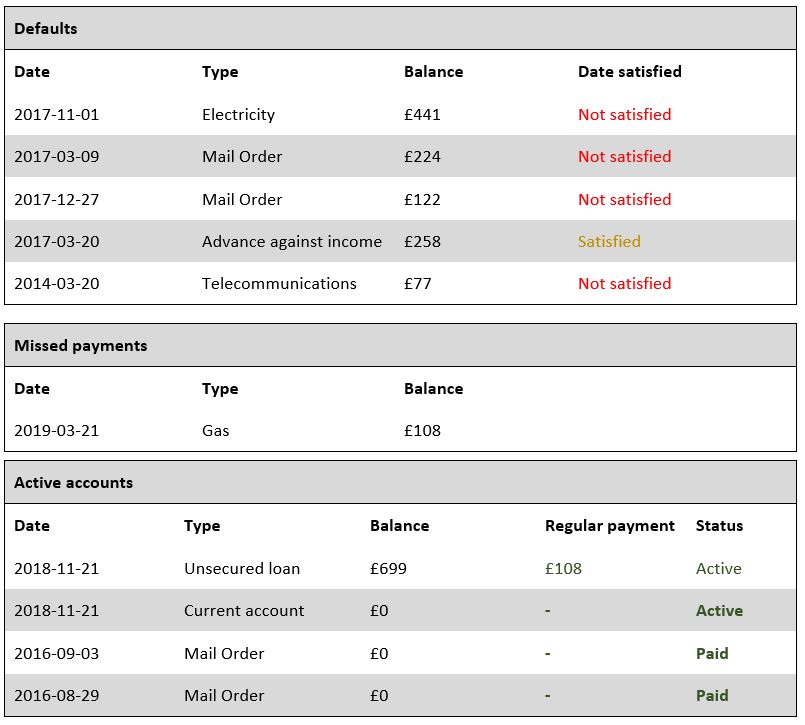

New feature: Display and organise credit accounts according to their status: Active, paid, missed payments and defaults.

Benefits: Faster assessment of repayment problems. Easy to identify trends.

Credit reports take a long time to read. Lots of different creditors displayed in no particular order. Reading pages of digits to figure out if credit agreements are up to date slows down loan turnaround. Because of this, automating decisions has little benefit if referred cases are taking too long to review.

This new feature conveniently separates out active and paid accounts from those with missed payments. Loans assessors can easily:

- See defaults as a proportion of all credit agreements.

- Understand intention to repay by assessing whether defaults are being satisfied.

- Spot trends, e.g. whether an applicant is beginning to struggle to repay or whether credit agreements are being paid at all.

- Review risk by reviewing the types of arrangements that have been agreed by other creditors.

For example…

Taking a look at the sample case above, ten accounts have been open in the last six years. Half have defaulted. Furthermore, all but one of the defaults remain outstanding. The advance against income (pay day loan) has been satisfied. However, this might be due to tougher enforcement options, including the use of Continuous Payment Authorities.

Back in November 2017 an electricity bill defaulted. The gas bill is now missing payments. Basic bills are going unpaid. Therefore, the chances of another loan being affordable are small.

The applicant obtained a high cost loan in November 2018. And it’s up-to-date. This is likely to be a weekly paid loan (£108 per month is £25 per week). The loan might be up to date, but since it was taken out the gas account started missing payments. A Current Account is active, but with a nil balance and no regular payments it is unlikely to have an overdraft. The applicant has paid off two mail order accounts are paid off. Nevertheless, these facilities may have been restricted following defaults on other mail order accounts.

The decision engine declined the application. The predicted bad rate was 15%.

You can also read our article about Mobile Phone Defaults.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.