In mid-April NestEgg was one of the presenters at the Finance Innovation Lab Covid19 event. We shared research on credit union loan applications since lockdown and explored how NestEgg is planning to measure the impact of, and recovery from, Covid19. To do this we’ll be using the new Financial Health Indicators, built partly with funding from the Affordable Credit Challenge.

What will the impact of Covid19 be on people’s financial health?

- Are people spending less on ‘fun stuff’ because shops and bars are shut? Does this mean they are paying down debt and saving more?

- Or has freed up income from been eaten away by the cost of ‘needs’ such as more expensive groceries and bigger heating and energy bills?

- How have the furloughed fared? Does having 1/5 less income mean that its been hard to pay down debt and as such are people more likely to be having repayment holidays? Has their credit score fallen as a result?

- The pre-crisis average household savings ratio was 4% of net income. Is that up or down because of Covid19?

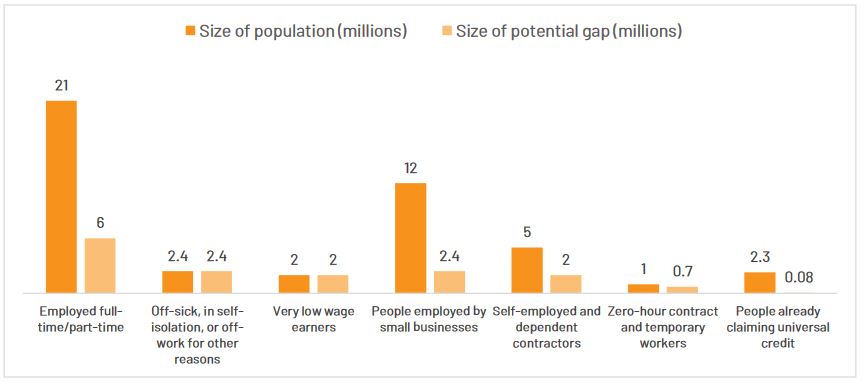

Citing data from the Office of National Statistics, Opinions and Lifestyle Survey, Fair4All found that almost 7 in 10 people are concerned about falling income. 30% fear they will be unable to save as usual.

The Fair4All report also noted gaps between provision and required support affecting over 15m people. Although 44% of Britons think Covid19 will only affect their finances in the short-term, 34% think the health crisis will have a long-term negative impact.

What is the impact of Covid19 on access to credit?

Earlier in April, we posted initial research about why people are borrowing from credit unions since Coronavirus. We estimate that £4 in every £10 borrowed since lockdown is used by members to deal with the impact of Coronavirus. Responsible lenders are ready to help. And there’s a gap in the market.

Before the Covid19 crisis, many credit providers had already shut shop. Their aggressive business models no longer work in a tougher regulatory environment.

But since lockdown, the overall credit market, both high street and high-cost, has shrunk. Lending conditions are tighter. Consequently, it’s harder to get credit. Additionally, the Coronavirus crisis will push some existing lenders out of business. Because of this, borrowers will have fewer choices.

Will more people flock to responsible lenders, or will the illegal money lenders step in? The Opinions and Lifestyle survey cited above found that 10% of people were worried about reduced access to credit.

Partly it’s a communication barrier to overcome. Fair4All argue that “Affordable credit products have real benefits to customers which can be better articulated, including the benefits to overall household resilience .”

The Money Advice & Pensions Service recognise the importance of education at the point of taking out credit. Additionally “services should be designed with the most vulnerable in mind, which would result in services that work for everyone.”

NestEgg is taking into account these assumptions when designing its software.

A five-step plan to recover from Covid19

The Coronavirus doesn’t just attack physical health. People’s financial wellbeing is suffering too and they need help to recover.

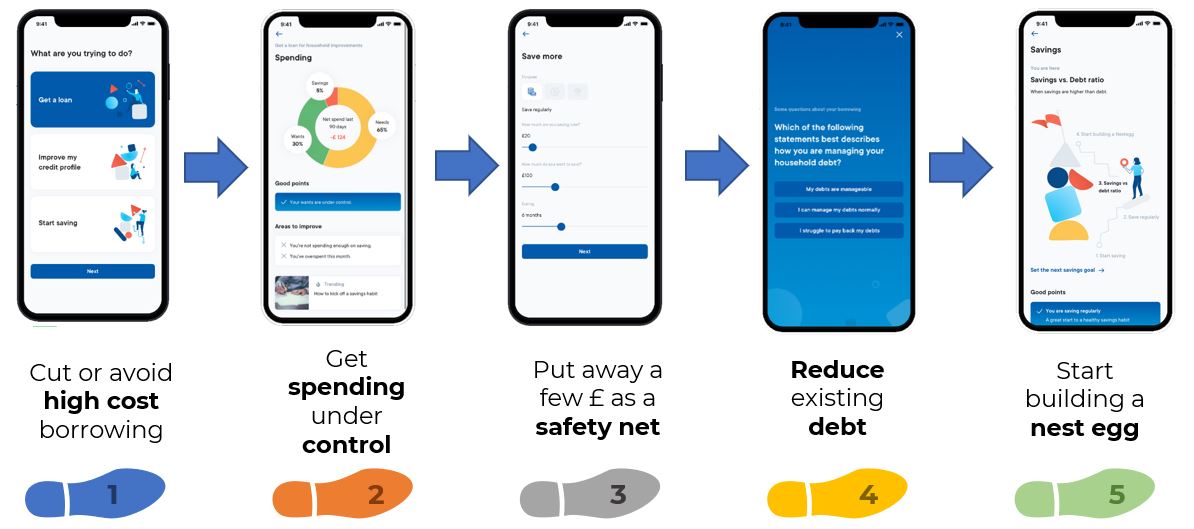

NestEgg helps people do this by taking them through a five-step journey to better financial health. Designed to nudge people to make long-term improvements to their financial wellbeing, the applicability of this approach with Covid19 has become all too urgent.

Our forthcoming consumer mobile app, provides individuals with their own set of Financial Health Indicators (FHIs), covering spending, borrowing and saving. Starting with avoiding high cost credit, FHIs help people get spending under control, start to save, reduce existing debts and build a nest egg. Over time, this will help individuals overcome the financial fragility Covid19 will have left in its wake.

The NestEgg decision engine transparently mirrors these steps. Credit assessments are made on the basis of someone’s overall financial health, not just credit referencing or Open Banking. People have never had this much control and visibility of their financial health before, encouraging potential borrowers to take the actions necessary to be accepted for a loan at the same time as achieving personal financial goals.

Measuring impact and recovery

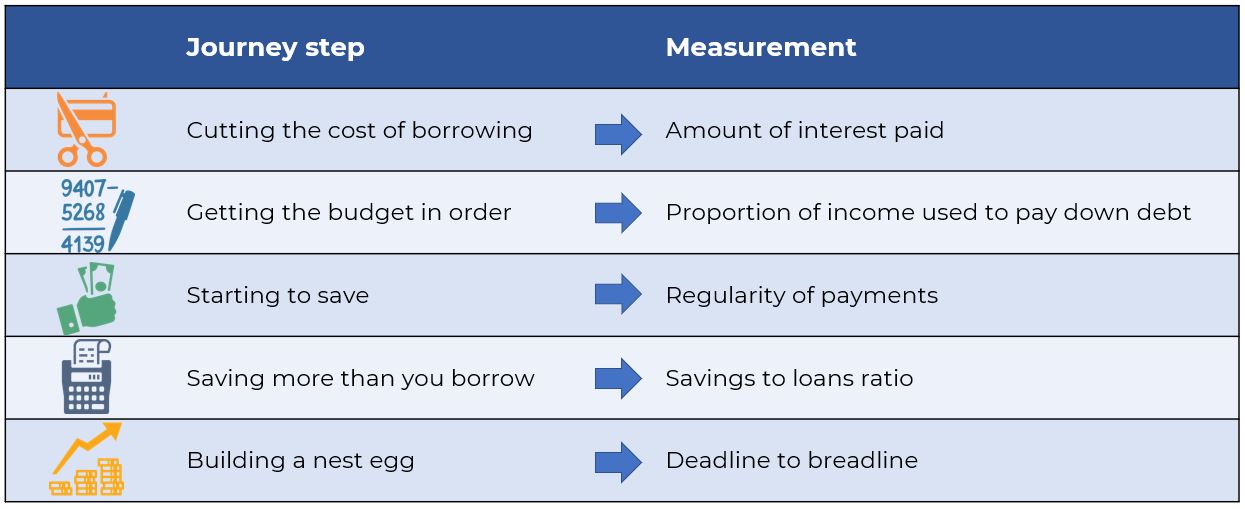

‘Journey steps’ are measured to assess changes to financial wellbeing over time:

Cutting the cost of borrowing: APR is less important for lower income households, but means higher repayments. Cutting the cost of borrowing from three or even four-digit interest rates is an important first step to getting in control of debt.

Cutting the cost of borrowing: APR is less important for lower income households, but means higher repayments. Cutting the cost of borrowing from three or even four-digit interest rates is an important first step to getting in control of debt.

Getting the budget in order: We use the 50/30/20 budgeting rule. Open Banking data splits household income into three different categories: essentials (needs: 50%) flexible spending (wants: 30%). And savings/loans (commitments: 20%). As long the use of money balances, the budget looks after itself.

Getting the budget in order: We use the 50/30/20 budgeting rule. Open Banking data splits household income into three different categories: essentials (needs: 50%) flexible spending (wants: 30%). And savings/loans (commitments: 20%). As long the use of money balances, the budget looks after itself.

Starting to save: With budgets under control, people free up money so they can start saving. Credit unions have their own nudging system for this, through the Save as You Borrow scheme. Borrowers typically have 10% of their loan repayment allocated to a savings account which cannot be accessed until the loan is repaid, reducing the need to borrow in the future.

Starting to save: With budgets under control, people free up money so they can start saving. Credit unions have their own nudging system for this, through the Save as You Borrow scheme. Borrowers typically have 10% of their loan repayment allocated to a savings account which cannot be accessed until the loan is repaid, reducing the need to borrow in the future.

Saving more than you borrow: It’s important to measure changes to the saving to loan ratio. For example, if someone has £5,000 in savings and £15,000 on loan the ratio is 3:1. It seems likely that this will tip more towards debt, during Covid19. When, overall, this tips in favour of savings, a safety net is created.

Saving more than you borrow: It’s important to measure changes to the saving to loan ratio. For example, if someone has £5,000 in savings and £15,000 on loan the ratio is 3:1. It seems likely that this will tip more towards debt, during Covid19. When, overall, this tips in favour of savings, a safety net is created.

This safety net can develop into a nest egg. Importantly this is about the ‘deadline to breadline’. This is the amount of money people have in savings to meet essential expenditure in the event of a loss of income. The UK average is 26 days. For private renters its 2 days. For those in social housing its 0 days. This is where NestEgg hopes its financial health indicators will make the biggest different for low income households.

This safety net can develop into a nest egg. Importantly this is about the ‘deadline to breadline’. This is the amount of money people have in savings to meet essential expenditure in the event of a loss of income. The UK average is 26 days. For private renters its 2 days. For those in social housing its 0 days. This is where NestEgg hopes its financial health indicators will make the biggest different for low income households.

Find out more

To get the latest view on lending and financial health, join our webinar in early June. What are the borrowing habits of low-income households? Is their financial health getting worse because of Covid19, or are there signs of hope?

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.