When an existing member applies for a loan, member history matters most. Someone might have a low credit score, but if they’ve been paying their credit union loan on time, that tells a different story.

Currently to access this important information you probably need to:

- Log into your core banking system

- Search for the applicant’s previous accounts

- Cross-reference with other loan performance data

- Switch back to continue the application review

This context switching is more than just inconvenient. It disrupts your decision-making flow and means vital information about your own members might get overlooked in busy periods.

Member history, where you need it

NestEgg now automatically displays your credit union’s own loan data in the Decision Engine. No switching systems. No separate logins. No disruption.

When reviewing existing borrower applications, it is now possible to zoom in on your own account history and view:

- Loans repaid over the last 36 months

- Current balances

- Payment status over time

At a glance insights

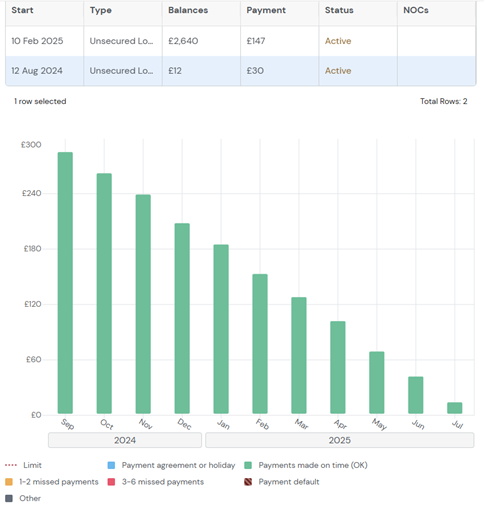

In this example, a loan has been repaid consistently and remained up to date. Provided affordability is good, this is very likely to be an accept:

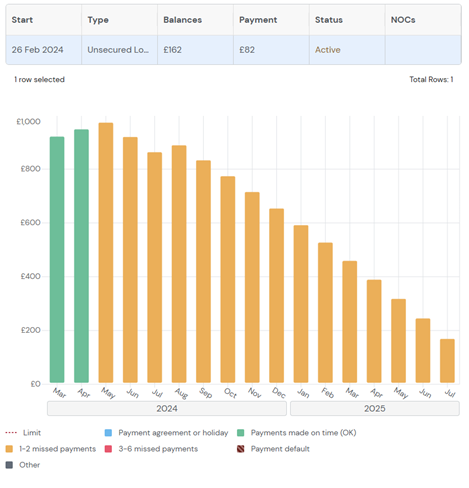

This example shows a credit union loan where the member initially struggled with two missed payments. However, the borrower quickly corrected course and has since maintained steady, regular repayments. Their demonstrated recovery and ongoing commitment to repayment responsibilities indicates strong approval potential despite the early setbacks:

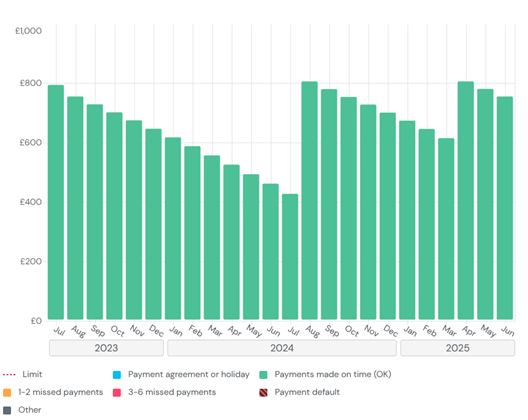

This borrower regularly tops up their loan facility, maintaining a good repayment status. Although the loan principal isn’t decreasing due to these ongoing advances, the member carries only modest debt levels. When savings growth also increases, creating an improving debt-to-savings ratio, additional lending may be justified. Open Banking data provides details of savings patterns, enabling lenders to assess the member’s true financial position and capacity for further credit.

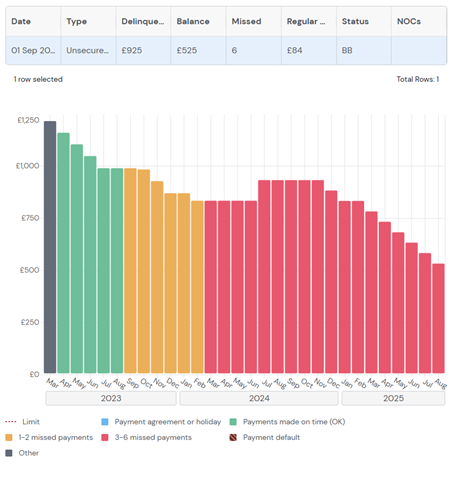

In this final example, the applicant experienced significant financial difficulty, accumulating serious arrears through multiple missed payments. However, they have demonstrated recovery over the past seven months, making consistent payments to reduce their outstanding balance. While this application would likely result in a decline under current circumstances, the sustained repayment pattern suggests strong potential for approval in the near term.

The benefits: faster, fairer, more informed decisions

- Complete picture on one platform: no more fragmented information gathering. See external credit data alongside your own lending history in a single, integrated view.

- Speed without compromise: make thorough assessments without the delays of system switching. Your decision-making process becomes faster while remaining comprehensive.

- Leverage your best data: your own lending data is often more predictive than external credit scores. A member who’s consistently repaid loans on time is a strong candidate

- Identify patterns that matter: spot important trends like recent improvements in payment behavior or temporary difficulties that have since resolved. This context helps you make fairer decisions that benefit both your member and your credit union.

- Reduce decision fatigue: when all the information you need is in one place, loan officers can focus on analysis rather than data gathering, leading to better decisions and less stress.

This feature represents our commitment to making lending decisions both quicker and more informed. Because when you have the complete picture of your members’ history with you, decisions are faster and fairer.

Ready to see your member loan history integrated seamlessly into your workflow? This feature is available now in the NestEgg Dashboard, contact us for a demo.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.