Credit scores are complex three-digit numbers that can baffle even the most experienced loan officer. Because of this, the NestEgg Decision Engine explains the main factors that are driving an applicant’s credit score.

Listing out credit score reasons makes it faster to find and focus on the problems with an application.

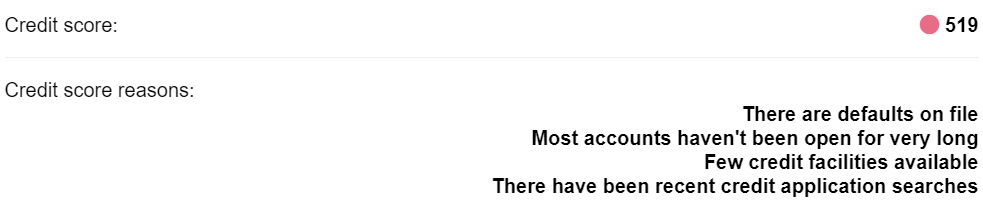

In the example below the credit score is very low. The Loans Officer knows that the applicant is applying for credit (recent searches), and is generally being turned down (few facilities are available and most accounts haven’t been open for very long). Other creditors may be turning down the applicant because (there are defaults on file).

The Loans Officer can now focus on what matters most; the search history and defaulted loan repayments.

Of course, there’s more much to making fair loan decisions than credit score. Nevertheless, it still remains the most effective indicator of overall risk.

Importantly, credit score reasons is just one of dozens of tools for fairer credit assessment provided by NestEgg. In fact, we’re constantly rolling out new features. Additionally, with our recent Innovate UK grant, there’s plenty more in store.

Find out about how we’re developing our software for fairer credit assessment by scheduling a demo below.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.