Marketing & Growth

Car loans roundtable

20 credit unions attended our Car Loans Roundtable on 10th November. The meeting explored the opportunity the Finance Bill presents for credit unions wanting to grow their loan books. Currently passing through Parliament, when enacted the Bill means credit unions will be able to offer Conditional Sales Agreements. Conditional Sales Agreements are similar to hire…

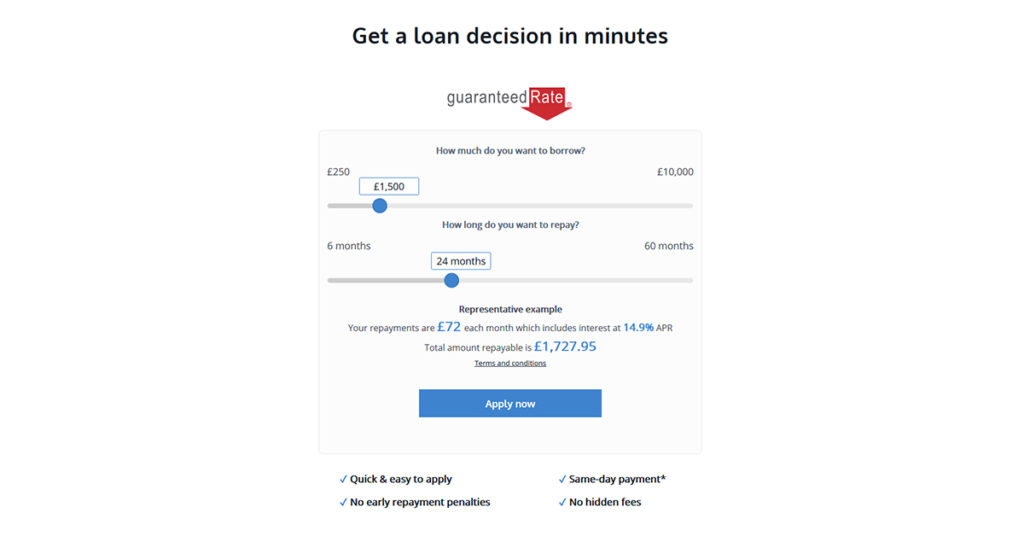

Read MoreFaster growth with easy online applications

Covid-19 has been a catalyst for change. A huge global nudge in the direction of doing things online. Because of this, borrowers expect easy online applications. Get this right and loan books grow. Get this wrong and 58% of people will never use your services again. Worse still, 6 in 10 of 25 – 34…

Read More