NestEgg is now regulated by the Financial Conduct Authority as a provider of credit information services.

This means we can now provide tips to loan applicants on how to improve their chances of being accepted for a loan.

Decline to accept in action!

How does it work?

- An applicant wants to borrow. But they’re unsure they qualify. Additionally, someone may have been declined for loan.

- Both are referred to NestEgg.

- Borrowers connect their credit profile and bank account to the (upcoming) NestEgg app.

- NestEgg identifies areas to work on. Tips are provided e.g. improving a credit score, dealing with missed payments etc.

- Borrowers who act on these tips, will improve their credit profile and financial health over time.

- Borrowers then meet the Decision Engine accept criteria for a chosen lender. Loan providers receive a quality referral.

Will it work?

We think so. Of course, now’s the time to prove it. This is the purpose of our participation in Cohort 6 of the FCA Sandbox.

Verifiable, repeatable experiments that deliver tangible improvements to financial health.

As a result, accept rates for loans will improve. Because of this, bad rates will fall. Consquently, responsible lenders profitability improves.

What about Covid-19?

NestEgg applied for regulatory permission before Coronavirus. However, our approach supports people affected by Covid-19.

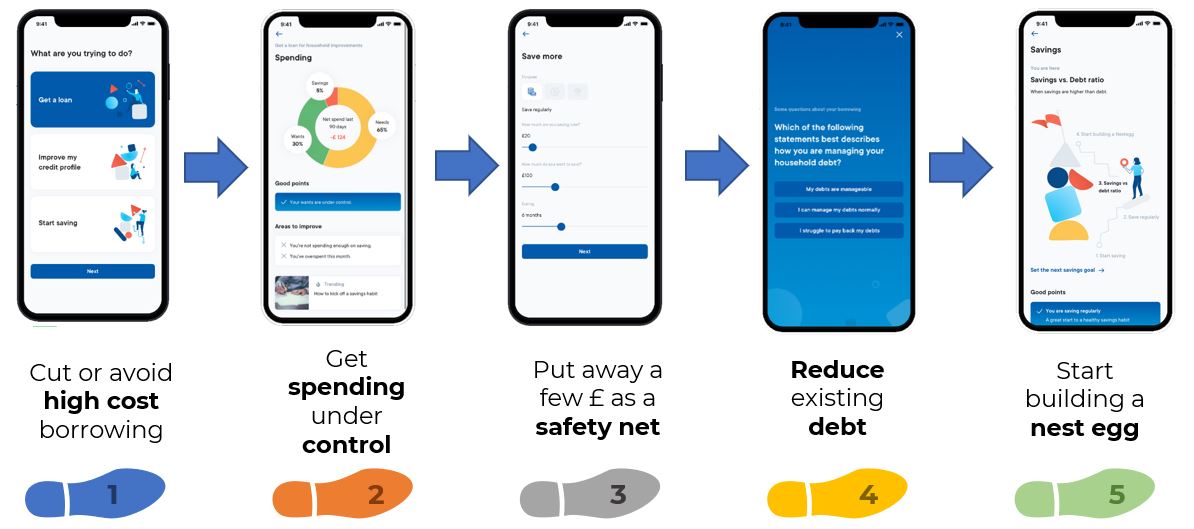

Importantly, our five point Covid-19 recovery plan is the same set of ‘job steps’ required to improve financial health:

Now NestEgg is regulated by the Financial Conduct Authority, we will be providing this service to responsible lenders.

Get in touch to find out more.

Additionally, sign-up to our email newsletter below 👇 to get lending and other insights.

And don’t forget to follow us on LinkedIn

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.