We’re delighted to announce that NestEgg is a semi-finalist in the Rapid Recovery Challenge.

Challenge participants are improving access to jobs and money, focusing on those hardest hit by the economic shock resulting from COVID-19.

About our solution

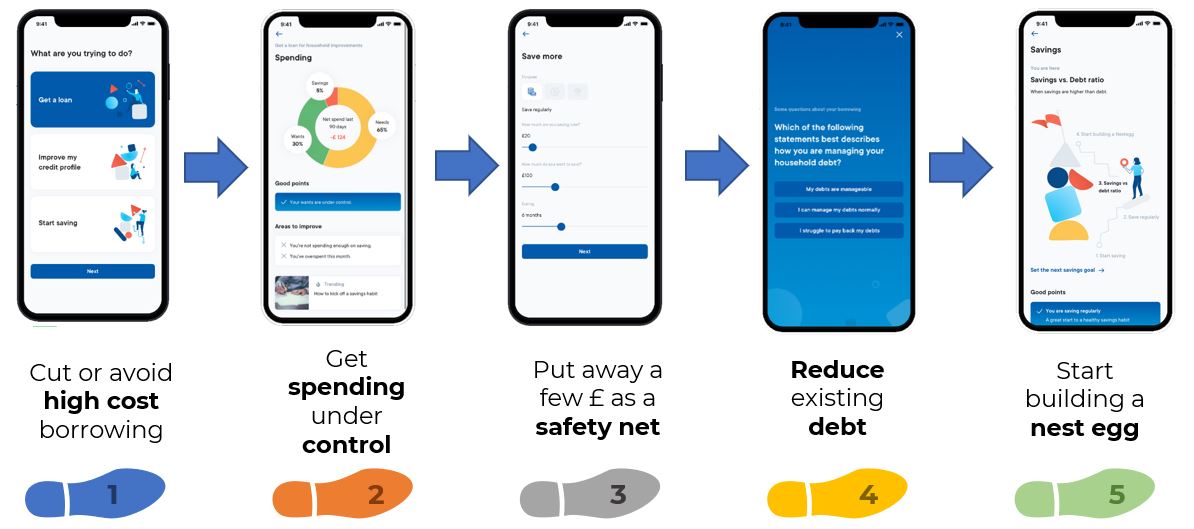

NestEgg’s financial health app makes it easy for low-income workers to access affordable credit. Moreover, it encourages users to start saving for a resilient future.

Combining data from credit files and bank accounts, the app transforms these into three Financial Health Indicators: borrowing, spending and saving.

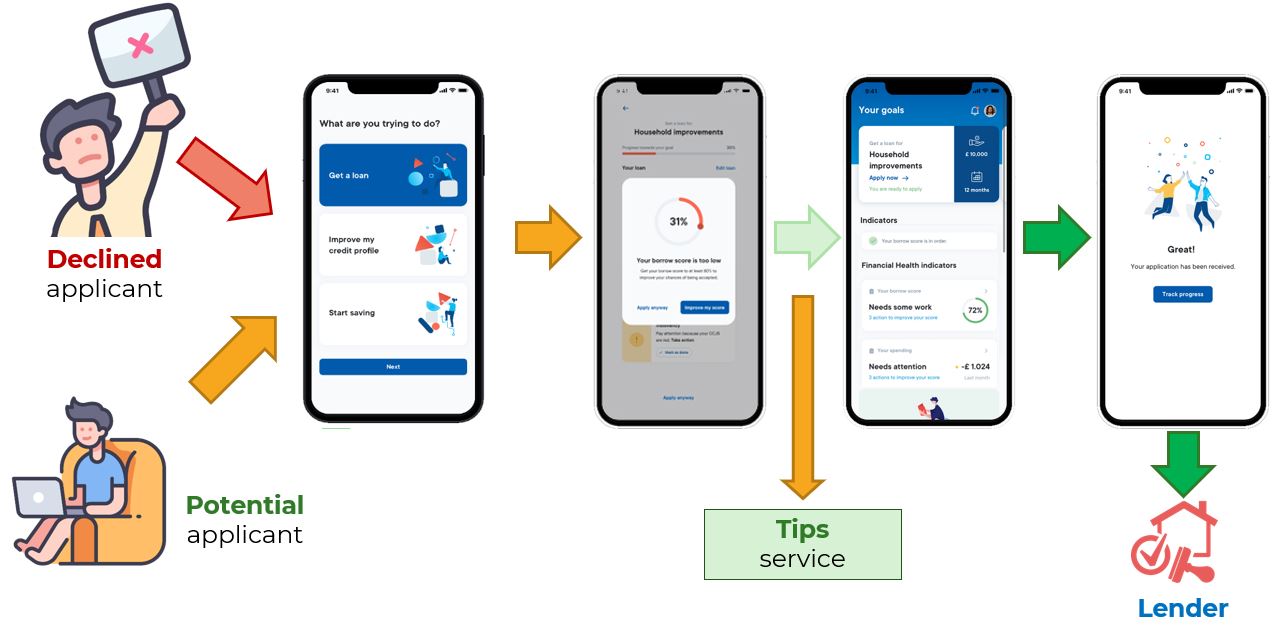

Applicants turned down for loans receive tips and advice. Because of this, users make the changes necessary to be accepted next time.

Goals are set against the indicators, helping people recover financially from COVID-19.

NestEgg: 5 steps to better financial health

Avoiding the backward steps of Covid-19

Responsible lenders and NestEgg have partnered for 18 months, finding ways to improve borrowers’ financial health.

Since the pandemic, low paid workers are being hardest hit. Significantly, 4 in 10 told us that they are worse off because of Covid-19. Credit scores have fallen further than the rest of the population. Furthermore, missed payments are rising.

The Rapid Recovery Challenge enables us to develop our app for COVID-19. Because of this, we’ll help people avoid backward steps that worsen financial health.

NestEgg – Backward steps away from financial health

For example, end-users’ problems start with loss of income. Whilst waiting for tax credits or work, credit cards and overdrafts fund essential purchases.

With reduced incomes, it’s hard to make credit repayments. Arrears accumulate. Credit scores tumble. Legal action may commence.

As a result, it becomes almost impossible to get credit from mainstream lenders. Consequently, people turn to high cost credit.

Importantly, the app helps people avoid backward steps, rebuilding their financial health and becoming more resilient.

Being a semi-finalist in the Rapid Recovery Challenge provides a fantastic opportunity for the partnership to redouble its efforts, helping people avoid high cost credit and get the loans they deserve. Furthermore, users become resilient to future shocks after COVID-19.

Join our 100k challenge

Join our partnership and help 100,000 low paid workers recover financially from COVID-19.

We’re expanding our partnership to support 1,000s more people.

The partnership will pull 1,000s of people back from their credit card limits. Lenders will help people get back on their feet after defaulting on loans. Additionally, increasing credit scores makes it easier to access affordable credit.

We’re expecting big increases in declined applications. But responsible lenders will account for only a small proportion of these. Responsible lenders helping their users is built into their D.N.A. Because of this there’s a commitment to respond rather than refuse.

Despite this, there’s an opportunity to encourage banks to refer declined applications. As a consequence, this would lead to 1,000s of new customers for credit unions and CDFIs.

For example, in the diagram below, a declined applicant connects their credit profile and bank account. They see if they qualify for a loan. However, at this stage a loan would not be accepted. Subsequently, tips are provided, outlining the changes required to be accepted next time. Applicants action tips. The app matches the updated credit profile against the accept criteria for participating lenders. Lenders are then alerted to the new, lower-risk, application.

NestEgg – Decline to accept service

Take part

Our COVID-19 Financial Recovery Action Group will meet on 14 January at 10am.

The webinar will explore the benefits of working with NestEgg and community lenders on the Rapid Recovery Challenge. Stakeholders and lenders are invited.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.