Anonymised data helps us better understand the risk profile of credit union borrowers. Information on topics such as County Court Judgments (CCJs) benefits credit unions because they can benchmark applications, understanding decisions against country-wide trends.

The data set on CCJs is relatively small and so this information should be viewed as an indicator of trends that should encourage more research in this area.

How are CCJs being used? Are creditors or individuals taking people to court? What kind of lenders pursue judgments? For what kinds of values?

Almost all CCJs are issued by creditors

95% of CCJs from a sample seen by the NestEgg Decision Engine were issued through the Northampton County Court Business Centre (NCCBC). That compares to a national average of 85%.

Applicants for credit union loans appear more likely than average to be subject to creditor initiated action than the wider population.

Creditors take ‘bulk’ court action at the NCCBC. But not all claims are issued by lenders. Claims made using Money Claim Online find their way to Northampton. As do parking disputes.

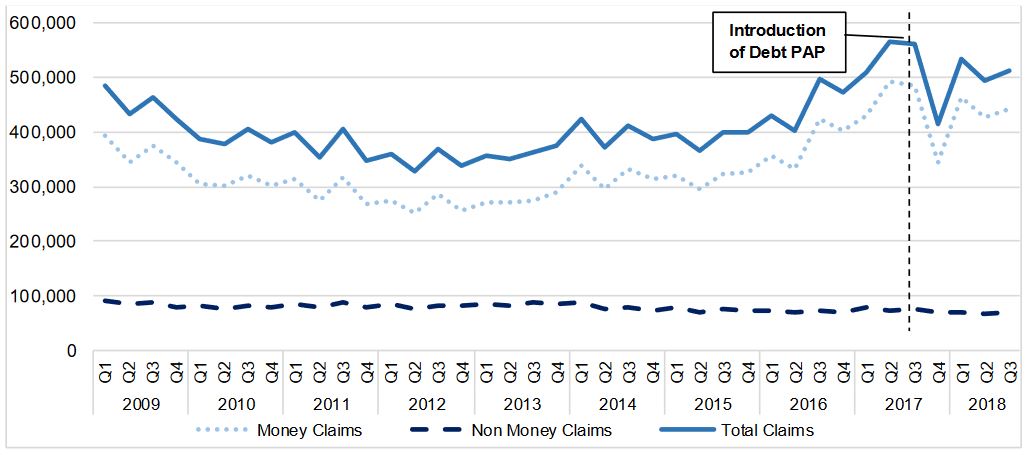

According to the Civil Justice Statistics Quarterly Review, between July and September 2018, 444,000 money claims were issued; a fall of 8% compared to the previous year. This is down from a peak of 565,000 claims issued between April and June 2017.

County Court claims by type , Q1( April to June ) 2009 to Q3 (July to September) 2018. Debt PAP = Debt Pre-Action Protocol)

Average values of CCJs are falling

The average CCJ seen by a small sample of credit union clients is £1,500. This is slightly higher than the (national) average CCJ issued during 2017/18 (£1,400).

Decision engine data includes CCJs going back six years, when average values were higher. This has the effect of pushing overall values up.

This continues a trend of falling CCJ values. In 2009 the average judgement was for £3,900.

This might indicate that creditors are more willing to pursue judgments. Court action is appearing earlier in the collections cycle. Just over half of claims at Northampton were for less than £500. One in five were for between £500 and £1,000. 23% had values between £1,000 and £5,000.

Impact on lower income households

Does this hit the poorer harder?

Those on lower incomes have lower than average value debts. Lower value debts are turning to defaults as incomes from tax credits and benefits fall in real terms. These creditors are pursuing court action. The most common defaults are for telecommunications, typically mobile phones, and mail order. These rarely exceed £1,000. Add on default and collection fees and the cost of the judgment itself and you soon end up at an average £1,400.

We may be witnessing that most CCJs against lower income households are being issued by telecommunications suppliers.

This was a small data set and more research is needed. But it is an interesting outcome. As we have previously blogged many mobile phone defaults are the outcome of consumer disputes. So increased CCJs, falling credit scores and the resulting higher charges for credit are not necessarily a product of a lack of intention or ability to repay.

This is further demonstrated by the fact that 12% of applicants taken to court paid off their judgement which is in in line with national averages.

Considerations for lending risk

If most CCJs are taken out for consumer disputes – should presence of judgments continue to be an important policy rule that often leads to loans being declined? Is it reasonable for credit scores to fall if the reason for the judgment is not an inability or unwillingness to pay? Does this increase the value of other data sets such as Open Banking to improve lending outcomes for those on the lowest incomes?

Get in touch and join in the debate!

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.