An Individual Voluntary Arrangement (IVA) is a form of debt management and alternative to bankruptcy. They are designed to help individuals who are struggling to manage their debt.

How do they work?

IVAs work by ‘freezing’ an individual’s debts (including interest and charges) for a fixed period of time (usually 5 - 6 years). Over this period, borrowers must commit to paying the agreed monthly amount towards their debt. Once the period of time is over, any money still owed will be written off.

These agreements are legally binding, which means neither the individual or creditor can back out, so long as the terms are being met.

What can they be used for?

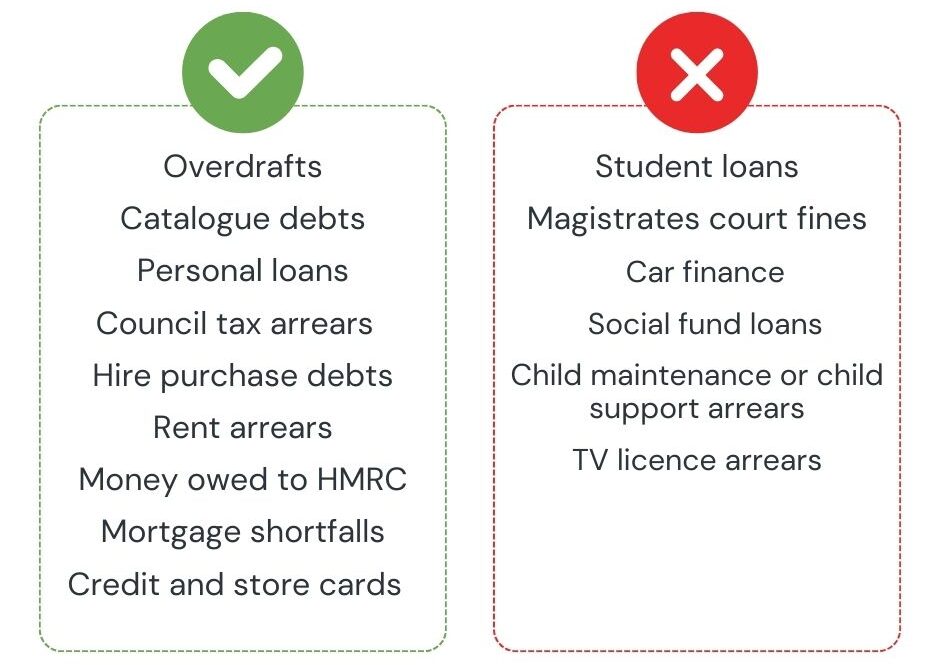

The following table outlines the common debts an IVA can and cannot be used for:

Table information taken from Money Helper.

Benefits of an IVA

There are several benefits to an IVA. But remember, everyone’s situation is different:

- Debt forgiveness: Once the term is completed, remaining debts will be written off.

- Legal protection: As the agreement is legally binding between an individual and creditor, creditors cannot take legal action to recover their debts during the IVA, so long as the terms are being met.

- Fixed duration: Typically 5-6 years, after which a borrower could be debt-free.

- Control: Borrowers may keep certain assets, like your home, which might not be possible with bankruptcy.

Things to consider before entering an IVA

- Impact on credit rating: An IVA will reduce your credit score. It will remain on credit files for six years. Some lenders automatically reject loan applications if there is an IVA on the applicant’s credit history.

- Commitment: It requires a long-term commitment to making regular payments.

- Not all debt is covered: Some debts, like student loans and court fines cannot be included in an IVA.

- Fees and Charges: There will be fees to pay to the Insolvency Practitioner. The types of fees may differ between practitioners, but are likely to be thousands of pounds.

Setting up an IVA

If you are considering applying for an IVA you should seek advice. Money Helper is a good place to start.

An IVA needs to be set up through an Insolvency Practitioner. They will complete a financial assessment to determine if an IVA is a suitable solution. If suitable, the Insolvency Practitioner will draft an IVA proposal for creditors which will outline how the individual intends to repay their debts and over what time period (usually 5 - 6 years).

Creditors will review and vote on the proposal. For approval, at least 75% of creditors must agree. On approval, an individual will make regular payments to the Insolvency Practitioner, who distributes this to the creditors.

There will be charges and fees included in the cost of setting up and running an IVA.

Is an IVA the right choice?

Entering into an IVA is a significant financial decision. It is suitable for individuals with a stable income who can commit to regular payments but whose debts have become unmanageable. IVA's are especially useful if an individual is considering a form of bankruptcy but own their own home (including on a mortgage).

However, an IVA may not be suitable for everyone. It is beneficial to get advice from a free debt service such as Money Helper to ensure all potential debt management options are explored, so that the best and informed financial decisions are made. Be wary of TV ads for companies that may charge high fees even though an IVA might not be the best option.

Please note: NestEgg is not a provider of financial or investment advice. Take as general guidance only. NestEgg assumes no responsibility or liability for any errors or omissions in the content on this site. The information contained in this site is provided on an "as is" basis with no guarantees of completeness, accuracy, usefulness or timeliness.

Boost your chances of getting an affordable loan

Enter your email to get tips once or twice a month

No spam. Unsubscribe anytime.