Combining credit and open banking data is the key to understanding affordability.

With interest rates rising and the cost of living crisis continuing, new ways of understanding affordability are essential.

Open Banking is one way to assess affordability because it gives the latest transaction data. However affordability is much more powerful when open banking is combined with Credit Reference Agency data (CRA), such as TransUnion or Experian).

A project funded by Innovate UK, enables NestEgg to provide the only decision engine in the market providing this level of insight by combining credit and open banking data.

The disposable income calculation

Counter-intuitively we’ve been looking at an approach which doesn’t directly take into account income. What’s critical is how people are spending money. Of course the NestEgg decision engine already looks at income in a number of different ways. However, if a typical month’s spend is deducted from income, then in most cases – rich or poor – the money’s been spent. Consequently it reveals little about affordability. It’s only part of the picture.

So we turned to the data to look for other insights, combining credit and open banking data.

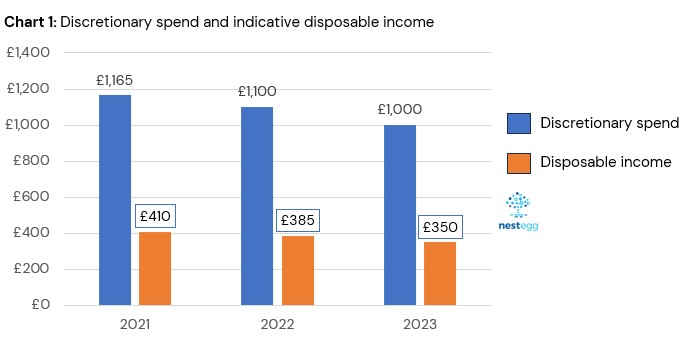

Firstly we used open banking data, in aggregate, to calculate discretionary spending.

This is the amount of money people had left over, once essential expenses were met. This has fallen 14% over the last two years.

Credit unions often use 35% of discretionary spend as a proxy for disposable income. Applying that, as the chart below shows, disposable income has fallen from £410 to £350 over the past three years:

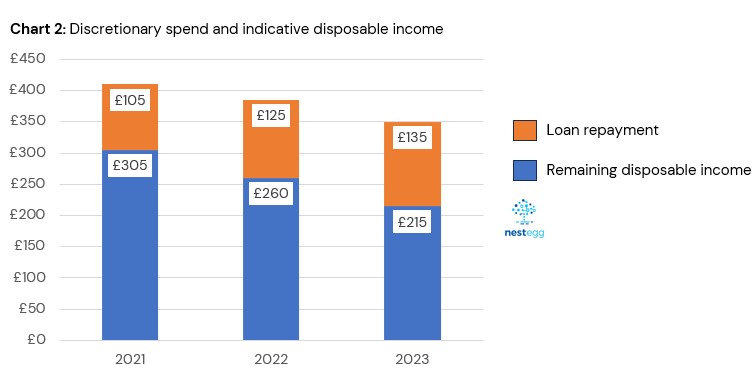

Secondly, we took the average proposed loan repayment and considered this as a proportion of disposable income.

In the graph below we can see in 2021 the average loan repayment to a credit union was £105. This left £305 disposable income. By 2023 the loan repayment as a proportion of disposable income rose from 26% to 38%:

And that’s really as far as open banking goes. Useful, but only part of the picture. Credit bureau data is an essential addition.

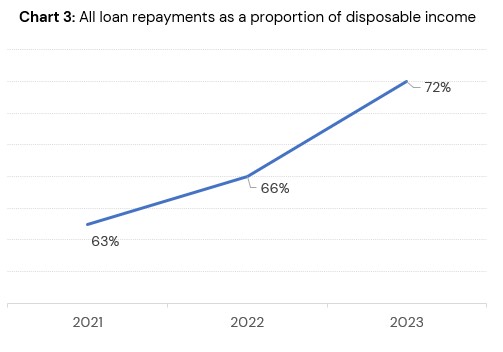

Therefore, thirdly we used CRA data to review all the other loan repayments. In 2021 63% of disposable income was being used to pay for credit. This rose to 72% in 2023:

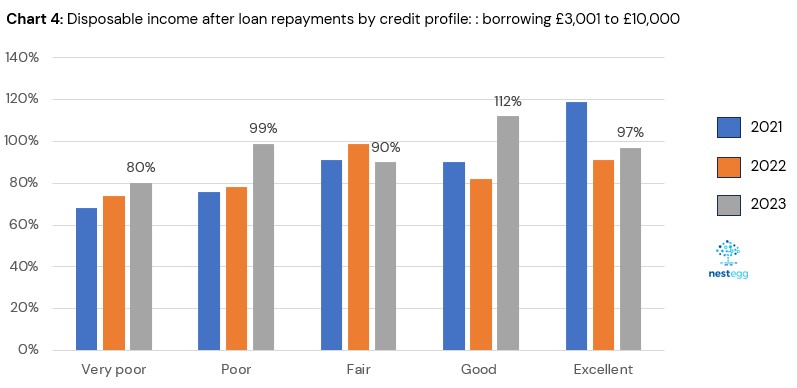

For some time credit unions have been considering how they attract borrowers with near prime credit scores who are looking for a larger sized loan. Unfortunately, the affordability news isn’t good.

Chart 4, below, shows the disposable income after all loan repayments by credit profile between 2021 and 2022. As we can see those with good credit profiles (604 – 627) are now spending 112% of their disposable income servicing loan repayments (excluding the mortgage):

Is lending smaller amounts, once again, the best strategy?

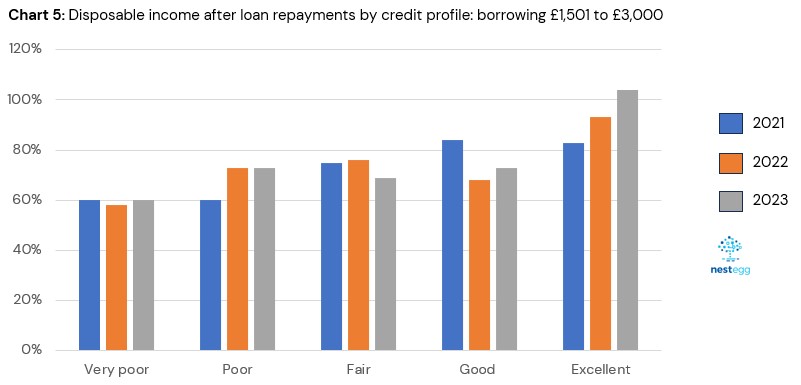

Repeating the exercise for people looking to borrow £1,501 to £3,000, results in more capacity for affordable lending. This is especially true for those with poorer credit scores.

People with good or excellent credit scores are more likely to have mortgages to repay. With rising interest rates disposable income has fallen. In other words, there hasn’t been an increase in loan repayments. Rising mortgage payments have led to an increase in essential spending.

We’re running a separate analysis relating to mortgage payments, which we’ll reveal shortly.

Automatic affordability decisioning

Now the data’s in, we’re building a summary of affordability in the decision engine dashboard. At a glance loans officers will be able to see the indicative disposable income and the proposed loan payment alongside existing credit commitments. A Red, Amber or Green status is applied depending whether disposable income is negative. As a result, Loan Officer time is saved when assessing disposable income.

For the first time, we’re combining credit and open banking data for better affordability assessment.

Book a free demo of our decision engine software here

More affordability insights

NestEgg is currently running a number of affordability experiments to answer the following questions:

- What’s happening to discretionary spending as a result of higher inflation and mortgage rates?

- Are people using credit cards and Buy Now Pay Later to meet their essential spending?

- By how much have mortgage payments increased and how does this impact affordability?

- What’s happening to missed payments? Are they increasing and what are the early warning signs?

We’ll be revealing more on this subject at our forthcoming Mutual Growth event.

If you’re a credit union, CDFI or Building Society you can join us in Birmingham and debate tactics to grow the responsible lending sector.

Book your place here

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.