The days when you had to pay to upgrade your software are on their way out.

NestEgg’s Decision Engine is Software as a Service (SaaS).

One of the many benefits of SaaS for users is that you can expect to see new features materialise from time to time as a result of new innovations and client feedback.

This month we introduced two exciting new features: identity verification and bank account owner checks.

Identity verification

Our Money Laundering Regulations complaint identity checks provide a score to ensure the member is who they say they are. As Callcredit specialises in short-term credit, we are more likely to return information about applicants on lower incomes, thereby reducing your need to revert to paper-based proofs of identity.

The identity check returns warnings if the applicant is on US or UK sanctions lists, is a politically exposed person or has been reported as deceased. It verifies dates of birth and provides warnings if the individual has only recently been on the electoral roll.

Bank account owner check

The regulator expects firms selling financial products at a distance to carry out anti-impersonation checks. An applicant might pass an identity check, but the information used in the application could be stolen.

An identity thief will want the funds they borrow to go into an account they own which will be different to the one used by the victim of the ID theft.

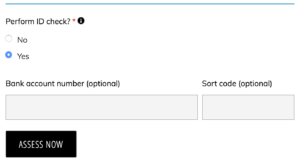

This is where our bank owner check helps prevent fraud. We verify the ownership of the proposed account for funds to be sent to and check the account number and sort code have been entered correctly. An alert is triggered if the account is new, has been closed or used for fraud.

Available now…

Identity and bank owner checks are now available within the decision engine.

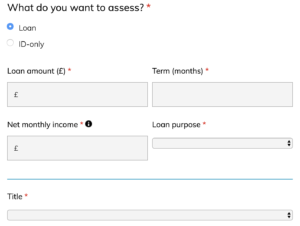

ID Verification (with or without a bank check)

ID Verification (with or without a bank check) along with a loan assessment

This means you can now check members who just apply for savings accounts as well as those borrowing.

As with all our services, these checks can be integrated into your online loan application process through the NestEgg API.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.