Rising mortgage rates and affordability is a big issue for lenders right now. Can people with mortgages afford to borrow? It’s important to know how much costs have risen and what impact that has on affordability and credit risk.

Our last blog explained how those with better credit scores (who are more likely to have a mortgage) have seen their discretionary fall, along with disposable income. In many cases almost all disposable was used to repay debt. For some borrowers, the debt burden is becoming unsustainable.

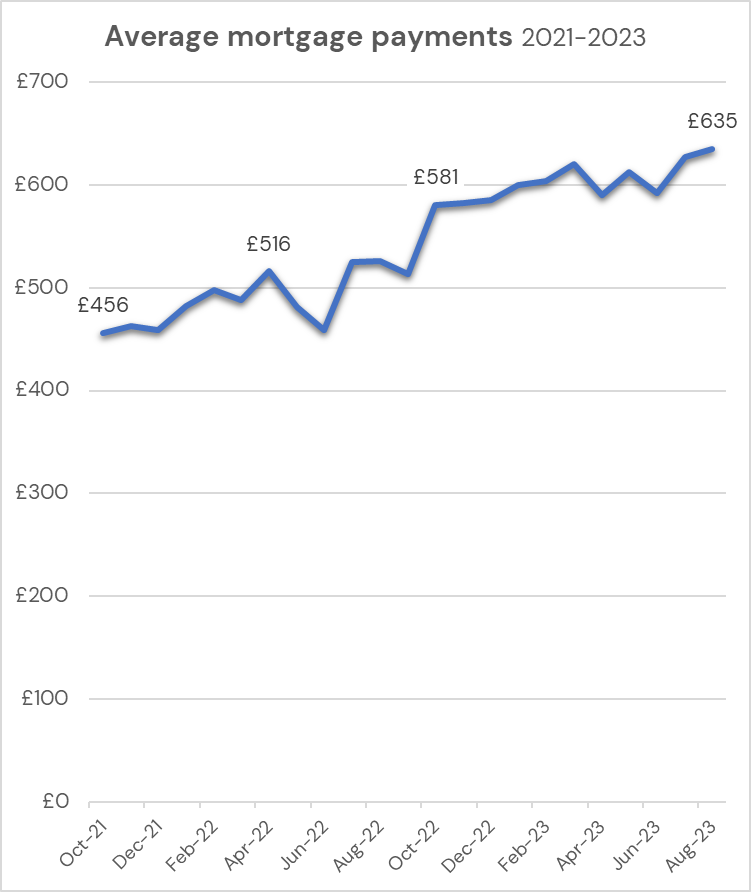

Mortgage payments have risen 40%

Back in October 2021, a loan applicant to a credit union had an average monthly mortgage payment union of £456. In September 2023 this had risen to £635. That’s a 40% increase.

At the same time, average spend on savings and investments fell from £210 to £110.

For those with a good credit score, the average mortgage payment has risen from just over £500 in October 2021 to £665 in July 2023.

What about mortgage arrears?

For all credit scores 5% of borrowers have missed payments on their mortgage in the last 12 months. This has risen by 0.5% over the last six months.

Rising mortgage rates and affordability are becoming an issue but, for people with poor credit scores the arrears rate is more worrying. 20% have arrears on their mortgage in the last six months. That’s a significant increase from 13% six months ago. This shows just how tight household finances are because, on average, mortgages have only increased by around £30 for this credit score profile.

Are people switching?

On the credit file status ‘U’ usually indicates a new account has been opened. The rate of new mortgage accounts has remained constant at 6% over the last two years.

Conclusions

So far mortgage arrears have only risen slightly. That’s no surprise. As the most important bill it gets paid before other creditors. However a 40% rise in the household’s main monthly bill (£200, on average) will impact affordability What’s happening ‘underneath’ this is just as important. Rising arrears, higher credit card usage and low current account balances are the key pressures felt by borrowers.

We’ll be exploring these early warning signs and considering what they mean for credit risk at our forthcoming Mutual Growth event. Book your slot.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.