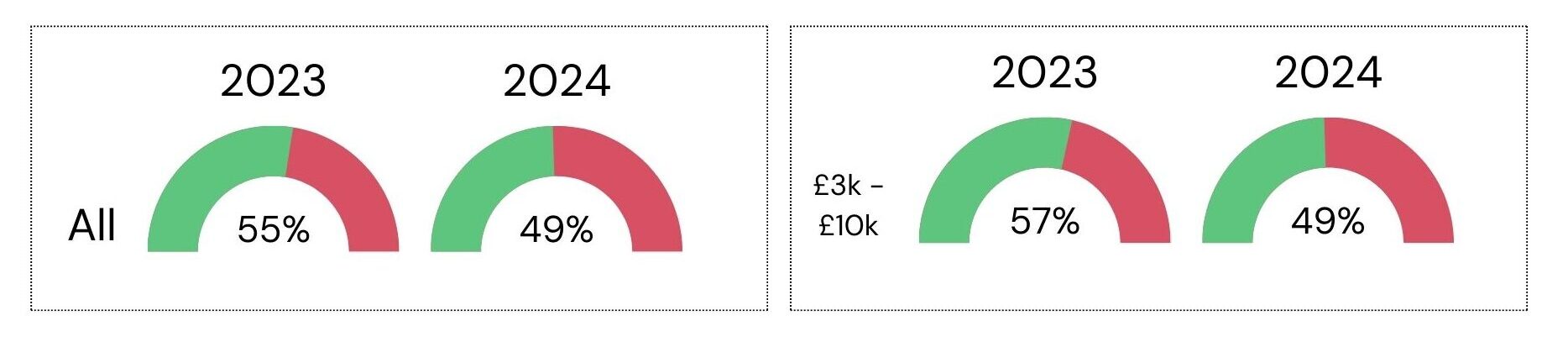

Over the past year there has been a shift in lending risk within the credit union sector. In 2023, credit unions in Great Britain approved nearly 6 out of 10 loan applications. However, as of 31 August 2024, this approval rate has dropped, despite applicants credit risk being lower.

What are these lending trends telling us?

Declines have increased

Over the past year decline rates have increased by 7%. However, credit risk has actually fallen.

This was higher for larger value loans:

Credit risk is lower

Credit bureau data shows credit scores have improved, albeit just by a couple of points.

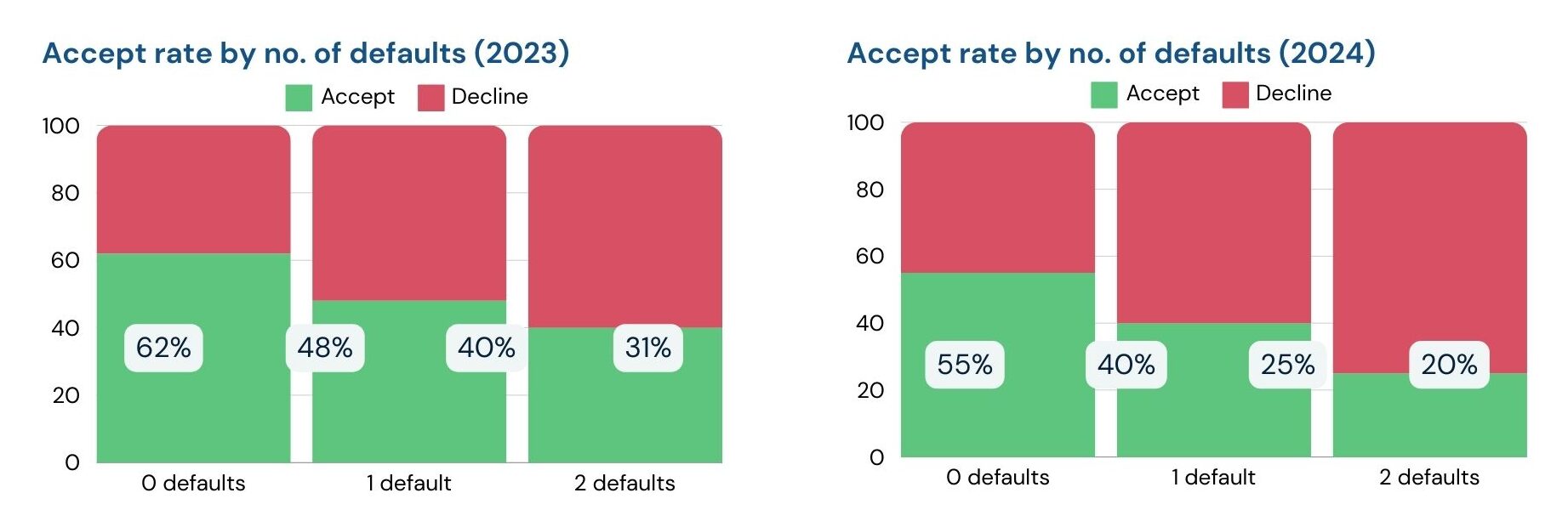

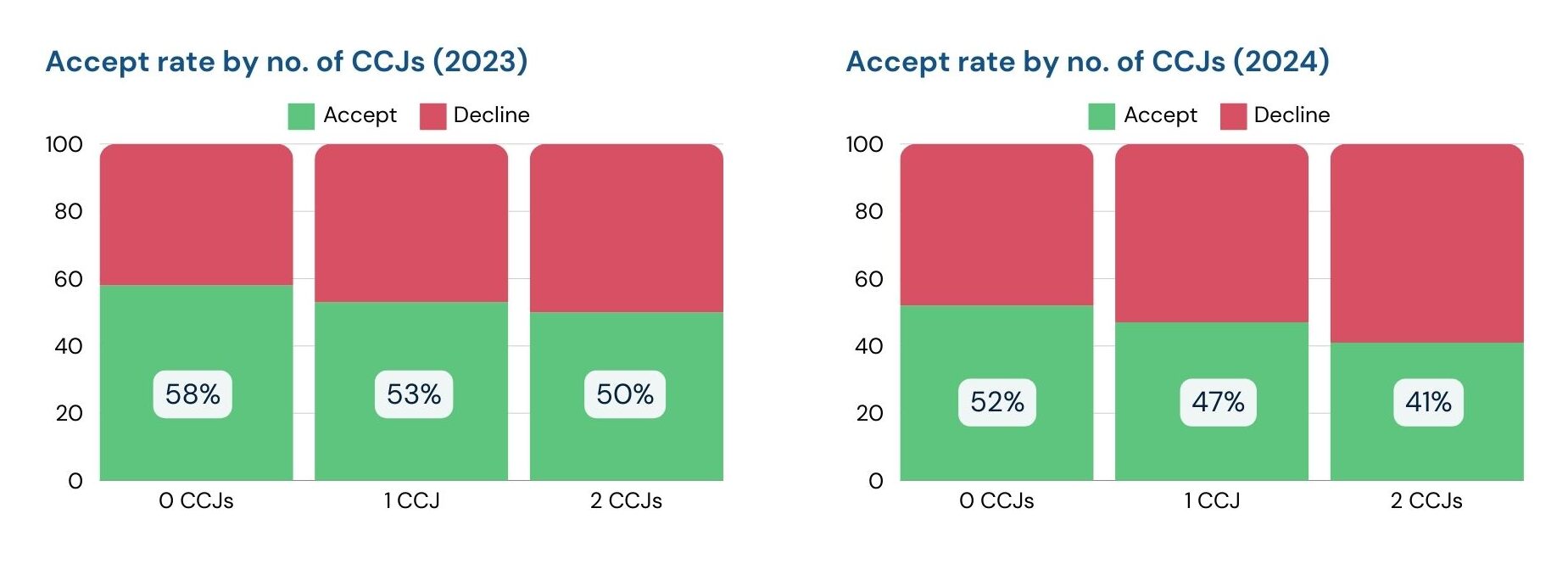

The proportion of applicants with County Court Judgments (CCJs) or Defaults has fallen. Despite this, the decline rate for applicants with multiple defaults has increased:

As it is for those with multiple CCJs:

Income

Income

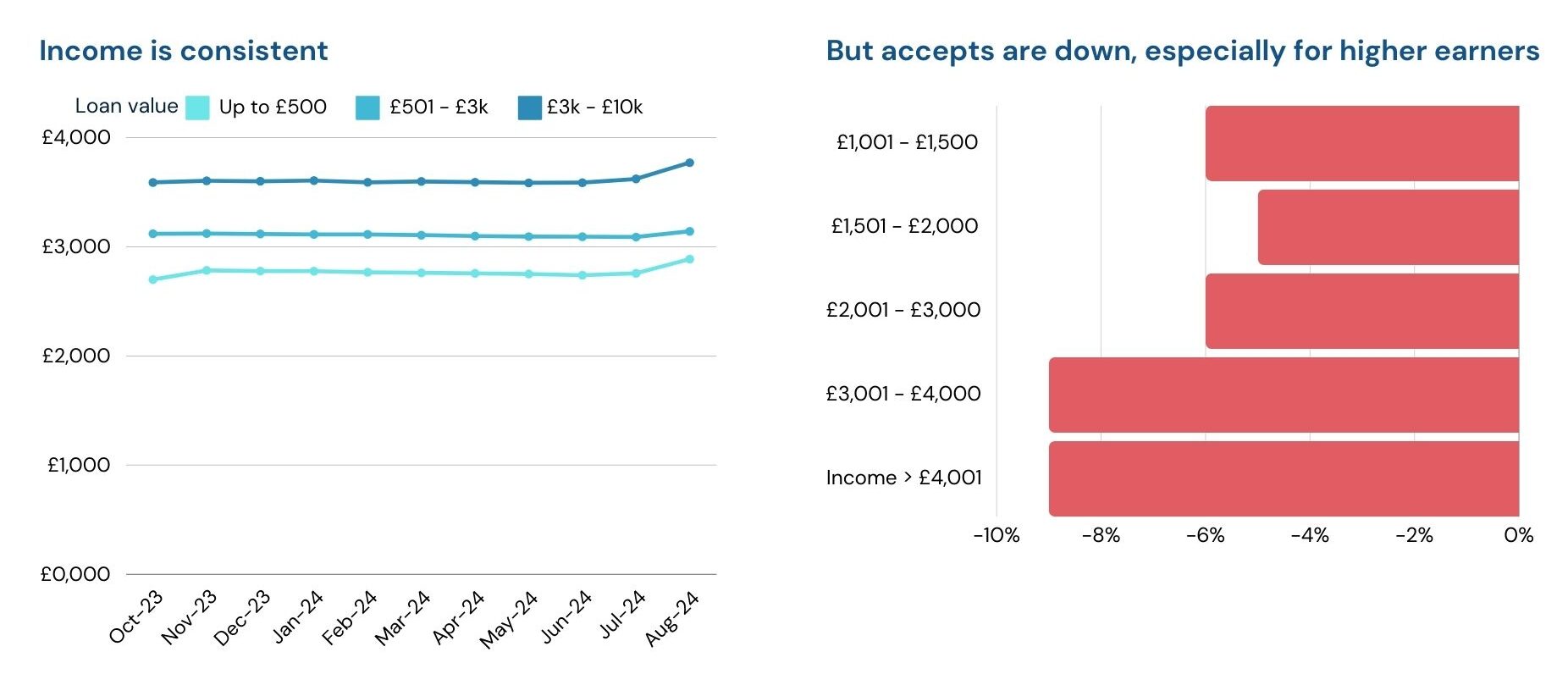

The average income of applicants rose from £2k to £2.6k.

This income has remained steady throughout the year, across all application values. Despite this, the rate of declines has increased more sharply for those earning more:

Spending

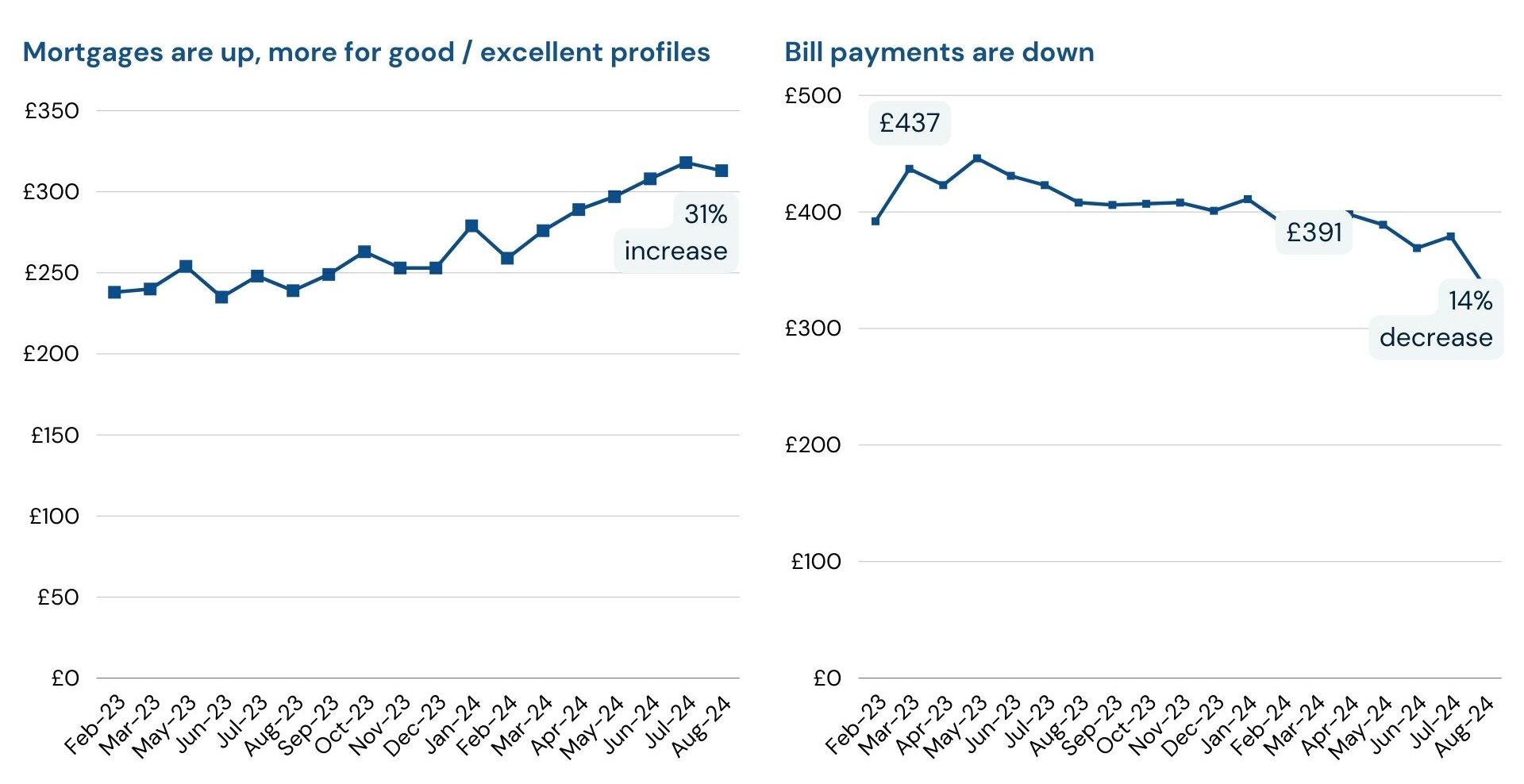

The most significant change to spending patterns has been, unsurprisingly, mortgages and rent. On average, rent and mortgages have seen costs increase by 30% adding £75 to the monthly bill.

Importantly, for those with the highest credit scores, the increase in mortgage payments has been slightly lower (29%) but, because the mortgages are higher value, payments are up £200.

On the other hand, bill payments are down £50.

Bounced Direct Debits have remained constant with no increase over the last 12 months.

On average applicants miss two payments each year. Each of those payments is worth around £175. The rate of missed payments for people with the lowest credit scores is three times that of those with excellent or good credit profiles.

Riskier spending

Gambling and Buy Now Pay Later (BNPL) spend has remained stable.

- On average applicants gamble once per month. The frequency of gambling for those with the lowest credit scores is significantly higher. Once someone is gambling several times per month, at least 10% of their income is used to fund this.

- On average, applicants make 16 BNPL payments per year. However, there’s a marked difference between credit profiles. Those with the highest credit scores make 6 payments per year and people with the lowest scores (and incomes) make 20 payments. BNPL use is rising at a faster pace for those on lower credit scores.

Conclusions

These lending trends suggest that lenders are considering an applicant’s spending habits more, rather than just credit data. This is leading to an increase in declines. The 30% increase in rent and mortgage payments is a key contributor. Despite this, there has been no increase in delinquency rates. Credit card balances are steady. There has been no increase in bounced payments. Defaults have fallen. People are generally managing these increased payments by reducing spend elsewhere.

There may be a tendency that having access to more data means there are more reasons to decline. It is essential to consider Open Banking data but only alongside repayment histories. However, missed payments on current accounts (bounced Direct Debits) are not manifesting themselves as missed payments on credit accounts.

Furthermore, higher rent and mortgages are the new norm. The UK has returned to the long-term average interest rates (3.5% since the 1990s and 6% over the last 50 years). Mortgage payments are not going down anytime soon. As a result, credit unions need to reevaluate risk and reward. Tactics include:

- Using soft credit checks. Credit unions using soft credit checks have seen volumes of applications rise by as much as 70%. The proportion of people applying with excellent or good credit profiles has also increased significantly.

- Open Banking rules can spot problems with spending, especially in relation to gambling, bounced payments and BNPL. However, this data should be balanced with other indicators of affordability, such as recent missed payments, debt ratios and credit card balances.

- Utilising Risk Based Pricing. Offering lower rates to low-risk applicants can attract a more creditworthy borrowers, leading to fewer defaults and increased income.

To find out how NestEgg can help your credit union maximise lending – get in touch

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.