Credit unions save low income borrowers, in Great Britain, £120m in excess interest every year.

NestEgg users generate a ‘social dividend’ of £200 saved interest, each working hour.

However, 40% of loans are declined. As a result, every year 100,000 vulnerable applicants are turned away by affordable credit providers.

Research into declined pay day loan applicants found 15% of applicants still borrow.

Applying this 15% to credit union declines means 20,000 borrowers end up with high cost creditors. These borrowers pay £4.5m in excess interest every year.

Moreover, around £2m of annual revenue is lost for the responsible finance sector.

NestEgg’s decline to accept service solves this problem.

Decline to accept

NestEgg clients can identify marginal declines. They provide borrowers with tips. These increase the likelihood of a successful application next time.

Our decision engine knows why a loan is declined. Because of this, tips are specific and relevant to the borrower. As a result, applicants are more likely to take the required actions. Following this, their credit profile visibly improves.

FCA Innovate helped with NestEgg’s application for the necessary regulatory permissions. Because of this, lenders don’t worry about providing advice to members. NestEgg takes care of it.

Decline to accept is delivered through different channels. This includes the app built for the Affordable Credit Challenge with Central Liverpool Credit Union. We’re rolling out the service to Decision Engine users.

Contact us for a demo.

Developing declined personas

Declined applicants share characteristics. CCJs over £500. Missed payments. Defaults. For in-work applicants it’s often about indebtedness. In some cases, referral for money advice is best. Every applicant benefits from a better credit score.

In light of this, personas for declined borrowers can be developed. Personas are fictional characters used to understand a segment of a target audience. We recently looked at using personas to identify lower-risk borrowers during Covid-19.

By definition a marginal decline is only a bit worse than a marginal accept. The distance to travel from decline to the accept is short. A nudge to pay off a small default. 10 points on a credit score. Paying off a credit card balance. All help move declines to accepts.

Evidently, the route to accept for many borrowers is similar. Moreover, there aren’t 100s of variables. Generally, only four or five areas need working on.

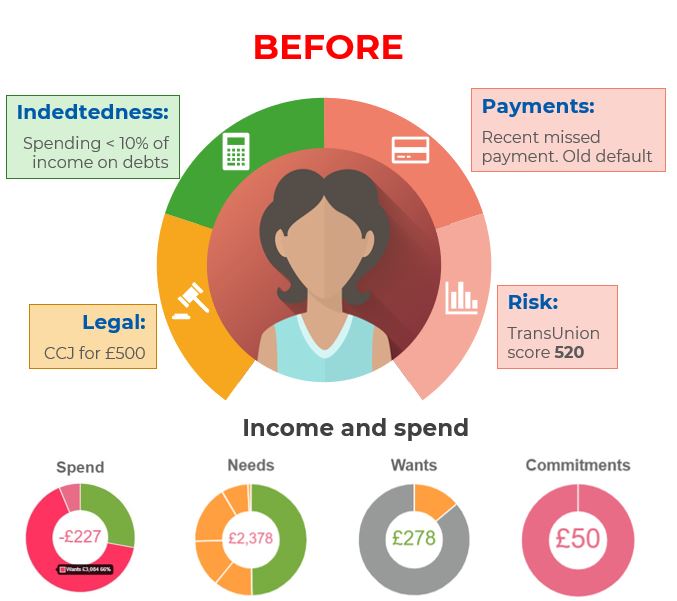

Looking at the example above, the loan has been declined because:

- There’s a missed payment. Futhermore, it’s not a one off. Bureau data shows a default from two years ago.

- The credit score is very low. Credit scores can be unfair to people on low incomes. However, they’re not without merit.

- Expenditure exceeded income by £227.

A CCJ for £500 isn’t a big issue. However, it’s not helping.

Refer to NestEgg

Applicants can be automatically referred to NestEgg’s app. Credit files and Open Banking data are brought across. Borrowers answer a few questions. This frames results. Compliant advice de-risks applications.

Nudge the borrower to accept

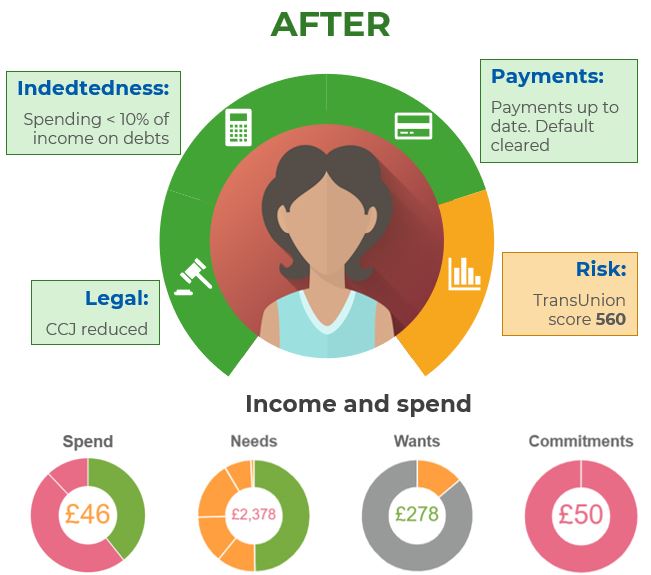

In this example NestEgg:

- Provides information about how lenders view missed payments.

- Recommends paying the missed instalment. Therefore the account moves from status 1 to status 0.

- Offers a tip; lenders like to see defaults paid off.

- Shares an article with five ways to improve credit scores.

- Sends a guide to making money go further.

The applicant subsequently:

- Balances her budget

- Clears the missing instalment on her loan.

- Pays down the default.

- Register for the electoral roll. Together with the actions above, this increases the credit score.

NestEgg automatically matches the improved credit profile with a lender’s decision engine settings. Consequently, when the decision turns from decline to accept, borrowers are invited to make a new application. This time they know they’re likely to be accepted.

Sign-up to our email newsletter below 👇 to get early access to our decline to accept service. And don’t forget to follow us on LinkedIn

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.