News

Featured feature: debt ratios

Debt ratios are important. And the cost-of-living crisis makes affordability assessments are more important than ever. To help loans officers identify problems early on, the NestEgg decision engine displays three debt ratios, speeding up loan decision time because we do the calculations, so you don’t have to. Credit worthiness rules from the FCA state that…

Read MoreFeatured feature: Automatic alternative offer

NestEgg’s decision engine provides an automatic alternative offer. Problem Sometimes a loan applicant applies for too much. But, given their credit profile, how much is the right amount? Working out an alternative offer is consuming. Checking lending policy to work out an acceptable amount takes time. The process slows everything down. As a result, members…

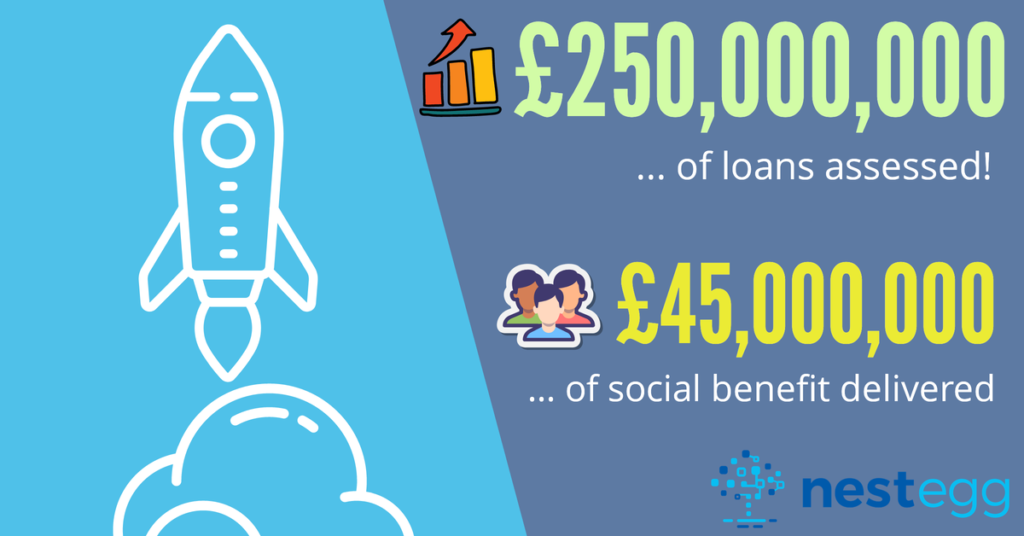

Read MoreNestEgg decision engine hits £1/4bn of loans

This week NestEgg decision engine hits £1/4bn of loans assessed. The £250,000,000 represents 200,000 loans having been evaluated using the NestEgg decision engine. But it’s the successes behind the overall big number that really matter. For example, every month in the last year has seen record lending for Central Liverpool Credit Union. Our latest London-based…

Read MoreWe’re hiring a Client Success Manager

NestEgg is hiring a Client Success Manager. The salary is £27,500 with a pension matched to 4% of gross salary. The role is 100% remote / home based. We are looking for a full time employee, but may consider fewer hours or a job share. About the role NestEgg software helps our responsible lender clients…

Read MoreA decision engine with free upgrades

NestEgg provides a decision engine with free upgrades. Here’s a brief line-up of three recent and three forthcoming updates. Importantly, our lender-clients help prioritise development during their user group. New features 1. Complete rule flexibility. Detailed rules enable lenders, for example, to set value limits for referring or declining defaults or County Court Judgments. Furthermore,…

Read MoreFREE training: credit score masterclass

We’re running a credit score masterclass in February because credit scores can be hard to fathom. Hundreds of factors contribute to a mysterious three digit number. A number that can mean the difference between getting a loan or not. Importantly, a credit score can influence the amount of interest charged for a loan. It can…

Read More