On 12th January we heard from seven speakers about how to grow your loan book in 2022.

Download a copy of the slides.

Credit scores are up …

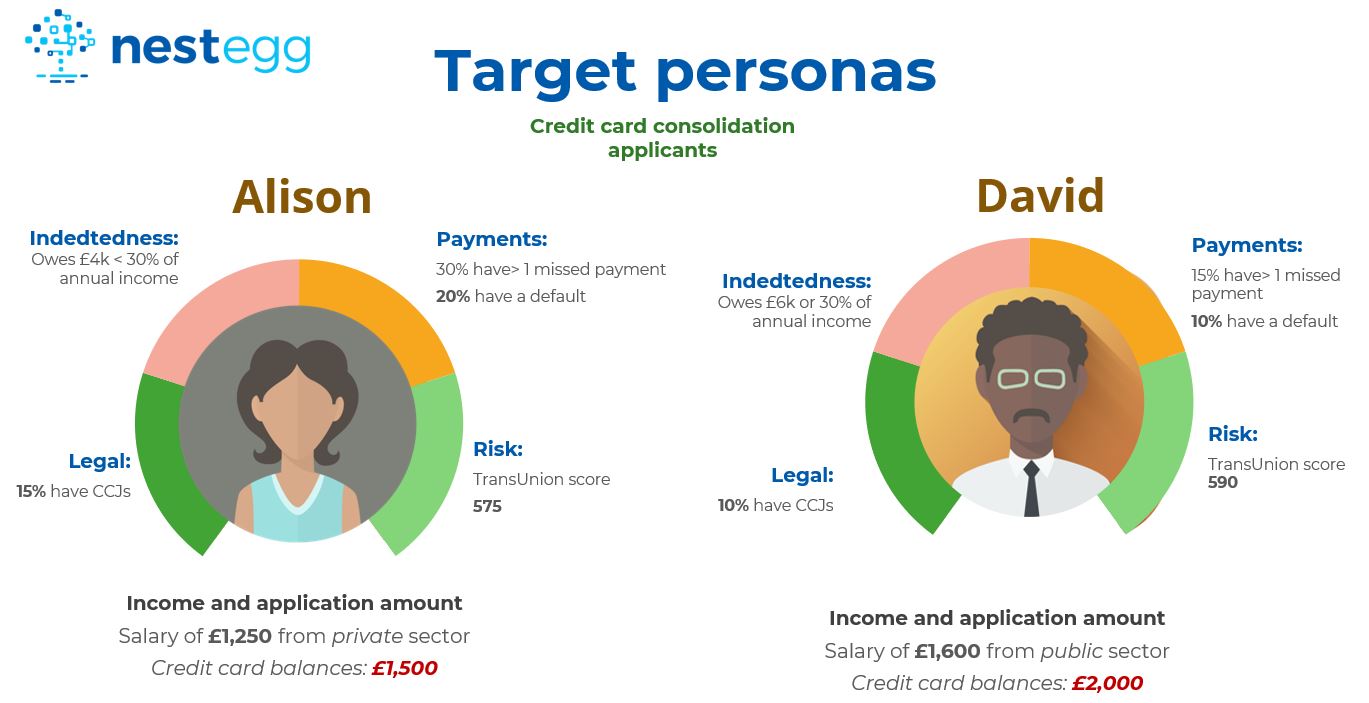

The credit data from NestEgg’s decision engine has shown that over the pandemic applicants’ credit scores improved. Defaults and legal action fell. However, there are indications that missed payments are rising once more. Consequently, legal action may increase.

Nevertheless, there remains a big opportunity for credit card consolidation lending. Such applicants tend to have the highest credit scores and fewest missed payments.

but so is the cost of living

Analysis by the Money Advice and Pensions Service found that one quarter of people had to borrow for bills and food. One in five may be relying on informal borrowing from friends and family. A similar proportion are likely to borrow to pay off other debts.

Households are facing additional bills of £1,700 per year. With inflation at over 5% disposable income is falling. Affordability will be THE issue for 2022.

Credit unions are recovering

From a lender perspective, Covid-19 led to increased share deposits. However, as Lurgan Credit Union pointed out this was more acute in Northern Ireland. At the same time loan demand fell across the UK. Consequently, capital requirements increased at the same time loan income fell.

Despite this, credit unions increased lending during Quarter 4, 2021. For example, Central Liverpool Credit Union enjoyed their busiest Christmas loans period ever. They are on target to break January lending records too.

With speakers from Northern Ireland (NI) and Great Britain (GB), we were able to contrast two different regions. And things were very different. For example, GB credit unions have a greater proportion of shares on loan. Take-up of credit unions in NI, is far higher than in GB.

Both regions can learn from each other. We’ll be running a roundtable between NI and GB credit unions on 23 March. Contact us to find out more.

Credit union growth plans

The webinar heard from two credit unions about their 2022 growth strategies.

Smart Money Community Bank Cymru told us how they’d taken a step-by-step approach to technology. An initial focus on removing barriers to access, making it easier for members to interact with the Credit Union.

In Autumn 2021 the Smart Goods website was launched (with NestEgg providing the decisioning). This has provided for significant and profitable membership growth. Importantly, offering a white goods loan service increased regulatory oversight. Furthermore because the Credit Union doubled in size over the last three years, it has outgrown its core banking platform. This will be replaced in 2022.

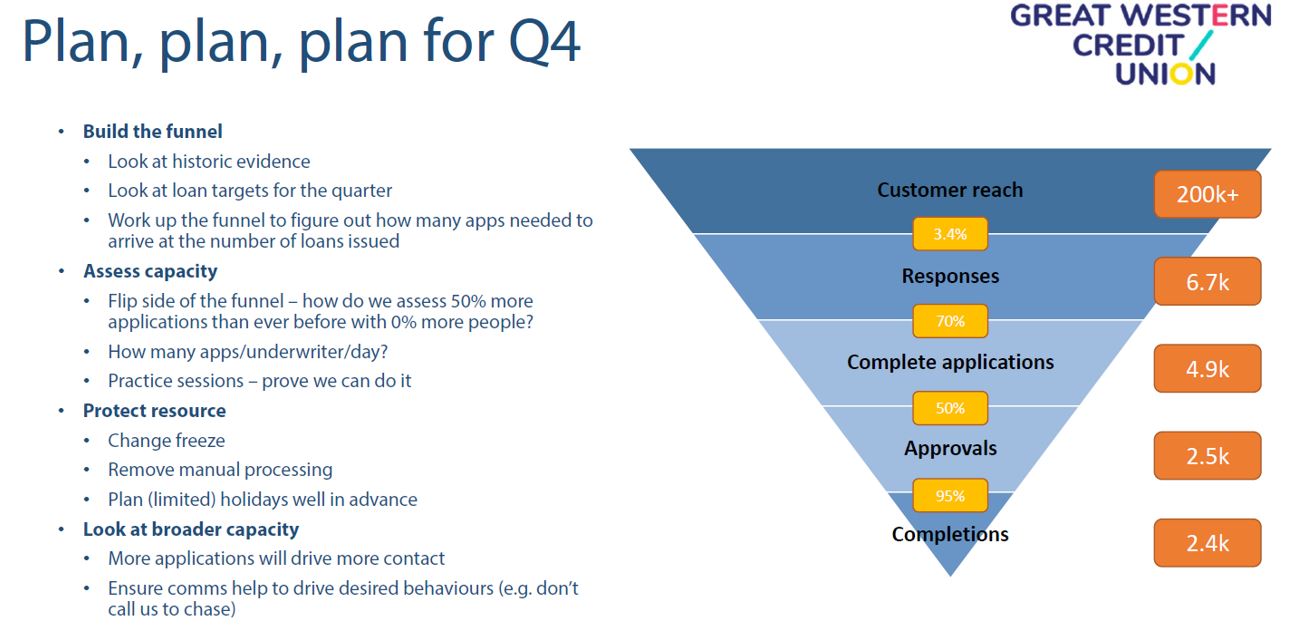

Like Smart Money, Great Western Credit Union recently extended its common bond. It has already made significant (and ongoing) investment in technology. However, the recent expansion in lending has only been possible because operational capacity was thoroughly assessed and stress tested. People and processes are well supported.

Moreover, marketing has been significant. The Credit Union is now effectively able to switch on or switch off a flow of applications, for example, by increasing or decreasing spend on Google adverts. Initial plans for 2022 include increasing payroll deduction, home improvement loans and eco-loans for green technology (e.g. loans to purchase electric cards).

Part of a movement

Credit unions, CDFIs, community and ethical banks and other mutuals form part of an ecosystem of fairer finance. Ethical alternatives are more important than ever as under-regulated fintech lenders create new risks for individuals. This is especially important as open banking develops into open finance. The Finance Innovation Lab is looking for ethical lenders to work with them to promote growth in the sector and overcome barriers to purpose-driven banking.

What’s next?

With the right growth strategies, responsible lenders are certain to expand in 2022. But there are signs that lending will be riskier. Nevertheless, the potential for more people to be financially excluded, because of Covid, means responsible lenders are more important than ever before.To support lenders to grow the loan book in 2022, NestEgg is kicking off 2022 by:

- Running a credit score masterclass on 23 February. This FREE training session will help loans officers better understand this important indicator of overall risk

- Bringing together credit unions from Northern Ireland and Great Britain for a roundtable on 24 March.

- Releasing a quarterly research bulletin with the latest trends in lending risk.

Sign up below for more information.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.