Last week marked a major milestone for NestEgg Decision Engine users, with the release of powerful lending analytics tools.

These insights provide credit unions with deeper data-driven decision-making capabilities, ensuring stronger financial performance, optimised marketing efforts, and improved risk management.

Are you growing?

Understanding loan book growth is essential when reviewing financial performance and adjusting business plans.

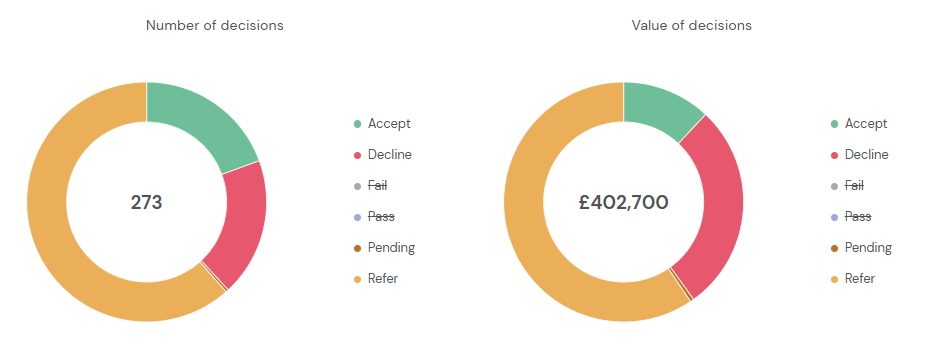

NestEgg’s Decision Engine enables credit unions to analyse the number and value of loan decisions over chosen time periods.

- Daily, monthly, or annual performance tracking.

- Comparisons between accepted loan values and business plan projections.

- Insights into whether additional marketing efforts are needed to meet targets.

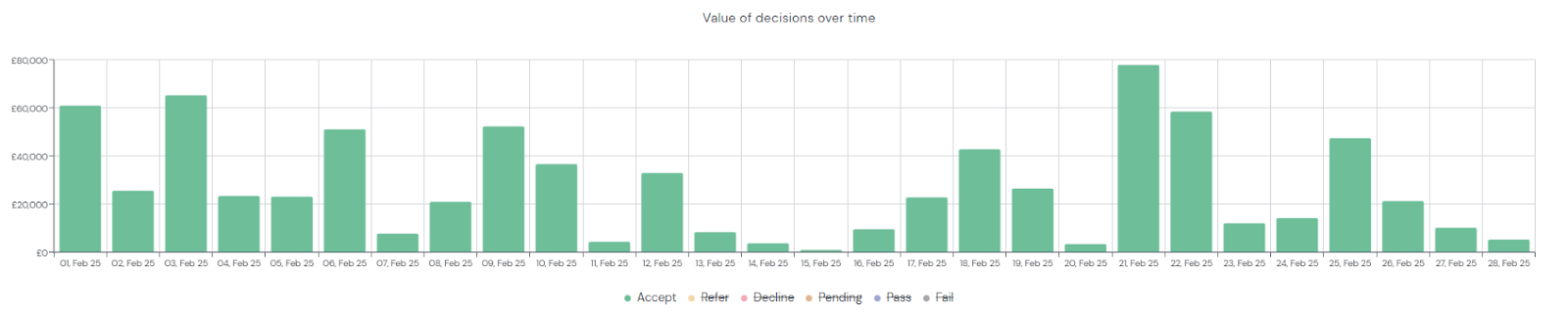

Long-term trends can be reviewed against business plan targets. For example, by providing a month-to-month overview of lending:

How are you growing?

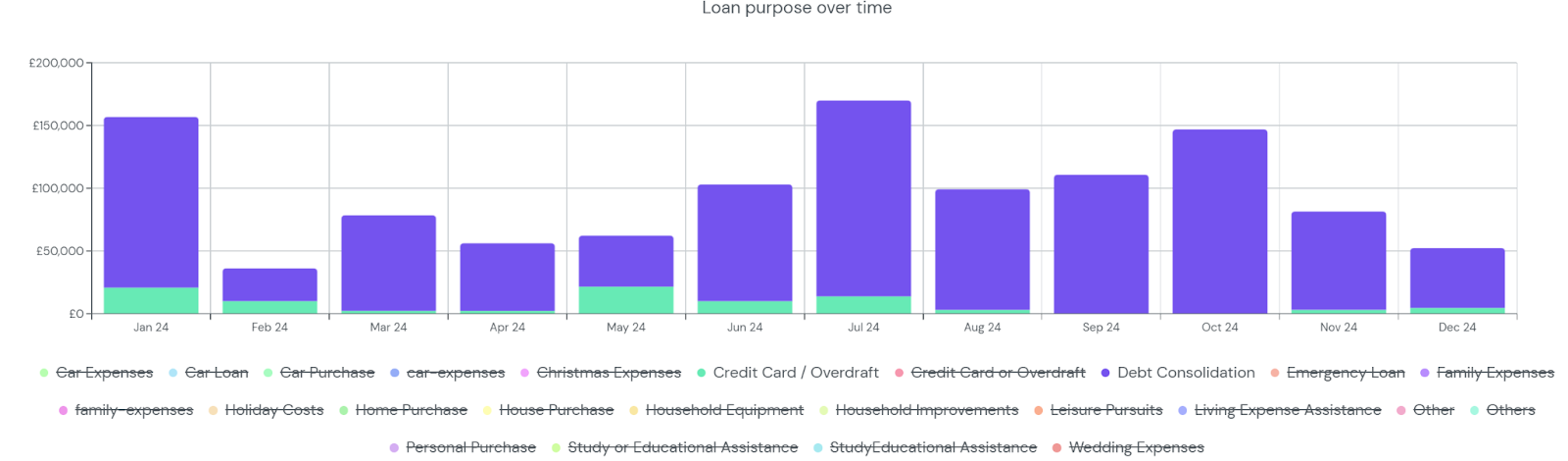

Marketing campaigns require a thorough understanding of loan demand. The NestEgg Decision Engine provides:

- Insights into the top 10 loan purposes by number and value.

- A monthly historical view of demand for specific loan types.

- Identification of seasonal trends. In the example below there are peaks in consolidation loans in January, July and October:

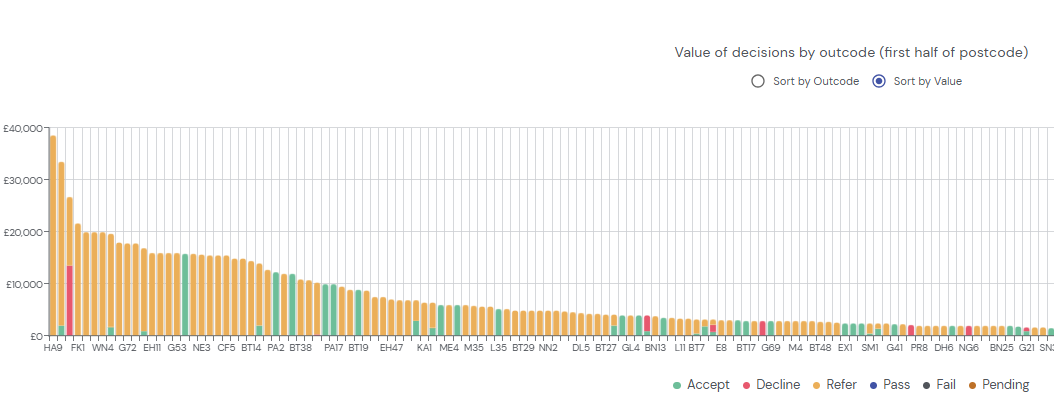

These insights allow credit unions to time their marketing efforts strategically, ensuring maximum take-up. Additionally, decisions can now be analysed by geography, helping credit unions with regional common bonds understand from where successful loans originate. As a result, it’s possible to identify untapped areas for growth.

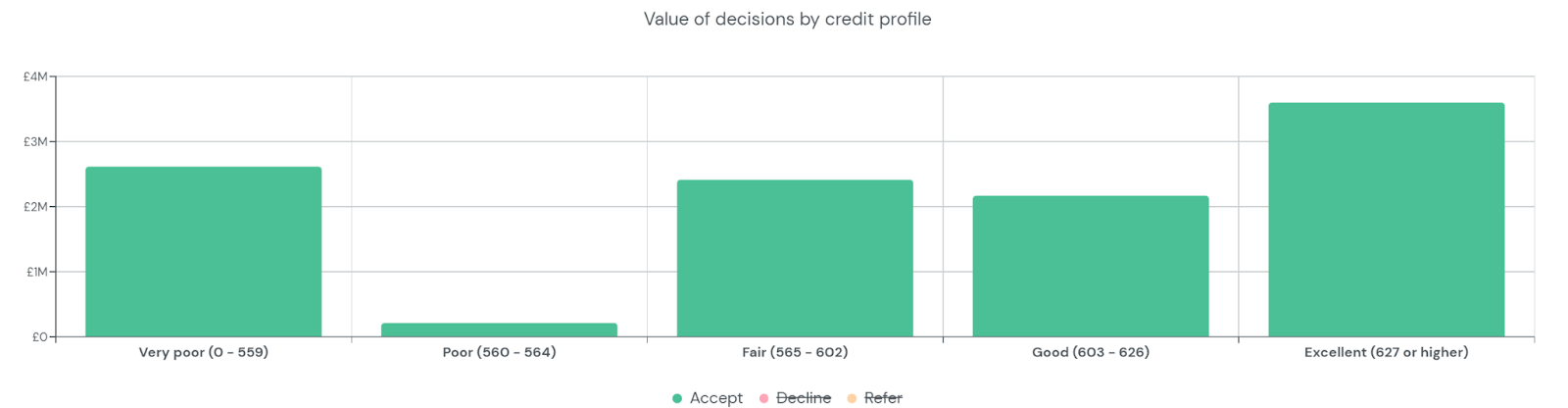

Is growth within your risk appetite?

Managing risk is fundamental when reviewing loan applications. NestEgg analytics provide an overview of accept, refer, and decline decisions by credit profile (very poor, poor, fair, good, excellent). By analysing the value of final accepted loans by credit profile, credit unions can:

- Predict potential bad debt rates.

- Ensure lending remains within risk tolerance levels.

- Refine decision-making criteria based on acceptance trends.

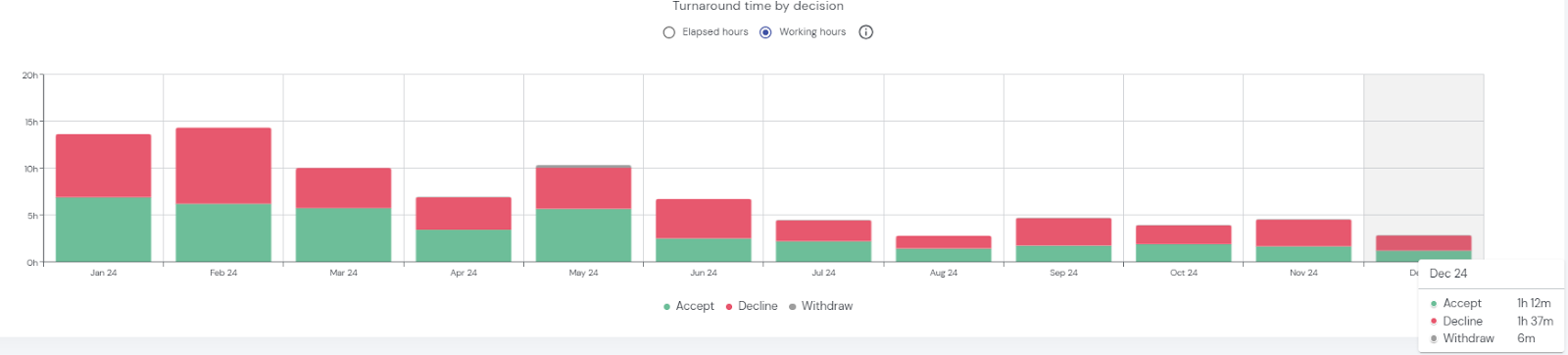

How efficient are your operations?

Operational efficiency is key to improving decision accuracy and reducing manual interventions. NestEgg’s analytics now track the:

- Time from loan application to final decision.

- Impact of automation on decision-making speed.

- Efficiency of automated decision rules.

For example, a recent analysis enabled a reduction in loan decision turnaround time from seven hours in January to under 1.5 hours by December:

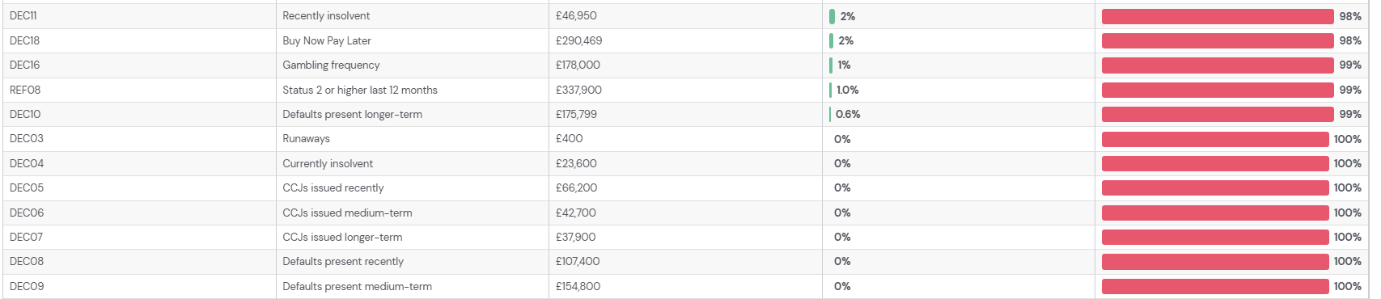

This has been made possible by analytics that help credit unions fine tune decision rules so that they can maximise automation. In the example below, automated recommendations are not being overridden, enabling a credit union to fully automate declined applications.

On the other hand, in the example below, around two-thirds of referrals result in a final decline decision. Logically, one third is therefore accepted. As a result, those refer rules should be maintained:

Take your lending to the next level with NestEgg

These powerful analytics ensure that lenders can make data-driven decisions, improve risk management, and optimise operational efficiency. When your credit union is looking to enhance its decision-making capabilities, NestEgg can help.

Book a demo today and discover how NestEgg can transform your credit union’s lending strategy.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.