NestEgg’s decision engine provides an automatic alternative offer.

Problem

Sometimes a loan applicant applies for too much. But, given their credit profile, how much is the right amount?

Working out an alternative offer is consuming. Checking lending policy to work out an acceptable amount takes time. The process slows everything down. As a result, members start phoning the office to chase their loan application and the work mounts up.

Solution

NestEgg’s decision engine provides an automatic alternative offer.

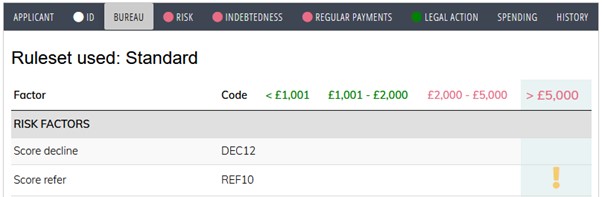

In the case below the loan application was for over £5,000 and was a decline. In fact, anything over £2,000 was a decline. Nevertheless any loan for £2,000 and under was an automatic accept:

Additionally, an applicant might be offered a higher amount.

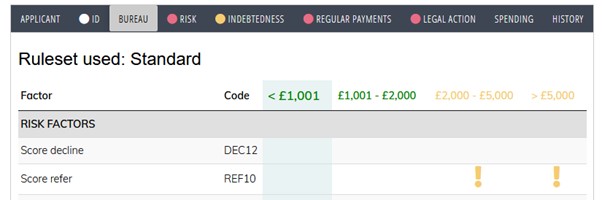

In the case below the application was for under £1,000 yet on lending strategies up to £2,000 the applicant would have also been an auto-accept. In fact, a loan of more than £2,000 was only referred because of credit score:

Benefits

Automatic alternative offers lead to fewer declines. Enabling a lender to turn around loans really quickly and maintain excellent service. Loans officers can be safe in the knowledge that they’ve made a reduced offer in compliance with lending policy.

Book a demo

Fill the form in below to schedule a demo of the NestEgg decision engine:

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.