Credit unions take note: smaller loans aren’t always high risk. Nor are they always for people who are out of work.

For this analysis, we looked at the last six months’ of data from over £500m + of loans assessed by NestEgg’s decision engine.

Firstly, one third of all loans to community credit unions came from people with an income of above the national average (£28k). Five percent have an income over £40k.

Secondly, loan applications arrive from people with higher scores. This is especially the case in Northern Ireland.

Thirdly, smaller value loans are often made to the lowest risk applicants.

Credit unions across the island of Ireland should reflect on these findings as they consider widening access to smaller loans.

Looking at applicant credit profiles

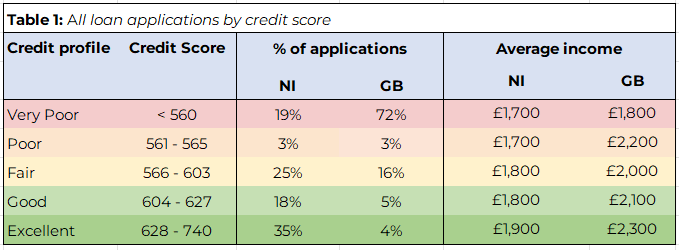

Table 1 shows loan applications to community credit unions by credit score, received in the last six months. In GB Almost three quarters of all applications are from those with very poor credit scores.

However over half of applications in Northern Ireland are also to those with the highest credit scores:

Smaller loans, high credit scores

People with higher credit scores borrow from credit unions. £500 loans are NOT always riskier than £5k loans.

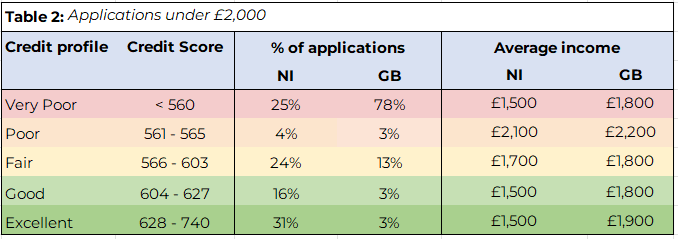

In Northern Ireland for example, just under half (47%) of all loans for £2,000 and below are provided to those with good or excellent credit scores.

Furthermore, in Northern Ireland – 4 in 10 loans for £500 or less, were made to borrowers with the highest credit scores:

Myth busting

This analysis tells us that (contrary to popular belief):

- Smaller loans aren’t always high risk

- Loans of all sizes, including the smallest loans, are not just for those on the lowest incomes

More insights

Next week, we’ll take a look at credit profiles in more detail. For example, what proportion of borrowers with a fair credit profile have a CCJ or default? How many credit union borrowers have a mortgage and what does the average level of indebtedness look like by credit score?

Sign up below to receive these insights straight to your inbox.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.