Lending Risk Insights are a yet another new feature for our Decision Engine users. Achieving the right balance between risk and reward helps credit unions grow their loan book and reduce bad debt. NestEgg’s new Lending Risk Insights help responsible lenders achieve this win-win.

For many years credit unions have faced uncertainty when assessing lending risk.

- What’s the overall bad debt risk, right now?

- Are certain products performing better?

- How long does it take for loans to default?

- Do existing members have fewer missed payments?

- Is the risk balance right across the loan book?

- What’s the relationship between credit score and write offs?

- Can I have confidence in automation to improve turnaround time?

Now NestEgg has the answers. Here’s just a small sample (we like to keep a few surprises up our sleeve) of what our new Lending Risk Insights can illustrate.

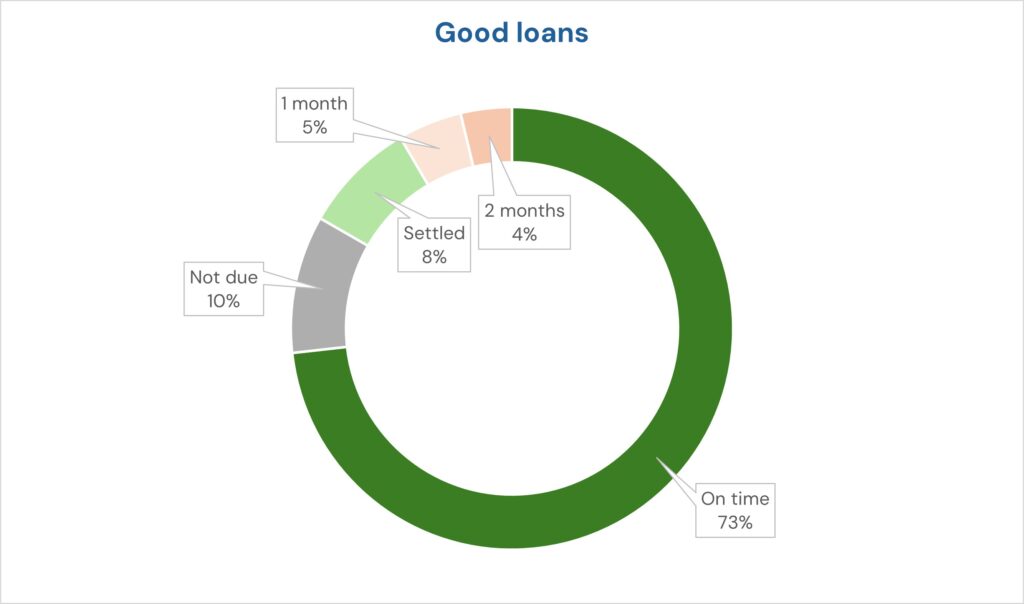

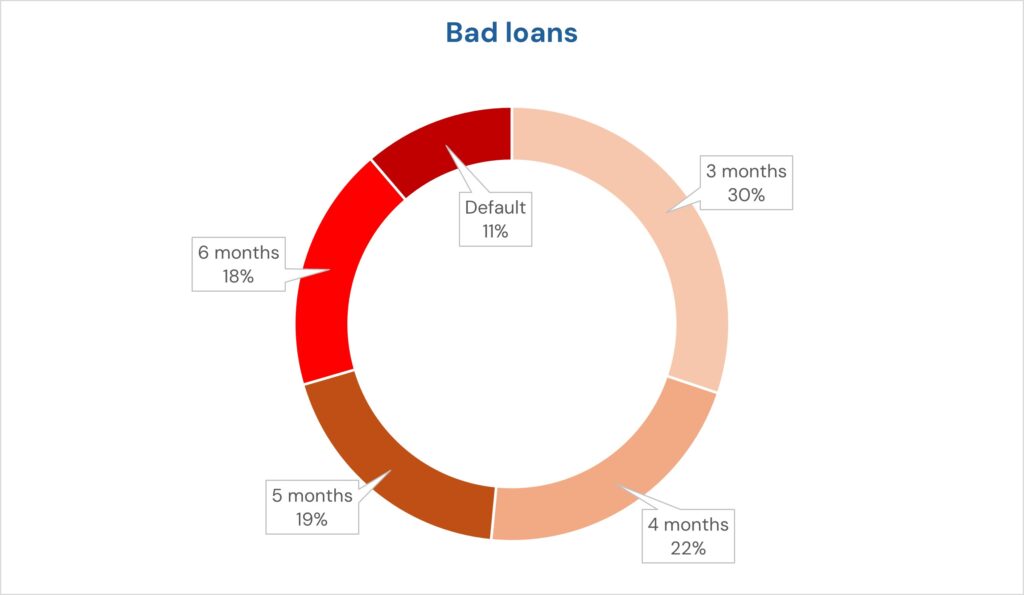

How much bad debt is there?

Credit unions assess the overall arrears and default rates together with the distribution of delinquent loans across the arrears lifecycle. Most importantly, this can be seen on a product-by-product basis.

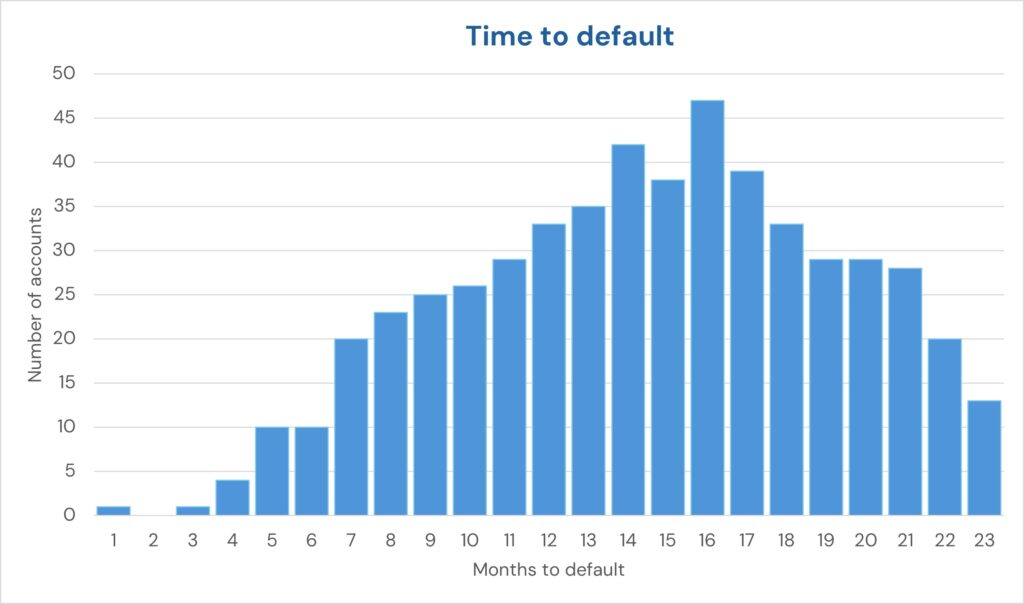

When do loans go bad?

A distribution of time from delinquency to default can highlight issues with particular products. Additionally it can present opportunities for timely interventions to support borrowers at a point before they miss a payment. Consumer Duty compliance and lower defaults result. It will also clearly indicate whether the credit union is at risk from first payment defaulters.

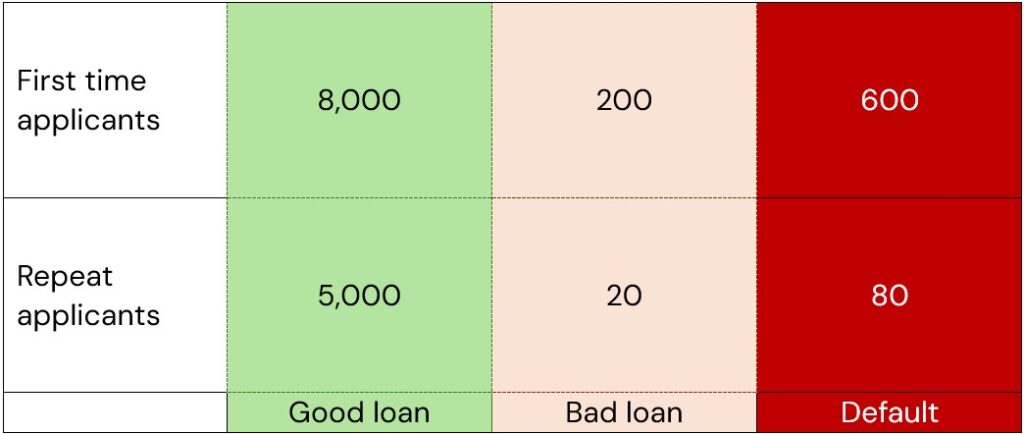

Is there a difference between existing and new applicants?

Lower pricing for existing members is a much-utilised retention and reward strategy. But to what extent do repeat loans perform better?

In the example below 800 of the 8,000 loans issued to first time applicants went into arrears or default (10%). However, for the 5,000 loans made to repeat applicants only 100 ended up in credit control (2%). Therefore, first time applicants were five times more likely to miss loan repayments. How does your credit union compare?

Does the amount lent impact on delinquency?

Counteroffers are common way to still say ‘yes’ but for a lower amount. Conversely a larger loan might be offered. For example, an extra debt may be included in a consolidation loan.

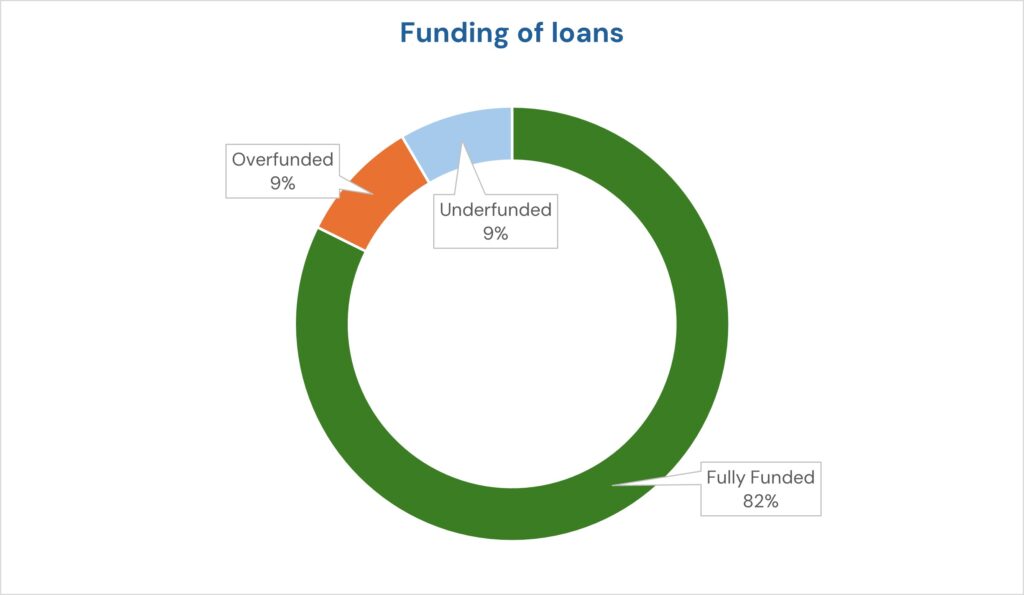

NestEgg examines the variation of funded amount and then considers the relationship between funding, value and delinquency.

Additionally, credit unions spread risk with fewer larger loans and a higher number of smaller value advances. But is this spread delivering the right results? Lending Risk Insights provide the answer.

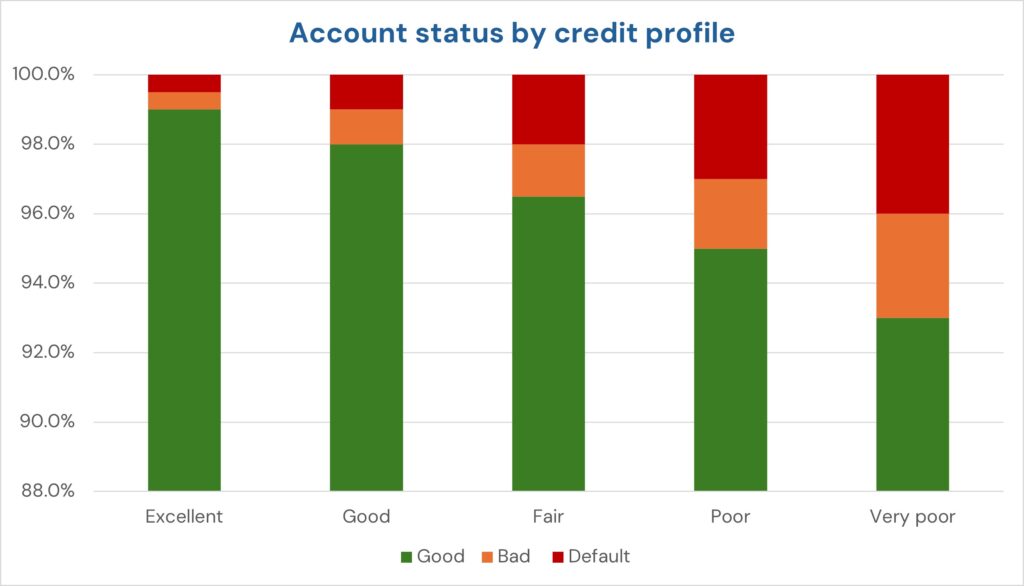

What’s the relationship between bad debt and credit score?

Credit score remains the easiest and best known way to assess overall credit risk. Knowing arrears and default rates by credit profile improves pricing and is a first step to Risk-Based Pricing. Knowing bad rate by credit score improves automation and shows the impact credit unions are having to support those most in need.

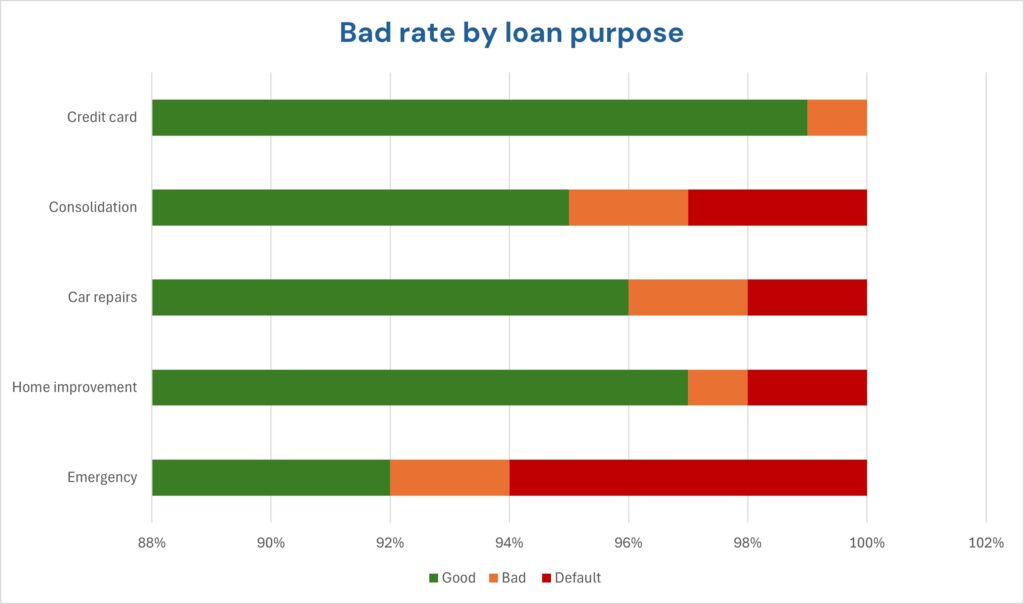

Does loan purpose drive bad debt?

Are some loan purposes more likely to result in missed payments? An accurate answer improves pricing strategies, risk controls and marketing campaigns whilst spreading risk across the loan portfolio.

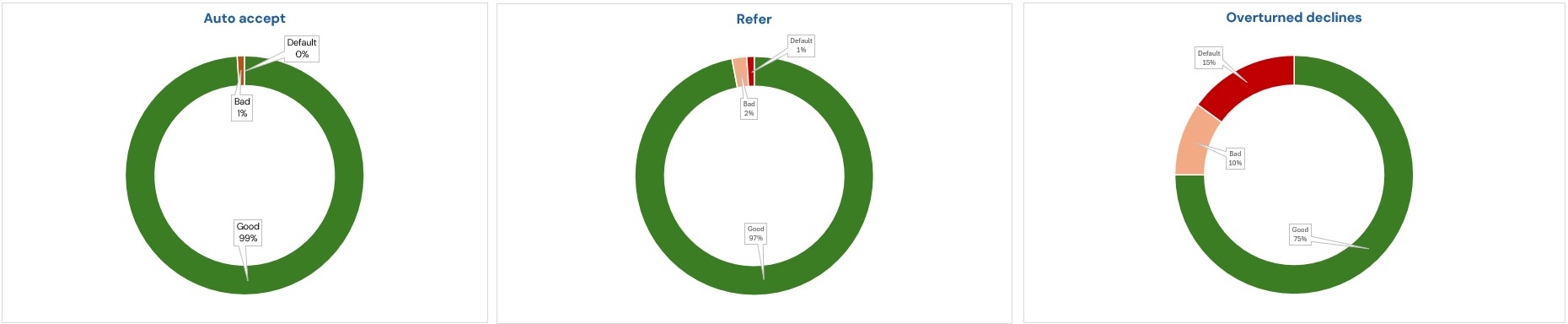

Can we automate more?

Where auto accepts perform better than the overall default rate, this presents a compelling case to fully automate the accepted loans. By far the best way to grow lending is to turnaround loan applications within the hour. NestEgg lenders achieving this are sky-rocketing their lending.

Answer those questions

NestEgg lenders already have a head start. Lending Risk Insights are available right now.

Lending Risk Insights are available shortly after going live on NestEgg’s Decision Engine. They are a great complement to our recently released lending analytics. There’s no need for unanswered questions about lending risk. NestEgg provides the answers so you can grow your loan book within your risk appetite.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.