It's not easy getting people to visit your website. Don't make them jump through hoops to apply for a loan.

Asking someone who's just ordered something off Amazon with a single-click to fill out a long-winded form is only going to lead to applicants dropping out.

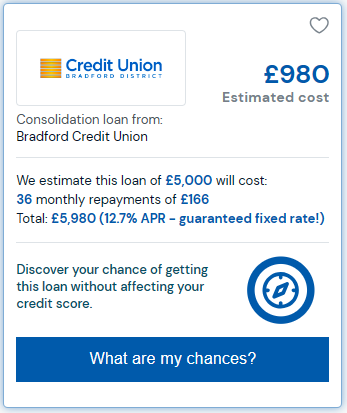

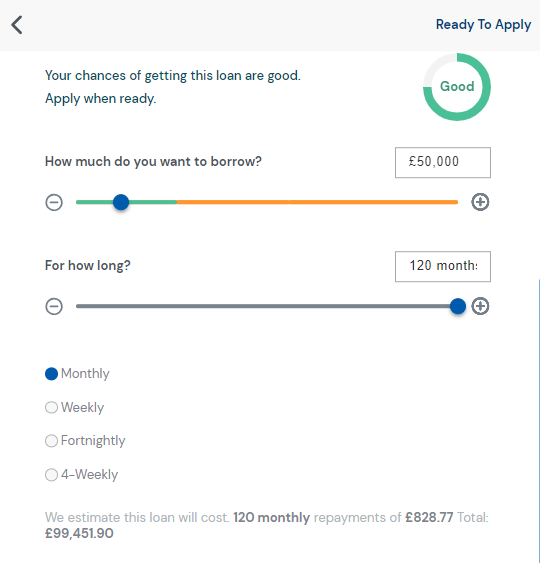

Loan Matching is an easy way for borrowers to find the right loan products they are likely to be accepted for.

Ready to find out more?

Schedule a call to discuss how NestEgg Loan Matching can benefit your credit union

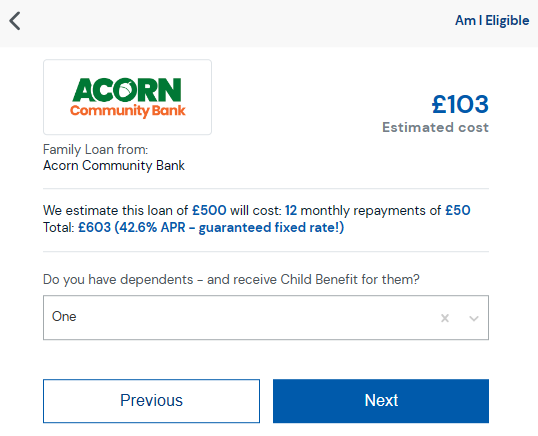

Pre-qualify applicants

If you operate a membership system, such as a common bond, Loan Matching ensures that only those who qualify can apply to borrow.

Don't take our word for it...

Wolverhampton City Credit Union went live in January 2021. By May, the number of applications for loans more than doubled compared to the previous year. Over the same period, the value of loan applications almost tripled.

Fewer than 5% of loans now arrive face to face. The average age of a borrower fell from 34 to 28 during the first half of 2021.

More applications with soft credit checks

Hard credit checks have a negative impact on an applicant’s credit score. If this is all that is on offer many applicants will look elsewhere.

Because of this, Loan Matching provides soft credit checks. Potential borrowers can see if they meet a lender’s criteria to be accepted for a loan before they apply. This has no impact on their credit score. Soft checks improve conversion rates.

When an applicant applies in this way they can see not just whether they’d be accepted but what the maximum amount is that they could get.

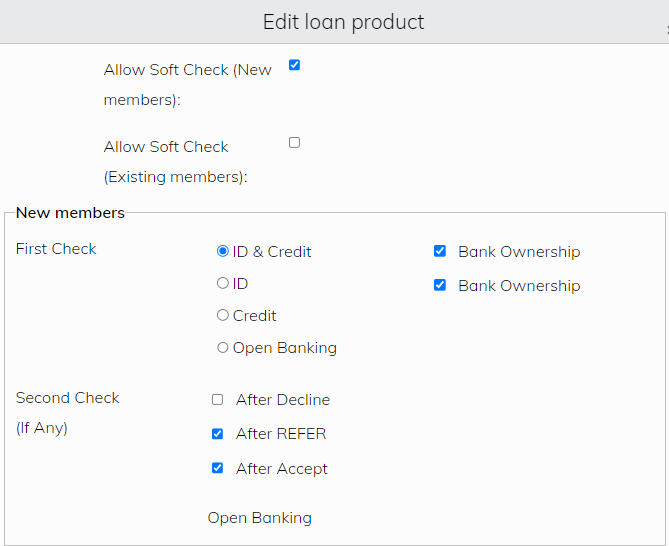

Easy to configure

Choose your data

In addition to selecting soft credit checks, you can use an open banking only assessment process or not call credit data at all in the case of a secured loan.

Easy to maintain

You can now bring products to market in minutes.

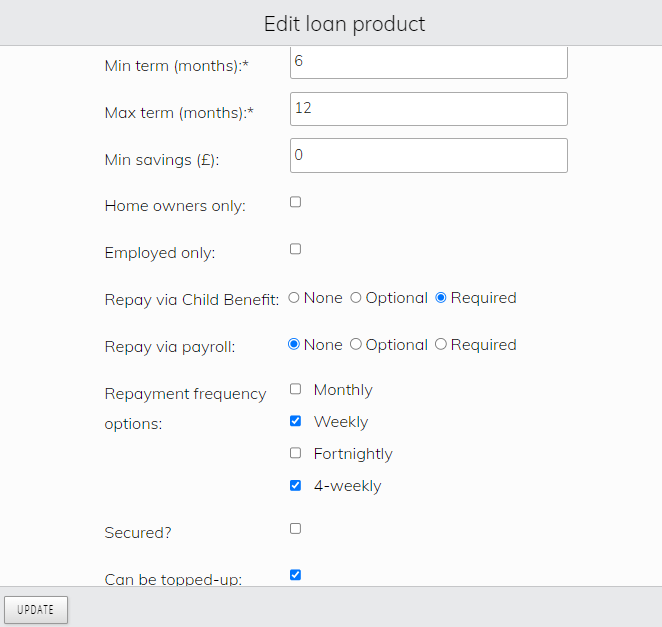

Using NestEgg’s decision engine dashboard, you can change membership criteria, create new or edit existing loan products and link them to custom rule sets. You can even decide which questions to ask for different products at the click of a button.

Once you update these settings they are instantly applied to your version of Loan Matching.

Ready to find out more?

Schedule a call to discuss how NestEgg Loan Matching can benefit your credit union