The ‘50/30/20’ method is a budgeting tool and can assist you in managing your money more efficiently.

Using this method of budgeting is a good way to increase your savings. Savings are a crucial part of money management. Recent UK saving statistics found that 34% of adults have either no savings, or less than £1000, in a savings account.

With the current rise in the cost of living, it is more important than ever to manage your money.

We will discuss what the 50/30/20 budgeting method is and explore if this method is realistic.

How does it work?

Having a budget can improve your money management, increasing confidence and reducing stress.

The 50/30/20 rule is an easy and low-effort way to plan your spending.

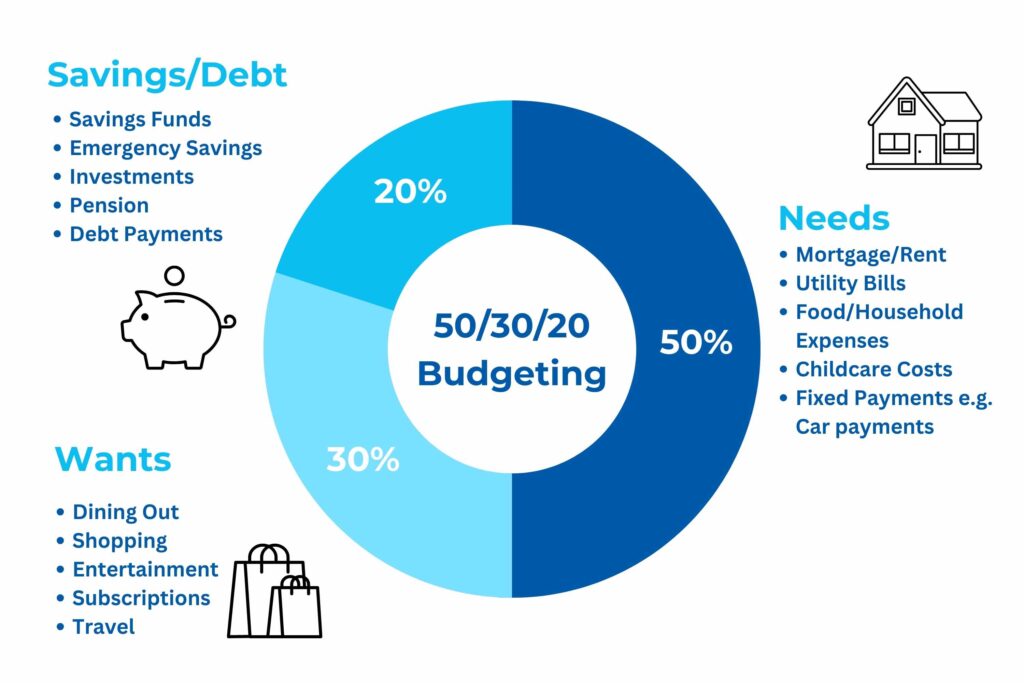

The rule requires you to split your expenses into three main categories:

- 50% of your income on needs

This includes essential living expenses such as: rent/mortgage, utility bills, food, childcare and household costs, and transport to work.

- 30% on wants

This includes discretionary spending such as: eating out, entertainment, shopping, trips, and subscriptions.

- 20% on savings or debt

This includes paying off debt, or putting money into a savings account, investment, or pension fund.

As an example, if you are a single household and your net income is £1,500 per month, you should aim for:

- £750 spent on ‘needs’

- £450 spent on ‘wants’

- £300 placed into savings and/or paying down any debt

Using this method of budgeting allows you to see where your money is being spent. This is a useful way of identifying areas you may be overspending or spending unnecessarily. For instance, if you buy multiple takeaways per week, many of which charge for delivery, you may choose to collect on the odd occasion and reduce delivery costs. Or even reduce the number of takeaways per week.

This technique is a good way to get into the habit of budgeting consistently. Additionally, the beauty of this method is that you are in control. If an unexpected expense has knocked you off track one month, don’t worry. Just try to get back on track the following month.

Is this method realistic?

Everyone’s situation is different, and with the current cost of living crisis this method of budgeting may not work for everyone.

Whilst the cost of living crisis has certainly highlighted the importance of budgeting and money management. Conversely, it has made it difficult for many to dedicate to saving.

If saving 20% of your income is not realistic, you can always adjust the percentages and aim to save a smaller amount. Similarly, if you can afford to save more you can increase your saving amounts.

Putting money aside for a rainy day or having a savings goal is what many should aim for. Therefore, it is a good idea to analyse your expenses and keep track of your money.

Boost your chances of getting an affordable loan

Enter your email to get tips once or twice a month

No spam. Unsubscribe anytime.