Last week we looked at how smaller loans aren’t always high risk, now we’ll examine loan applications by credit profile.

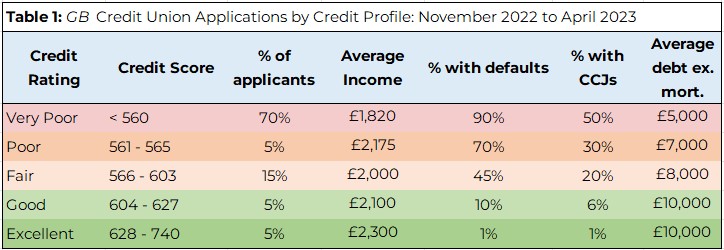

Table 1 shows results from 50,000 applications to community credit unions in Great Britain (GB), sorted by credit rating.

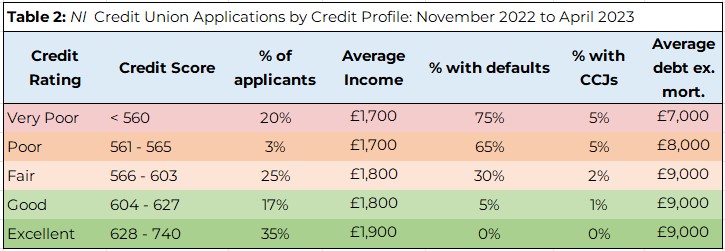

Table 2 shows 5,000 applications to community credit unions in Northern Ireland (NI).

Applications by credit profile

It will come as no surprise that 7 in 10 applications to a GB credit union are from people with the lowest credit scores (below 560 using TransUnion’s ranking). In NI, 1 in 5 have the lowest score, but the accept rate is 10% higher.

Court action

Half of all GB applicants with the lowest scores had a County Court Judgment (CCJ). Many credit unions accept CCJs. NestEgg’s decision engine rules can cater for this. For example if the loan is small, the judgment is under £500 and over one year ago – that might be a reason to refer for manual review rather than decline. In NI, the rules tend to be stricter.

CCJs are often the result of a consumer dispute. Utility bills, mobile phone and catalogue debts, often lead to an argument between buyer and seller. A one off might be acceptable. However, NestEgg research indicates that if there is more than one CCJ in the last three years, the borrower was twice as likely to become a bad debtor.

Defaults

The stand out risk is defaults. In GB, 9 in 10 applicants with the lowest credit scores had a default in the last six years.

A default is where borrower has missed six or more consecutive months of payments on an account. These remain on the credit file for six years. The impact on credit score wanes over time.

Having a firm view in relation to defaults is critical. An occasional default on a mobile phone might be OK, but recent defaults on loan agreements probably requires a decline. NestEgg’s decision engine rules are highly configurable to distinguish between these nuances.

A longer-term view is also important. NestEgg analysis suggests that, for applicants with the lowest credit scores, up to 50% of all write offs were for borrowers with five or more defaults over the six years covered by their credit report. Over time, where the number of defaults exceeds the number of repaid accounts, the risk of lending is exceptionally high.

Even those with good profiles have some defaults, although these tend to be more than three years old (otherwise the credit score would be lower).’

A cost of living impact?

Next week we’ll take a look at missed payments in more detail. By splitting the past year into two, six-month segments we can better understand the impact on people’s ability to repay since the cost of living crisis. Early delinquency is especially important. Spotting missed payments, early on, is a good indicator of the likely future propensity to default on an agreement.

Sign up below to get these insights straight to your in-box.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.