Sticking to your budget for bad debt isn’t always the best course of action. What if spending another 1% on write offs, brought in more income than the extra bad debt cost?

Using credit scoring to manage a loan portfolio

Credit scoring enables lenders to estimate the bad rate based on a score. Hundreds of factors contribute to this credit score. A lot of weight is given to repayment histories with other creditors. If a payment is missed, the score goes down. Missing several payments in a row can send a score into freefall, as does becoming overindebted.

The benefits of credit scoring go beyond deciding whether an individual loan is accepted or not. It can help a credit union budget for bad debt more effectively as part of a portfolio approach to overall lending risk.

If you have a 5% budget for bad debt you can align your loan decisions to a specific credit score that is likely to deliver this result.

Risk vs reward

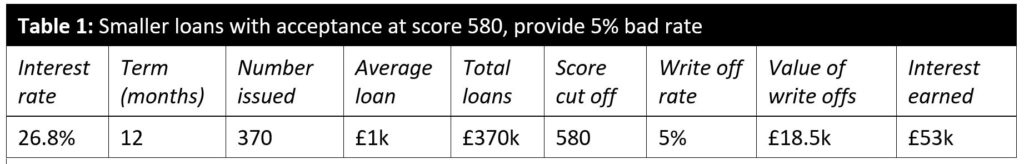

If loans issued above a score of 580 result in a 5% bad rate, you will pay £18.5k in bad debt charges when you lend £370k in the example below in table 1:

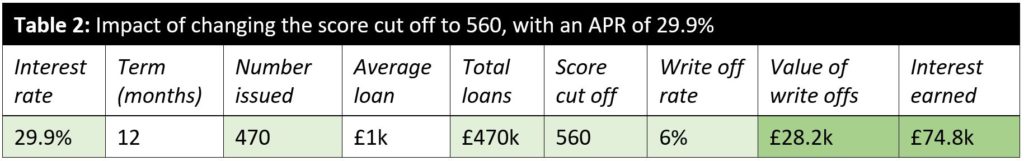

Moving the credit score cut off point down to 560 might increase the bad rate to 6%. However, if it means granting an extra £100k of loans, because more declines turn to accepts, it is worth paying the extra bad debt costs.

As the extra £100k is higher risk, you may use risk-based pricing to set the average APR to 29.9%. The income earned on the larger loan book is nearly £75k. That’s £22k more than in table 1, over twice the extra £10k bad debt charge:

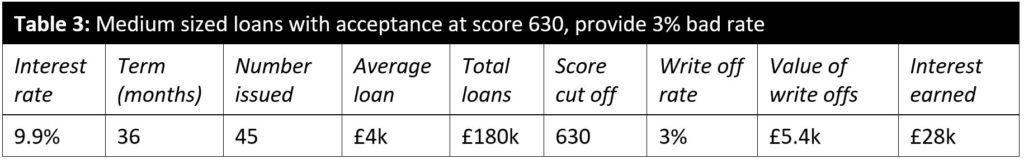

Apply that to another part of a loan portfolio targeting loans in the range £5k – £9k:

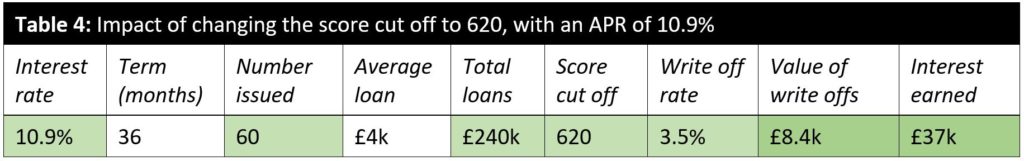

Cutting the accept score to 620 increases the bad rate to 3.5%, but means another 15 loans are accepted. Whilst the bad debt rate increases by £3k the overall income goes up by £9k to £37k when the average APR is increased to 10.9%:

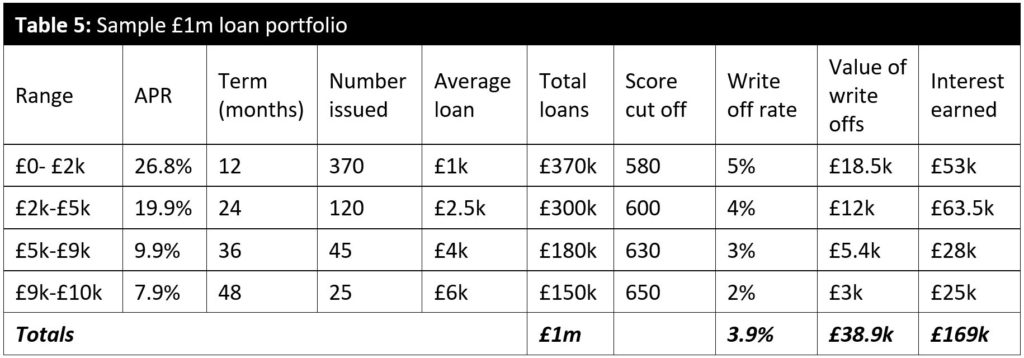

Here’s an example £1m loan portfolio as it was:

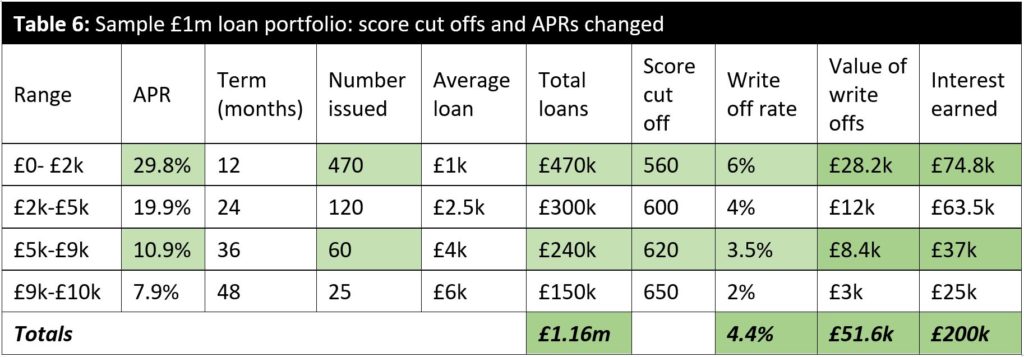

And here’s what happens when changes outlined in tables 2 and 4 are applied:

By adjusting credit score cut offs the bad debt has increased by £12.7k but the earned income has increased £30.8k; a net gain of £18k.

In this context a bad loan is not the same as a loan that will definitely go unpaid. The bad definition means that the debt will end up at least three consecutive missed payments in arrears or that the debtor becomes insolvent, overcommitted or subject to a County Court Judgement.

A strategic approach to credit scoring

Think of credit scoring as more than just a way to assess individual applicant risk. It’s a tool that can help you review different financial scenarios and strike the right balance between risk and reward.

You can perform a ‘retro analysis’ to understand what score drives what bad rate or monitor loans going forward. We can advise any credit union adopting the Decision Engine on the right score cut off points to align with your risk appetite.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.