Unlock a stream of pre-qualified loan applications

The NestEgg Broker Platform matches people who are actively looking for affordable loans with responsible lenders in general & credit unions in particular.

Ready to find out more?

Schedule a call to discuss how the NestEgg Broker Platform can benefit your credit union

Tap into applicant sources previously beyond your reach

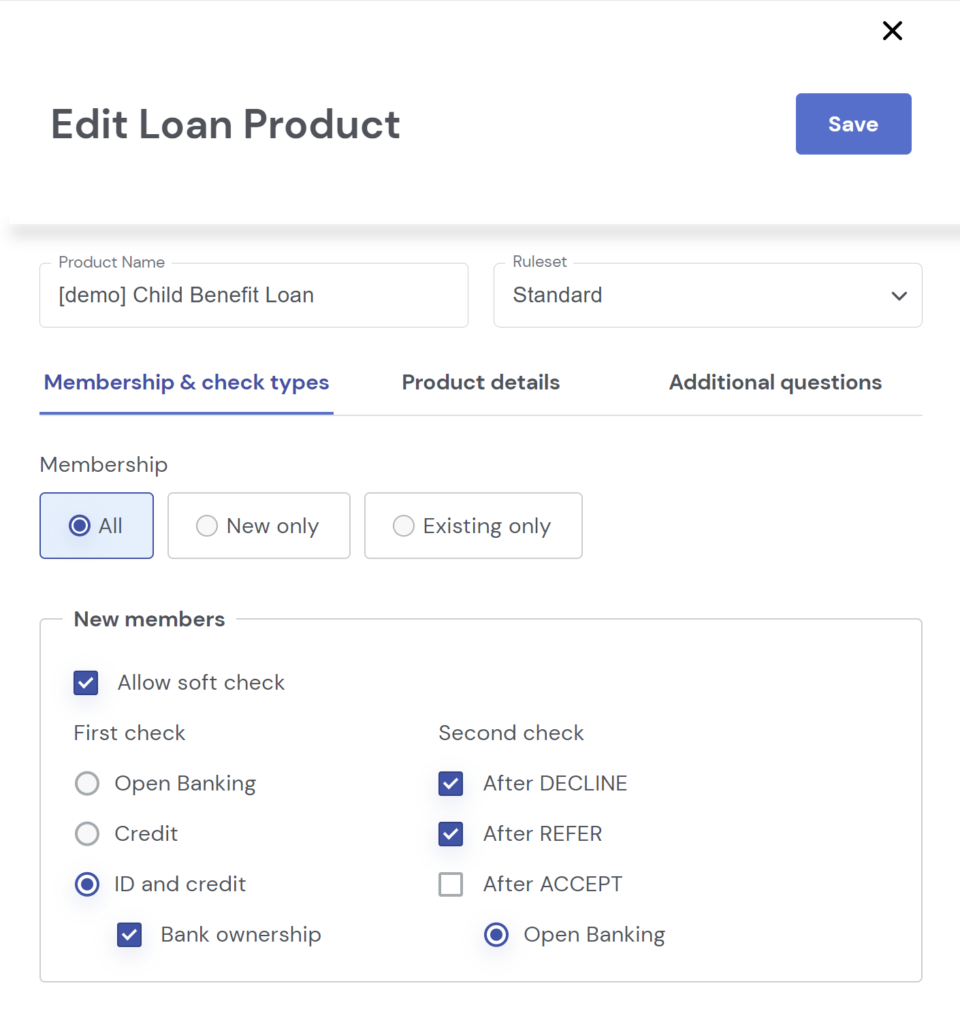

Applicants are guided through your eligibility checks for joining (and for each of your individual loan products)

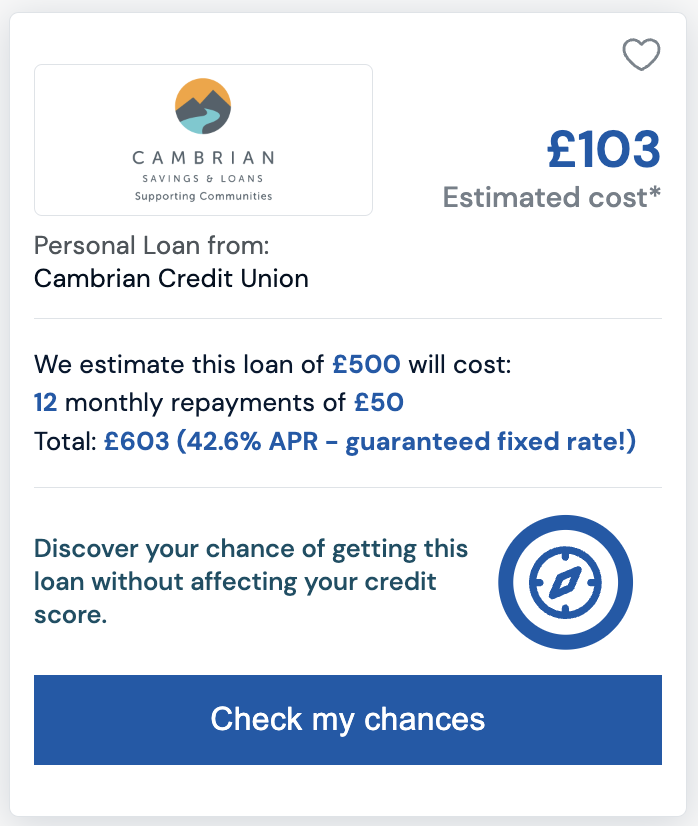

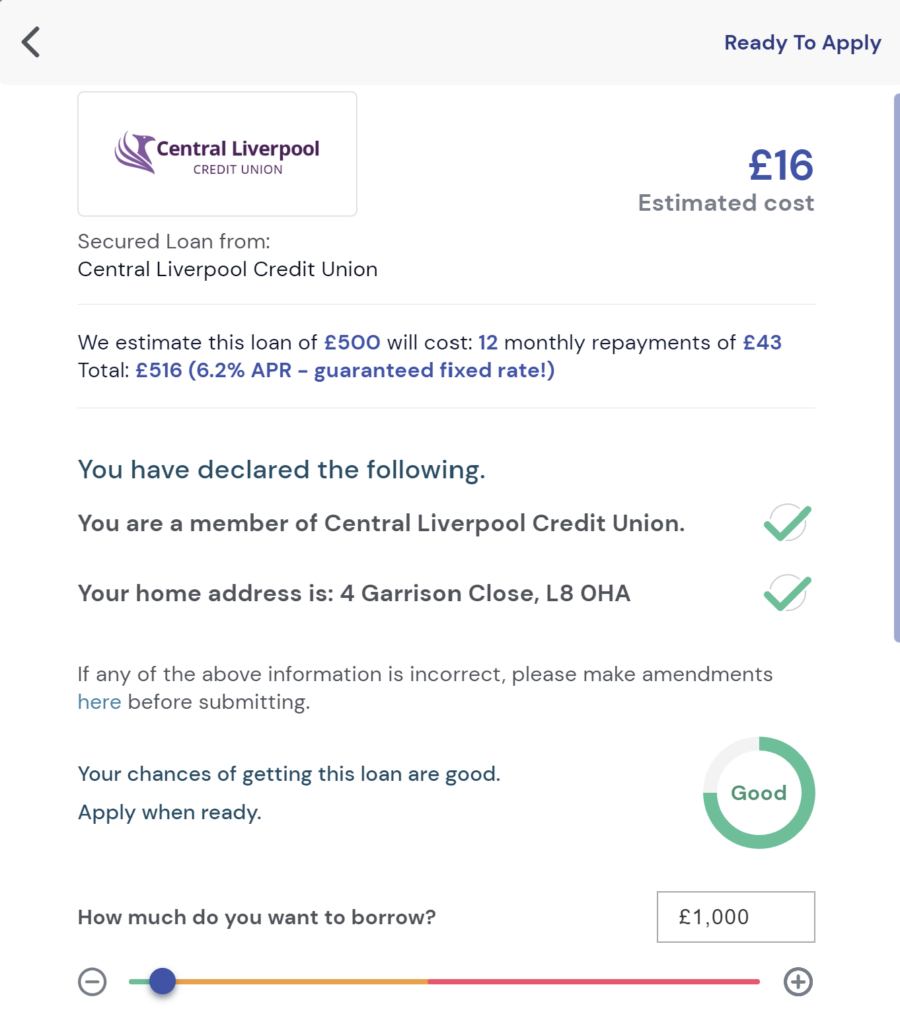

Applicants can find out if they could get a loan - without affecting their credit score

Applicants can easily apply for a loan with you

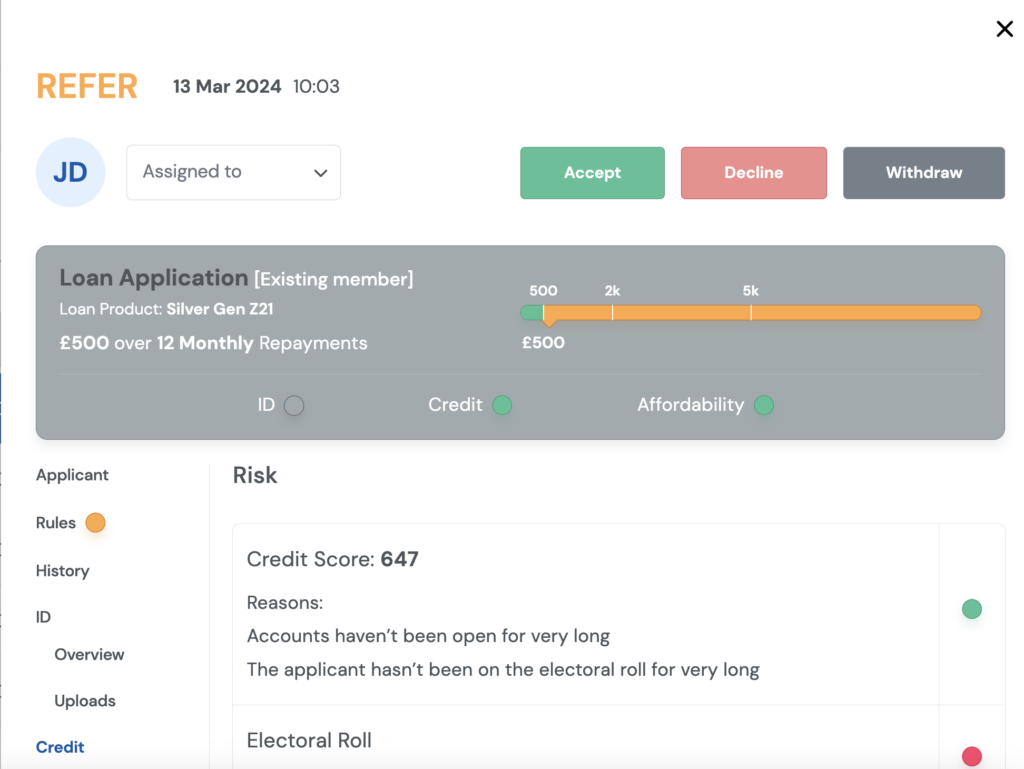

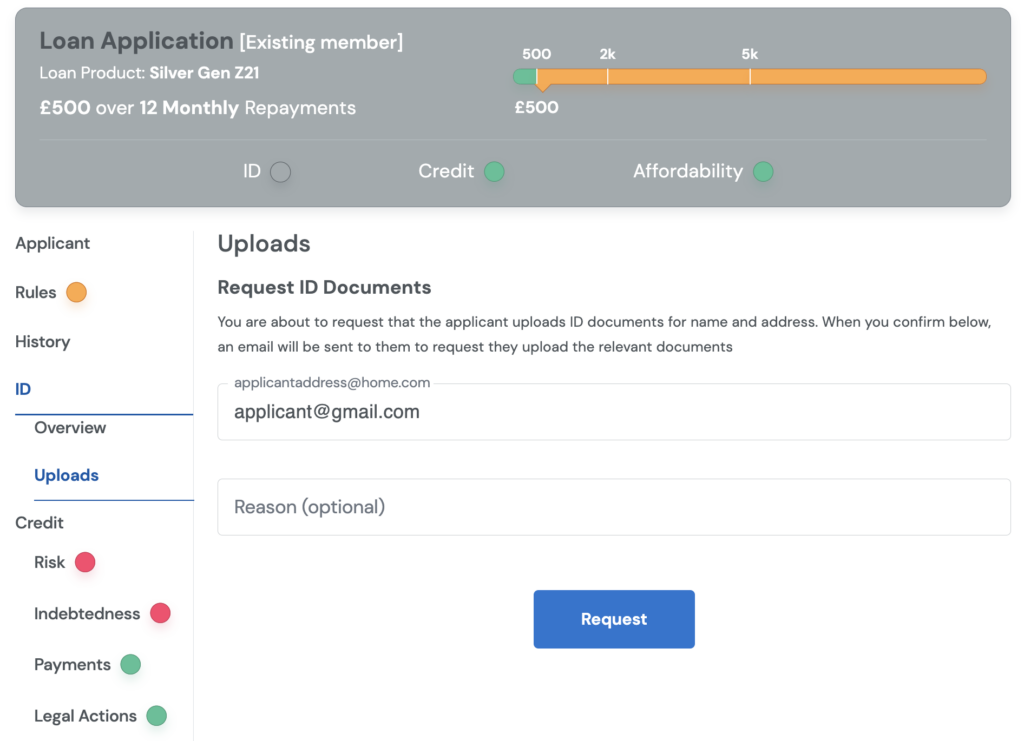

Make fast, fair & data-driven lending decisions using NestEgg’s market-leading Decision Engine

Keep applicants updated as you process their application

Consolidate your reputation as a responsible lender - and fulfil your mission as a credit union

Help spread the word & fly the flag for responsible lending

Risk-free trial

Ready to find out more?

Schedule a call to discuss how the NestEgg Broker Platform can benefit your credit union