20 credit unions attended our Car Loans Roundtable on 10th November. The meeting explored the opportunity the Finance Bill presents for credit unions wanting to grow their loan books. Currently passing through Parliament, when enacted the Bill means credit unions will be able to offer Conditional Sales Agreements.

Conditional Sales Agreements are similar to hire purchase. Loan agreements would include the condition that the goods don’t belong to the borrower until they’ve paid the final instalment. Until that point the lender may repossess the goods if the borrower falls behind with payments.

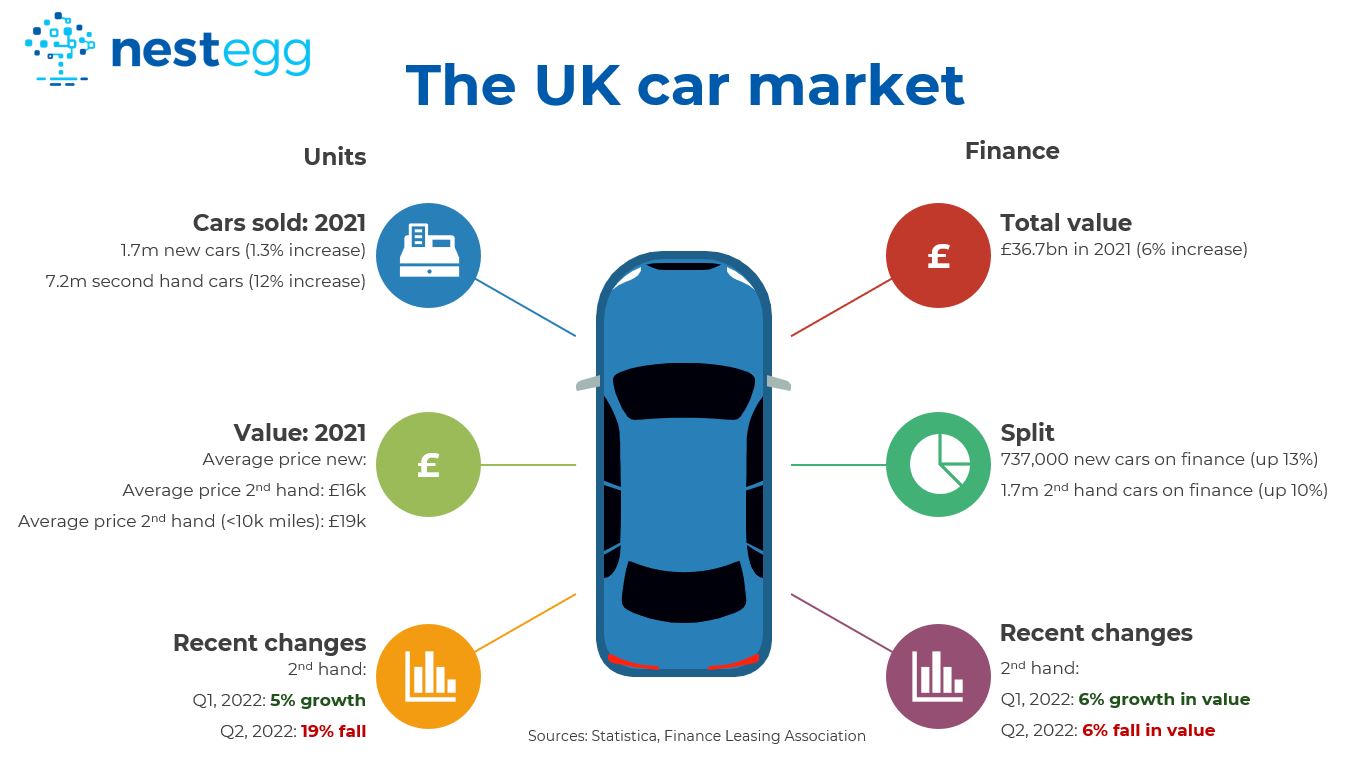

The car loan market

In 2021, 9m cars were sold. The vast majority are second hand. The average price of a 2nd hand car was £16,000. Almost 2m second hand cars were bought on finance, a year-on-year increase of 10%. However, the value of these loans fell 6% in quarter 2, 2022. This is perhaps a reflection of falling demand as the cost-of-living crisis bites.

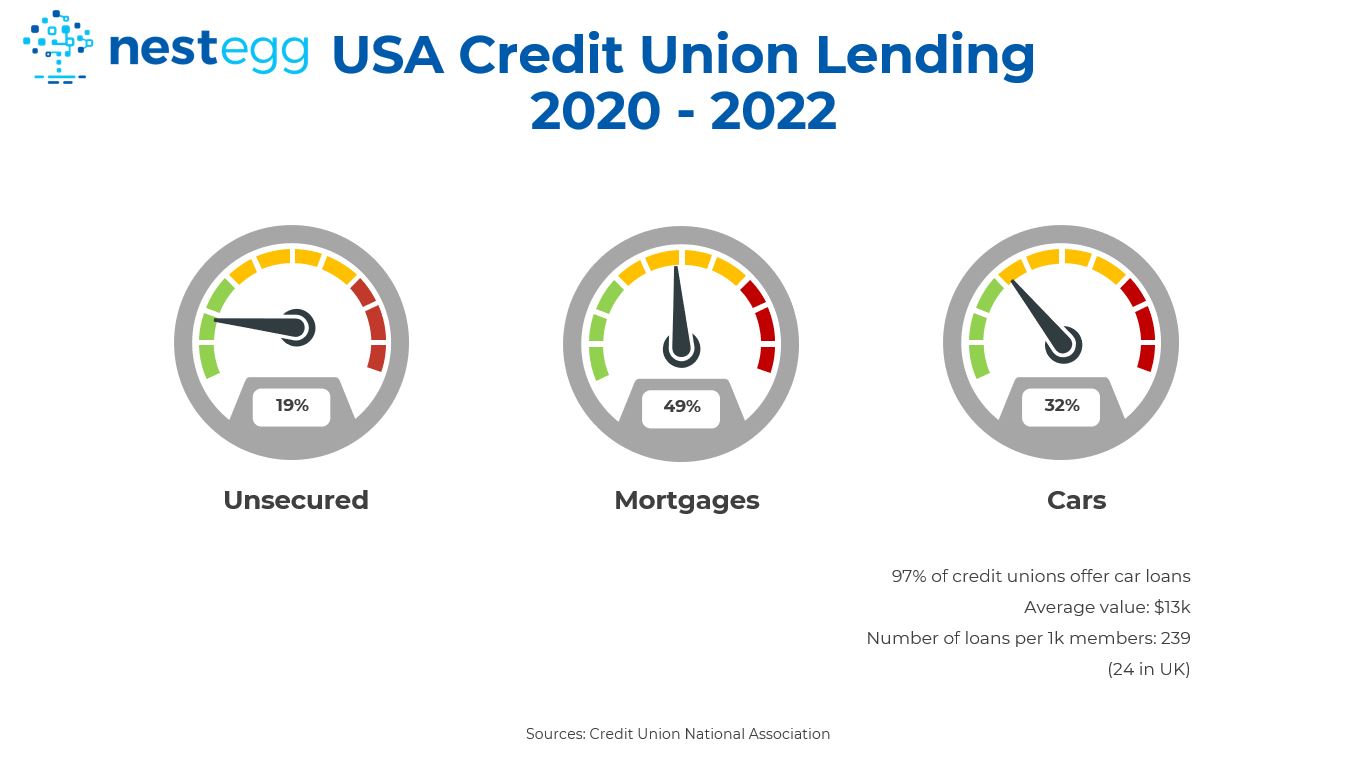

US credit unions lead the way

In the United States 1/3 of lending (by value) is auto finance. The average value of loans is lower than the UK at $13,000 (£11,000). However, the number of loans per 1,000 issued is 10x higher than the UK (USA: 239 per 1,000 loans. UK: 24 per 1,000 loans). Because of this, there’s plenty of opportunity for growth.

A view from ABCUL

Robert Kelly, the CEO of the Association of British Credit Unions, outlined the long journey to getting the legislation updated. New rules will help diversify the loan book and income streams. As a result, credit union members are more likely to take out more than one product. Often known as increasing wallet share, credit unions will be able to meet more member needs

But there are challenges ahead, especially in relation to compliance. Credit unions will need additional regulatory permissions. This is on top of the Consumer Duty requirements from July 2023.

A Credit Union Services Organisation (CUSO) may carry out centralised activities on behalf of credit unions. This could include legal support.

A view from HEYCU

Hull and East Yorkshire Credit Union is a community-based credit union with 16,000 members and a loan book of £5.5m. With strong regulatory capital and liquidity, the Credit Union feels that it has sufficient resources to make larger car loans. Furthermore, with a geographically large common bond there are plenty of car dealerships to partner with. Some salary sacrifice schemes offer car loans, but there are potential taxation issues. On the other hand, car loans on payroll deduction is a growth area.

Typical car loan applicants

NestEgg decision engine data shows car loan applications account for fewer than 5% of all loans by number. However, these did make up 10% of all loan applications by value. Average values were 4x the norm, at almost £5,000. Importantly, credit scores were near prime. Furthermore, automatically accepted decisions were 12% higher than all loan types. Eventually 7 in 10 car loans are accepted.

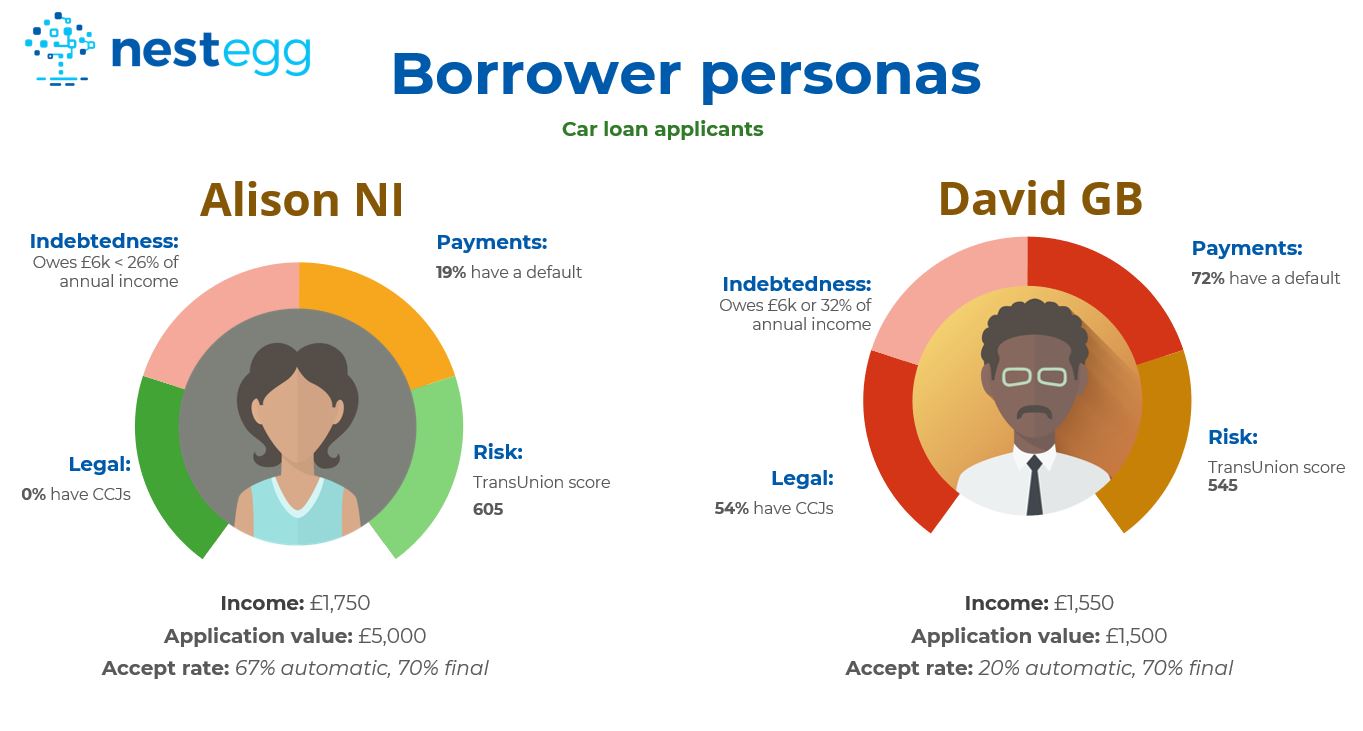

Personas

We took a look at two borrower personas. A persona is a typical type of borrower.

Alison, for example, was a member of a Northern Ireland credit union, where membership can be near-universal. With a broader range of borrowers, loans tend to be less risky, overall. Therefore, it was unsurprising that Alison had no CCJs, only mobile phone defaults and a credit score of 605. Alison needed just over £5,000 for a second hand car. This would be repaid from a monthly net income of £1,750. Overall debts represented around 26% of annual income.

David, on the other hand, was a member of a credit union operating in the top 10% most income deprived regions in Great Britain. His loan request was £1,500 for a 2nd hand car. This would be repaid from a net income of £1,550. 75% of people matching David’s ‘persona’ had defaults. One in three had a county court judgment. David’s credit score is in the bottom 20% at 550.

As David wouldn’t be able to afford a larger car loan, a conditional sales agreement might be disproportionate to the value of the loan. There’s little point in incurring the legal overhead for a small loan. Consequently, this is business as usual lending.

Credit unions in GB have needed to broaden their membership base for some time. Offering larger loans will help as more people are attracted to an increasingly diverse range of products.

Breakout groups

Four breakout groups looked at the key risks and infrastructure required to make this work.

Overall, Conditional Sales Agreements were seen as a good opportunity to grow the loan book, but not necessarily one to rush into. Furthermore, there’s a lot of preparatory work to do. Compliance and infrastructure, included. Would a CUSO need to be created to make this work at scale? On the other hand, there are many car finance firms already providing such a service. Therefore, there’s plenty to learn from companies already operating in this area.

For context, it was noted that we are in a cost of living crisis. The longest recession in a century is predicted. Because of this, lending is getting tougher. However, if loan declines increase, this could be offset by a small number of Conditional Sales Agreements to the right borrowers.

Next steps

NestEgg’s decision engine is currently being configured to provide a specialised car loan rule set. This should improve automation for second hand car loans. Additional data can check car valuations and legal status. Because larger car loans are being granted already, increasing the data for car loans will help develop a sales, marketing and delivery strategies for this new opportunity.

If you’d like to continue (or join) the discussion, simply fill in the form below. We’ll then be able to share your details with others considering offering conditional sales agreements. We’ll set up a further meeting in early 2023.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.