NestEgg is delighted to announce our participation in cohort 6 of the FCA Sandbox.

The UK’s regulator is encouraging and supporting innovation in the interest of consumers.

NestEgg aims to reduce the number of borrowers using high cost short-term credit. As a result £millions can be saved in excess interest payments.

Our mobile app and software platform uses Financial Health Indicators (FHIs) to transform the way lending decisions are made. We’ll be testing the best ways to improve vulnerable borrowers’ financial health and credit profile.

Credit assessment based on financial health

Credit scoring is useful, but it can be tough on low income borrowers, leading to unreasonably declined loans. For example, repaying loans weekly reduces a score. Furthermore, applicants living in low-income areas, where default rates are higher, may have points deducted.

Similarly, Open Banking is no panacea. Because it only gives a recent snapshot of affordability. Importantly, consumer confidence in Open Banking is nascent at best and suspicious at worst.

For community lenders, like credit unions, savings data are important. Applicants may have a low credit score. Borrowers may barely break-even expenditure-wise. Despite this, evidence of regular saving is a good way to demonstrate thrift. That’s an old-fashioned word. However, credit unions are legally obliged to promote prudent use of money. Because of this, our app helps them achieve this mission.

Putting borrowers in control

Never before will borrowers benefit from such tailored guidance. Because of this the quality of loan applications will improve. Importantly, this ‘customer intimacy’ drives value.

Our innovation is to share information used for lending decisions with the consumer. This will be in the form of FHIs. Consequently, this rebalances the relationship between consumers and lenders by giving more visibility to the use and interpretation of data used for lending. Therefore, consumers have more options. As a result, this lowers price.

The FHIs seen by the user are reflected back in the NestEgg decision engine, with the applicant’s consent. This shared overview of financial health, includes a borrow score, good points and areas to improve. Open Banking reveals a spend according to the 50/30/20 rule. Importantly, actions taken, and the direction of financial health is shown.

Promoting saving

This isn’t just about credit scoring. FHIs cover borrowing, spending and longer-term goals. The overall aim is to help consumers become savers rather than borrowers.

When NestEgg talked to 250 credit union members in late 2019, we asked questions about borrowing. But everyone wanted to speak to us about saving. It quickly emerged that the number one money goal was to build a safety net, not to borrow more.

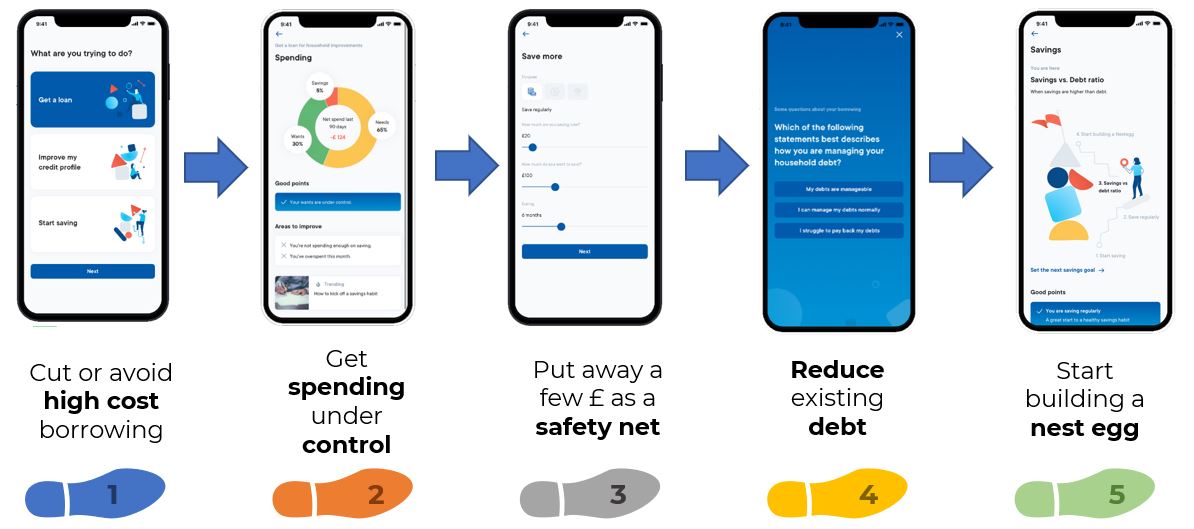

Consequently, financial health is about moving people from being net borrowers to net savers. NestEgg has devised a five point plan to better financial health. It is the first stage – accessing lower cost credit that we will be testing in the sandbox:

The NestEgg five point plan to better financial health

Decline to accept

Community lenders decline 40 – 60% of loans applications.

The NestEgg app provides users with actions to take. Because of this, they make the required changes to be accepted for a loan.

Users connect their credit profile; see how they’re doing and where to improve. An expanding number of tips move applicants from decline to accept. Helping members improve their credit profile will increase responsible lenders’ loan books. NestEgg clients could increase lending by £10m in the six months to March 2021.

Will this all work?

This is the point of the Sandbox. Real tests. Real people. Conducted in a safe environment, promoting best practice. The tests conducted in cohort 6 of the FCA Sandbox are designed to ensure:

- Consumers connect sufficient data to meaningfully populate FHIs

- FHIs improve at a speed that shows consumers tangible benefit

- Borrowers sufficiently engage, demonstrating a business case for lenders

Initially we’ll be working with Central Liverpool Credit Union. Together we built an app for the Affordable Credit Challenge.

Once initial testing is underway, we’ll be opening up to other responsible lenders. And not just credit unions. Nor do you need to be a decision engine user to contribute.

Importantly, testing includes extensive research. Participants will benefit from this. As a result, they can offer better support to their users.

Get in touch to find out more.

Additionally, sign-up to our email newsletter below 👇 to get lending and other insights. And don’t forget to follow us on LinkedIn

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.