Combining credit bureau and open banking data is a key advantage of the NestEgg decision engine. Because of this loans officers only need to be in one screen to be able to compare two important sets of data.

Read on to see how this works in practice. Combining credit bureau and open banking data provides a fuller, rounder picture. Consequently, accept or decline decisions are more robust. As a result the loan book grows and bad debt falls.

Early warning signs

Combining spending data with credit balances provides a perspective on how credit spend impacts the bank account balance. Importantly this can be an early warning sign for potential future missed payments, even when the accounts are currently up to date.

Importantly, early warning signs can appear across both data sets. Whilst open banking can show someone’s credit commitments sending their bank balance down, the credit data also provides early indicators of trouble ahead.

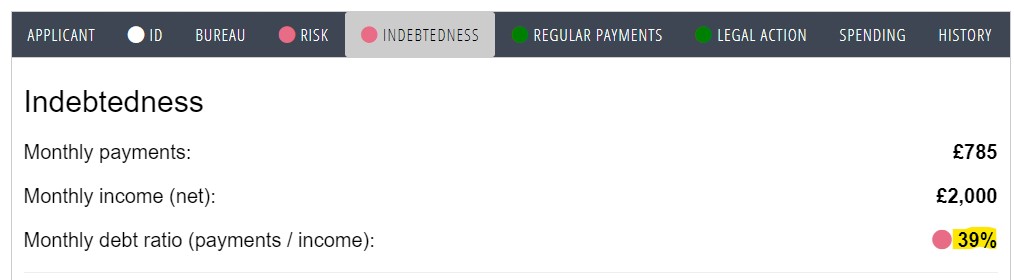

In this example, the NestEgg decision engine uses credit bureau data to show that an applicant is spending 39% of their monthly income servicing credit commitments. 25% would normally be too high:

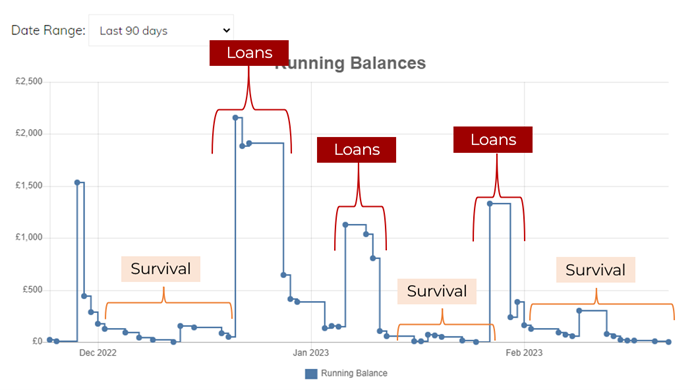

Open banking powers a new running balance chart. As a result, the impact on spend of these commitments can be assessed. The balance falls by 2/3 almost overnight. Clicking any dot on the running balance chart shows that day’s transactions. In this case these were dominated by several transactions for loan repayments.

The consequence is that the applicant’s income is quickly used up with loan repayments and they enter a period of survival spending.

Loans officers have an inevitable question to answer – how is the individual affording to live for the large part of each month. The next use case explores this.

Is credit funding day to day expenses?

In this example, the credit bureau data shows credit card balances are high compared to limit:

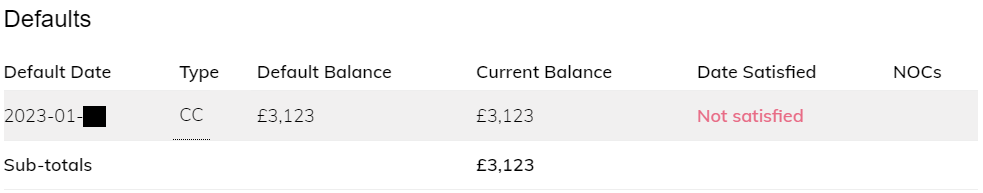

Furthermore, the credit data also shows a recent default on a credit card. The payments can no longer be met:

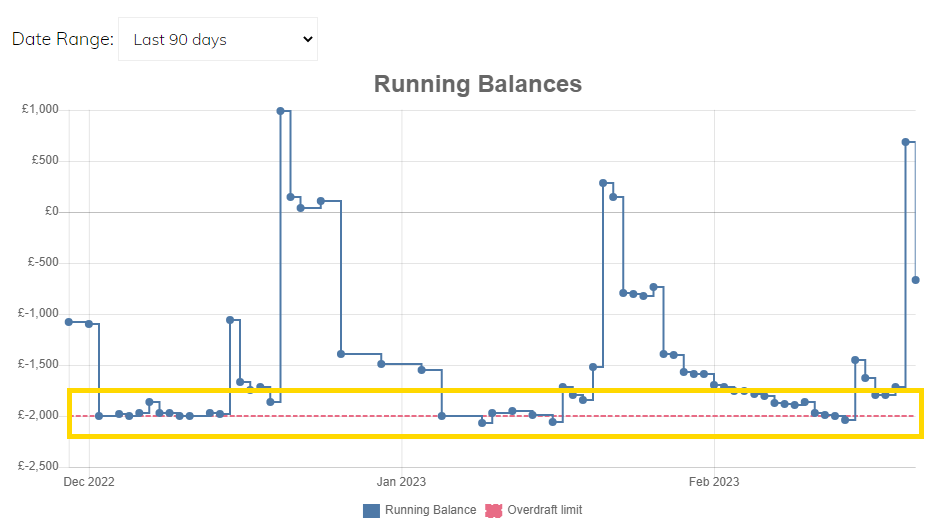

With two clicks you can switch to the running balance chart. In this case, the chart shows that each month the bank balance remains close to, or over, the overdraft limit:

Clicking through transactions we can see no spend on housekeeping. The expense is being funded elsewhere, i.e. the credit card.

However, that credit card defaulted in January (as shown by the credit data). This may explain why housekeeping was being funded from the current account from late December.

On balance, it seems very likely that this applicant will struggle to meet their day to day commitments and will miss payments on their other accounts sooner rather than later. It was only possible to reach this conclusion by combining credit bureau and open banking data.

Verifying the full picture

There can be a mismatch between open banking and credit bureau data. For example, when only one data set returns information on a credit commitment. As a result using open banking or credit bureau in isolation can give the wrong impression of risk.

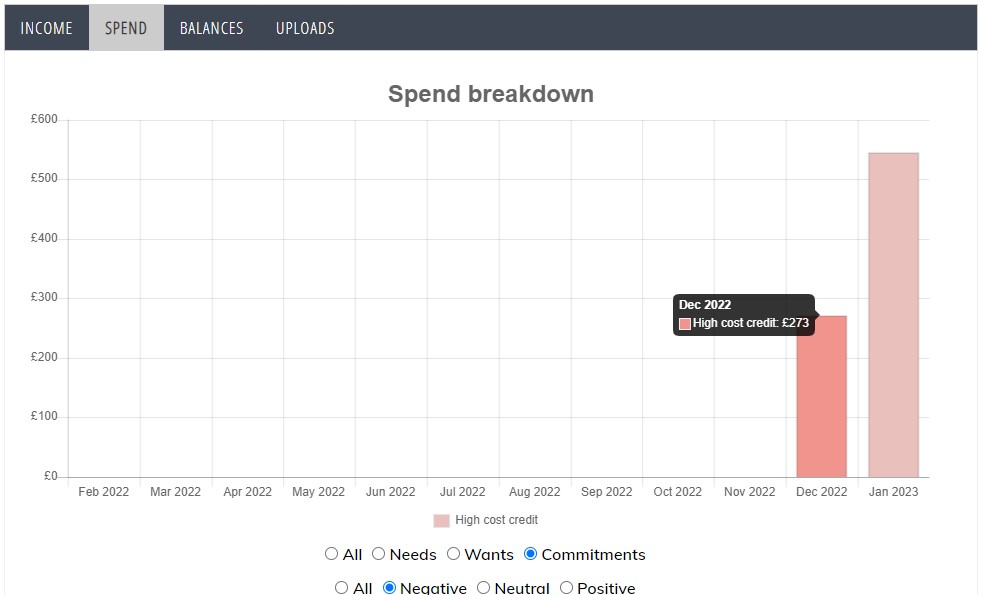

In this case the open banking data is telling the loans officer that there is a new high cost credit commitment for just over £270 per month:

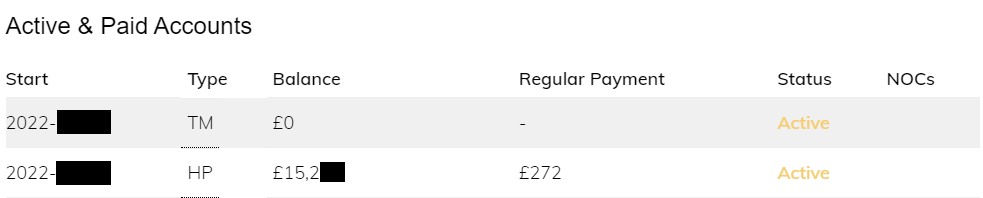

The credit data confirms this amount each month for an agreement taken out in late 2022 with payments of £272 per month:

Find out more

Credit data is tried and tested. Open Banking is new and innovative. In isolation, Open Banking can only show part of the picture. However, combining credit bureau and open banking data is the only way a comprehensive credit assessment can be made.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.