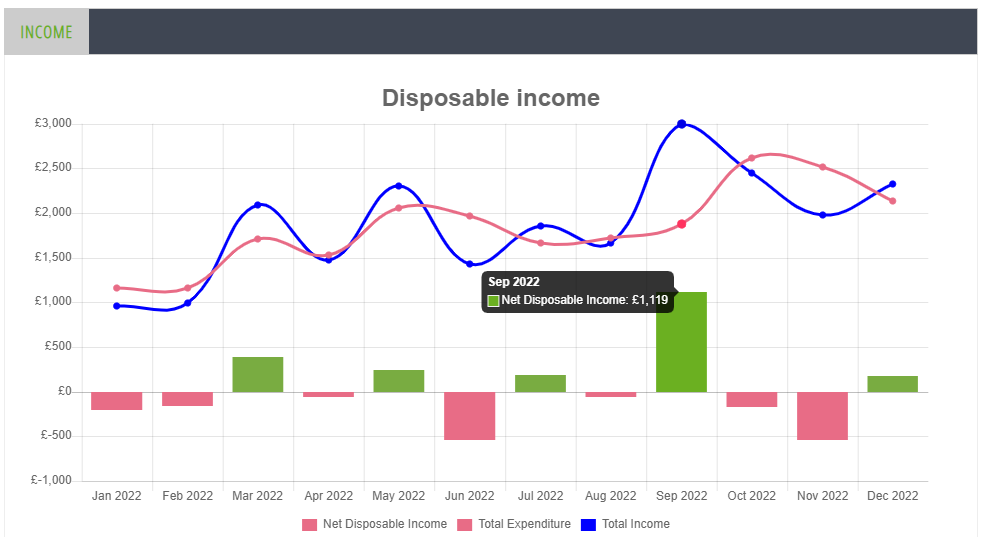

Read MoreNew feature: open banking affordability charts

NestEgg has launched a new feature: open banking affordability charts. The cost-of-living crisis is developing into a recession. Of course, this isn’t good news for responsible lenders. Because of this, it’s more important than ever to navigate data so those that are struggling are spotted early on. One of the advantages of NestEgg’s decision engine…

Read More