…and how to fix them

At last week’s ABCUL conference, NestEgg highlighted 7 key reasons why many credit unions struggle to grow their loan books.

Drawing on insights from 250,000 loan applications worth £550 million (that were decisioned by NestEgg’s partner lenders since the last conference), the data shows that by avoiding these seven common pitfalls, credit unions could significantly boost their lending impact.

With 9 million people declined by banks annually, the market opportunity is huge. If credit unions could capture just 20% of that segment, they’d issue £2.6 billion in loans. This would double the size of the sector. But first, the reasons why many credit unions struggle.

Mistake #1: assuming everyone wants a loan today

On average, 13% of people seek a loan each year.

In a common bond of 1 million people, that equates to nearly 11,000 potential borrowers each month. However, most marketing urges people to “apply today,” even though fewer than 0.04% are actively looking for a loan on any given day.

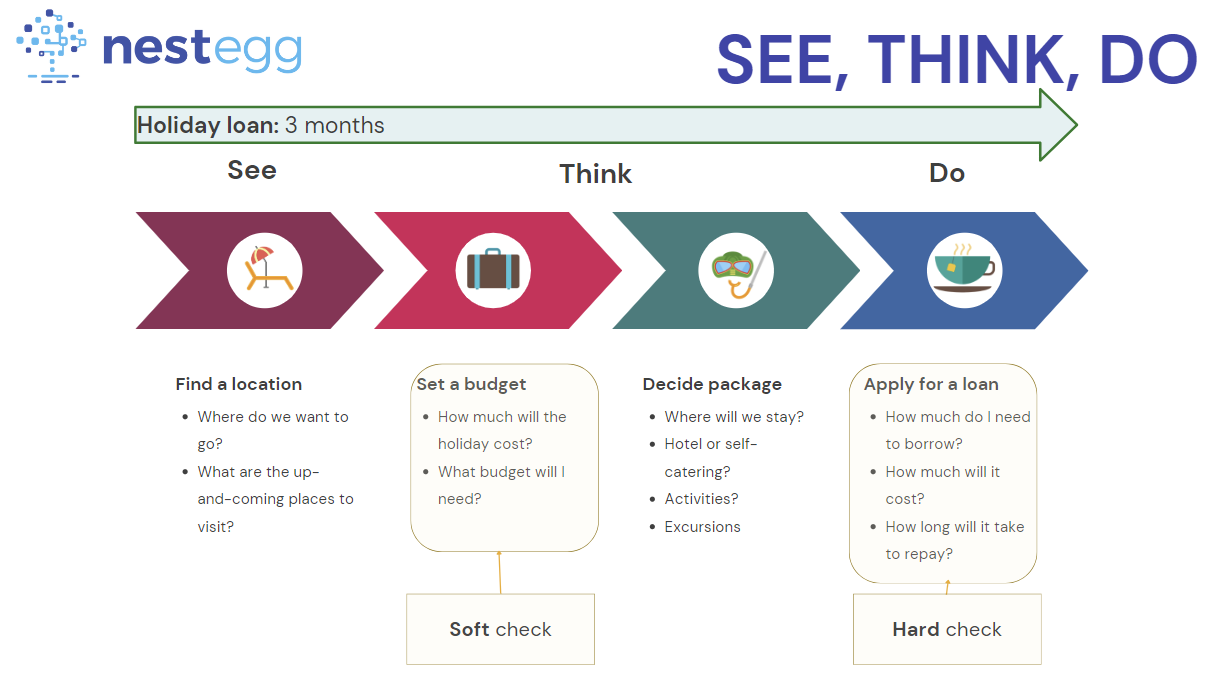

Take holiday loans, as shown in the example below. Before applying, most borrowers spend time researching destinations, setting a budget, and deciding whether they’ll need to borrow to fund their trip. By the time they’re ready to apply, they’ve already built trust in the brands that offered the most helpful financial guidance during that journey.

Credit unions that stay visible during this consideration phase, position themselves as the go-to lender when it’s finally time to apply.

Mistake #2: it doesn’t always have to be 42.6% APR

Many credit unions default to the maximum APR of 42.6%, but this can reduce competitiveness.

Borrowers coming from banks are often used to seeing lower APRs, even if they don’t qualify for those rates. When faced with a 42.6% APR, around 90% of potential applicants drop out.

In contrast, loans offered at a 19.6% APR see a much lower dropout rate of just 30% and tend to attract lower-risk borrowers.

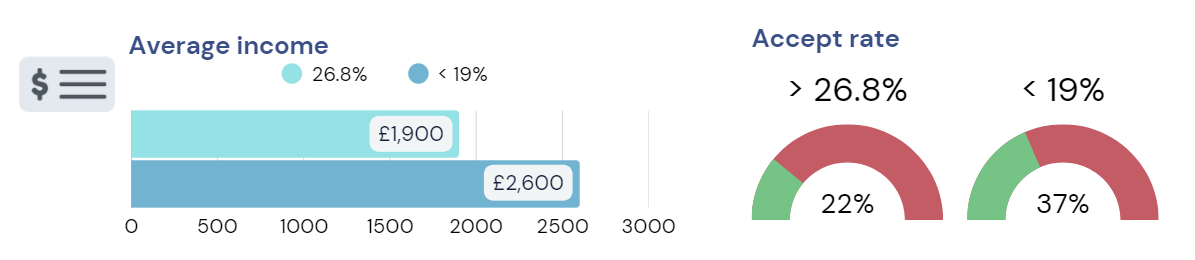

The charts below compare outcomes for applicants offered a 26.8% APR versus those offered under 19%. The results show that lower APRs are associated with applicants earning, on average, £700 more per month and a 15% higher approval rate.

Mistake #3: it doesn’t have to be divisible by 0.5%

Credit unions often stick to rigid APRs like 19.6%, 26.8%, or 42.6%, simply because that’s how the interest rate cap evolved.

However, sticking to fixed rates can limit growth opportunities. Dynamic pricing, where rates are adjusted based on risk and market conditions, can attract more borrowers while maintaining profitability.

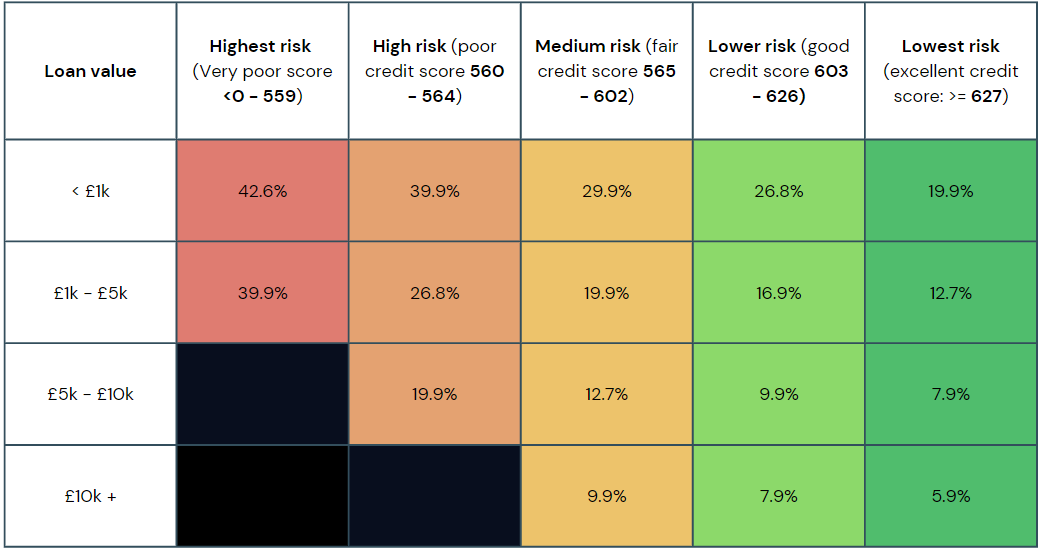

One effective approach is Risk-Based Pricing (RBP). With RBP, loan interest rates are tailored to a borrower’s credit profile. Lower-risk applicants receive lower APRs, while higher-risk borrowers are charged higher rates. This strategy helps credit unions lend in a way that’s both fair and financially sustainable, offering affordable options to those who qualify.

In the example below, a simple table is used to determine the interest rate based on the loan amount and credit score:

Mistake #4: don’t make people join before they can apply to borrow

Requiring borrowers to become members before they can apply for a loan increases dropout rates by over 25%. In an industry where the average abandonment rate is already 70%, adding extra steps only makes things worse.

Even more concerning, when applicants join first and are later declined, credit unions are left with inactive accounts and potential Consumer Duty concerns. Did the applicant fully understand they were opening a savings account, paying a membership fee, and required to maintain a balance?

To reduce friction and mitigate Consumer Duty risks, consider allowing people to apply first. If approved, then invite them to join.

Mistake #5: don’t insist on an initial payment before the loan is disbursed

Requiring a payment before issuing a loan erodes trust and drives borrowers away.

Credit unions that insist on an upfront payment before disbursing a loan see a dropout rate of 22%, compared to just 7% for those that don’t impose this requirement.

The real causes of bad debt are defaults, missed payments, and financial instability. Not whether a borrower makes a payment upfront. If payment reliability is a concern, it’s better to fix that process directly rather than exporting the problem into the credit risk model.

Mistake #6: taking more than 48 hours to approve loans

Speed matters.

Today, 88% of consumers expect same-day service. Between 2000 and 2023, the average human attention span dropped from 12 seconds to just 8.25 seconds. For credit unions, taking longer than 48 hours to approve a loan can lead to significant borrower drop-off.

Consider these examples:

- Credit Union #1 reduced its approval time from 25 hours to 16 hours. As a result, it grew by 10% and reduced its dropout rate to 11%.

- Credit Union #2 cut approval time from 7 hours to just 1 hour. It experienced 400% growth and a dropout rate of only 1%.

Faster decisions not only improve member experience, they drive growth.

Mistake #7: overloading borrowers with paperwork

In the absence of Open Banking, bank statements may be needed to carry out an affordability assessment.

However, requesting detailed income and expenditure information can deter applicants. Even when people aim to be honest, optimism bias often distorts self-reported data, making the extra paperwork both unreliable and burdensome.

Rather than overwhelming applicants, credit unions should use technology to streamline affordability checks, while still upholding responsible lending standards.

Grow your loan book

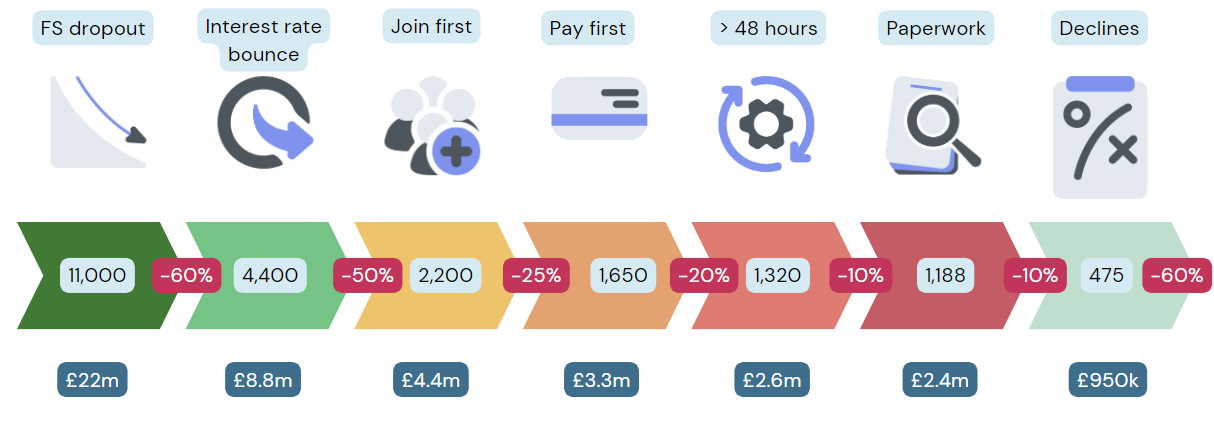

Let’s look at the impact of all the dropout factors listed above combined; the reasons why many credit unions struggle.

We start with 11,000 people applying for loans. At an average loan size of £2,000, that represents £22 million in loan demand.

Even with a generous assumption of a 60% dropout rate (typical in financial services) that figure drops to 4,400 loans worth £8.8 million. As each of the seven common mistakes is made, loan demand continues to shrink. In a typical month, this could fall to just under 1,200 applications. With an average accept rate of 40%, those 11,000 potential loans are reduced to just 475 approvals. Worth under £1 million.

That’s not a bad result, but it could be so much better.

By adopting flexible pricing, simplifying the application process, and engaging borrowers earlier in their journey, credit unions can attract more members, reduce abandonment, and compete more effectively in today’s lending market.

Find out how NestEgg can help you overcome these 7 challenges by using our Decision Engine, Loan Matching and Broker Platform.

Book a demo to learn more.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.