It’s International Credit Union Day. This year’s theme is building financial health for a brighter tomorrow.

NestEgg’s reason for being is to help credit unions improve the financial wellbeing of their members. NestEgg does this in six ways.

Fairer credit decisioning

Financial exclusion manifests itself in particular ways on a credit record. Responsible lenders, set up to tackle financial exclusion, have adopted lending policies to meet this ongoing reality. NestEgg helps them automate assessments for greater productivity and fairer decisions.

The NestEgg decision engine provides lenders with great flexibility to match automation to their lending policy. This might be setting value and recency limits for when defaults or CCJs are referred or declined. There are lots of options for credit score cut offs, treatment of insolvencies and other missed payments.

Our clients are easily achieving 25% – 50% auto accept rates for financially excluded borrowers. One of the reasons many people chose high-cost lenders was the rapidity of their decisions and ease of online applications. Now responsible lenders can match and even beat these service levels.

More accepted loans

On average, 40% of loans made to credit unions are initially declined. As a result, every year 100,000 vulnerable applicants are turned away by affordable credit providers.

Research into declined pay day loan applicants found 15% of applicants still borrow.

Applying this 15% to credit union declines means 20,000 borrowers end up with high cost creditors. These borrowers pay £4.5m in excess interest every year.

Moreover, around £2m of annual revenue is lost for the responsible finance sector.

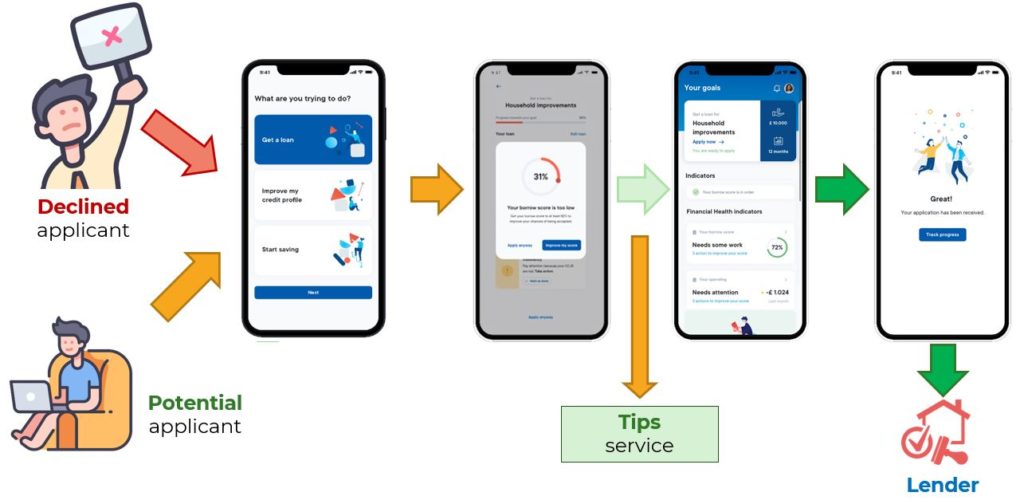

NestEgg’s decline to accept service solves this problem.

NestEgg clients can identify marginal declines. They provide borrowers with tips. These increase the likelihood of a successful application next time.

NestEgg – Decline to accept service

Saving members money

Since the last World Credit Union Day (October 15, 2020), NestEgg software has been used to decision 60,000 loans worth £90m. Approximately 50,000 applicants were financially excluded. We estimate these borrowers saved £15m in excess interest that would have otherwise been paid to high cost lenders.

NestEgg can hep credit unions monitor social impact in real time.

A financial health app

Over the next two years NestEgg will deliver 10,000s more referrals for community finance.

With our new app potential applicants can see if they qualify before applying. As a result, lenders don’t spend money assessing declined applications.

Our app provides over 200 nudges to help people:

- Improve their credit scores. These have fallen for lower paid workers since the pandemic.

- Reduce their credit card balances, which have been rising over the last 6 months.

- Get on top of missed payments.

- Clear up historical issues. Credit union members in their late 20s and early 30s told us that they had clear goals to tackle older CCJs and defaults.

Encouraging saving

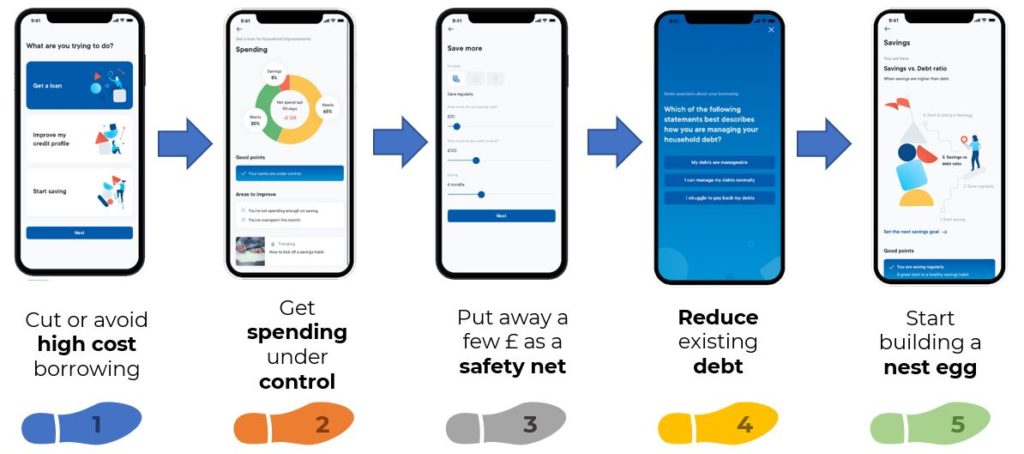

We asked 300 low income borrowers how they wanted to apply for a loan, breaking this down into 40 ‘desired outcomes’ across five steps to improving financial health. When speaking to members about borrowing they always turned the discussion to saving. People want to borrow less and save more.

Because of this the app encourages users to start saving for a resilient future. They do this by setting savings goals as part of a five step plan to better financial health.

Five steps to better financial health

Research and development

NestEgg shares research findings so that we can all better understand the changing nature of credit risk in low income households. Over the last two years we’ve looked at credit card consolidation loans, mobile phone defaults and the latest trends in CCJs. During the pandemic we’ve covered the impact of Covid-19 on low income borrowers, credit scores and assessed the early signs of recovery.

And now we’re about to start a project looking at how credit cards and overdrafts (AKA revolving credit) are being utilised by lower income borrowers. The research objective is to better understand the credit report characteristics of people managing revolving credit well. We’ll compare these to the reports of people who tend to move quickly to their limit and default. For the former we will develop decisioning strategies to help credit unions automate revolving credit applications rather than processing continual top up loans. For those that struggle with revolving credit we can enhance the nudges in our app which will encourage better use of credit cards and overdrafts, improving credit scores and financial wellbeing.

But don’t just take our word for it on International Credit Union Day …

Case study: Improving financial resilience in Liverpool

Almost 90% of loan applications to Central Liverpool Credit Union (CLCU) are made by members living in the top 20% most disadvantaged areas. Members’ vulnerability reduces when they receive a loan from the Credit Union. Firstly, the interest rate lower. Secondly loans are granted on the basis that a member saves as they repay. Consequently, savings and therefore financial resilience improves.

Almost 90% of loan applications to Central Liverpool Credit Union (CLCU) are made by members living in the top 20% most disadvantaged areas. Members’ vulnerability reduces when they receive a loan from the Credit Union. Firstly, the interest rate lower. Secondly loans are granted on the basis that a member saves as they repay. Consequently, savings and therefore financial resilience improves.

People who’ve been members of the Credit Union for two years have a savings to loan ratio of £1 to 20p. In other words, for every £1 borrowed they have 20p in savings. That leaps to a ratio of £1 to 50p after five years membership. This helps CLCU members achieve their number one money goal which is to save more

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.