This February and March, NestEgg is rolling out a major upgrade to its scalable Decision Engine, bringing 50 credit unions onto the latest and most advanced version of our award-winning platform. With this enhancement, lenders will benefit from even smarter, faster, and more powerful lending decisions—delivering greater efficiency and impact.

NestEgg offers a scalable Decision Engine that seamlessly supports responsible lenders no matter whether they issue under 100 or more than 10,000 loans every month. With its intuitive usability and no-code flexibility, it ensures smooth operations and optimal performance, no matter the volume.

Faster loans

But that’s not all. Our new Dashboard 2.0 isn’t just about a better User Interface, it’s about speed and efficiency. Since migrating, lenders have already seen a 20% faster loan turnaround, making it easier than ever to serve borrowers quickly and effectively.

Instant decisions, smarter lending

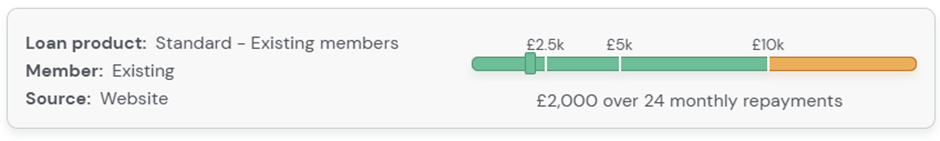

The moment an application arrives, decisions are clearly summarised, showing the requested loan amount and projected outcomes across different risk bandings. Need to adjust? Alternative offers are effortless. With built-in risk-based pricing and soft credit checks, you can make smarter, faster lending decisions with confidence.

What matters most

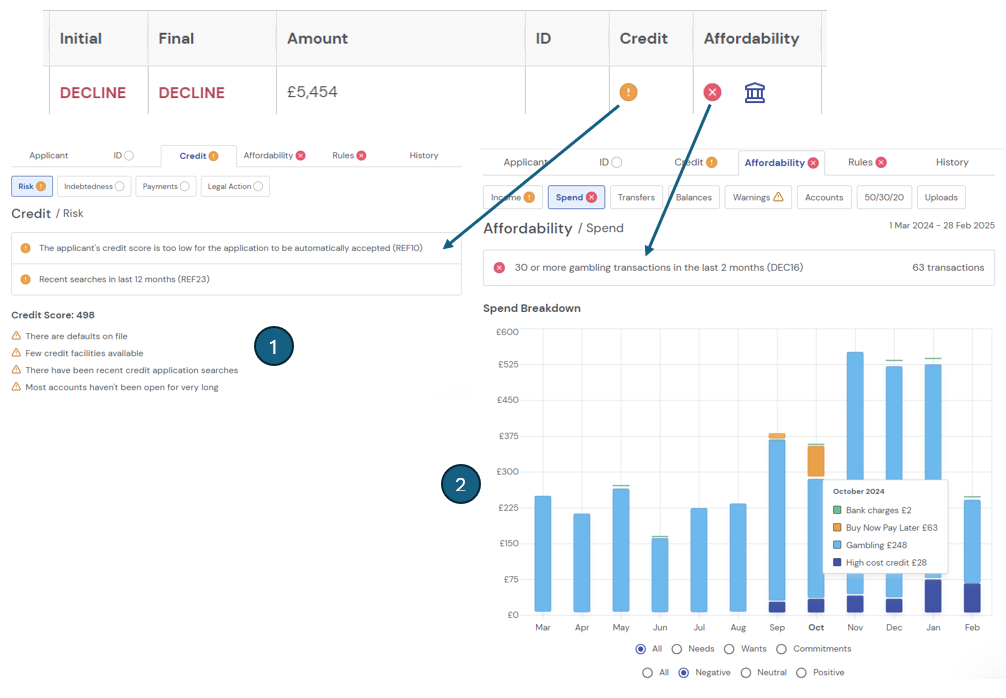

NestEgg’s scalable Decision Engine transforms loan processing by surfacing key applicant data, no need to sift through lengthy credit reports. Our powerful, customizable rules assess credit risk in seconds, factoring in credit score, debt ratios, repayment history, legal actions, and affordability.

We handle the complex calculations, so you don’t have to. Need to adjust? New rules go live in minutes, keeping you agile and in control.

In the example below, a Loan Officer instantly sees that key referral and decline rules have been triggered—highlighted clearly in the detailed view for quick decision-making.

- Credit data: the applicant’s credit score is too low for an auto-accept, and a high number of recent credit searches indicate they’re actively shopping for credit.

- Open Banking data: extensive gambling activity over the past two months has triggered an affordability decline rule.

With this level of insight, Loan Officers can make informed, confident lending decisions – fast.

Smarter affordability insights, accurate categorisation

The affordability section puts everything Loan Officers need at their fingertips—income, expenses, card payments, and savings—offering a clear picture of an applicant’s financial health.

- Instant insights: review account transfers, running balances, and affordability warnings that combine credit and Open Banking data.

- Deeper analysis: spot income trends, spending patterns, and budget compliance with the 50/30/20 rule for smarter lending decisions.

- Seamless categorisation: Open Banking data is notoriously tricky to classify, but NestEgg makes it effortless. Loan Officers can instantly update spending categories for current and future applications, ensuring unrivaled accuracy.

With over 400 Loan Officers across the UK using this feature, NestEgg is setting the new standard in Open Banking categorisation.

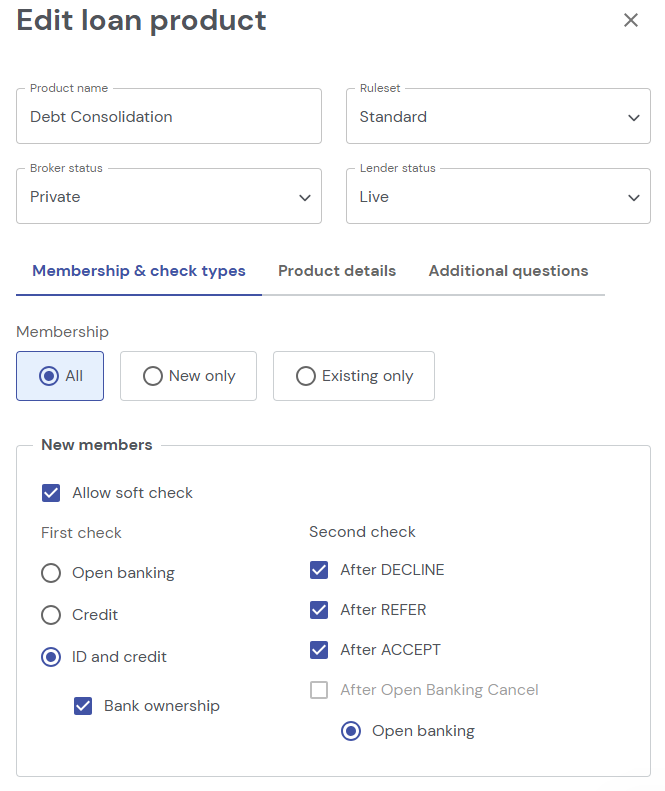

Create and customise loans in minutes

Design loan products your way—quickly and effortlessly. Set qualification criteria, terms, interest rates, and data checks with ease.

- Tailor borrower questions to fit your needs

- Apply soft credit checks for smarter lending decisions

- Encourage savings to support financial well-being

With one-click deployment, updates go live instantly. NestEgg offers a scalable Decision Engine that gives you full control and flexibility at your fingertips.

Seamless applicant communication

Keep applicants informed every step of the way.

- Automated updates: send emails when applications are submitted and reviewed.

- Instant requests: request Open Banking connections and additional documents, like payslips or ID, at the press of a button.

- Quick decisions: effortlessly notify applicants when they’ve been accepted or declined for a loan.

With streamlined communication, you enhance the member experience while keeping the process efficient and hassle-free.

Track progress

Get ready to take your loan portfolio to the next level. Our latest analytics tools deliver deep, actionable insights that help you pinpoint what’s working, optimize your strategy, and accelerate growth.

As the first major release on Dashboard 2.0, these cutting-edge reports provide an unprecedented view into credit union lending, helping you make smarter, data-driven decisions with ease.

Launching this week, these are the most advanced analytics tools the credit union sector has ever seen. Stay tuned—you won’t want to miss this game-changing update!

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.