Dealing with debt can be overwhelming, when it feels like there's no clear way out. Debt Management Plans (DMPs) can help individuals pay off debts at a rate they can afford, over a longer period of time. However, they will have consequences on an individual's ability to borrow in the future, as a ‘live’ DMP makes it very difficult to obtain credit.

How DMPs work

A DMP is an agreement between an individual and their creditors to help pay off debts through managed, regular payments. It's designed for individuals who can afford to make regular payments, but not necessarily the full amount they owe each month.

Through a debt management plan an individual will make one monthly payment to a DMP provider who then pays creditors on the individual’s behalf.

An individual borrower may be able to set up their own DMP without the need for an external provider. However, there are many organisations that offer free DMPs. For example, an organisation like StepChange, can help decide if a DMP is the right choice, as well as setting them up. There are also DMP companies that will charge a fee for their services. If choosing a company that charges a fee, it’s important to ensure they are registered, authorised and regulated by the Financial Conduct Authority (FCA).

What can a debt management plan be used for?

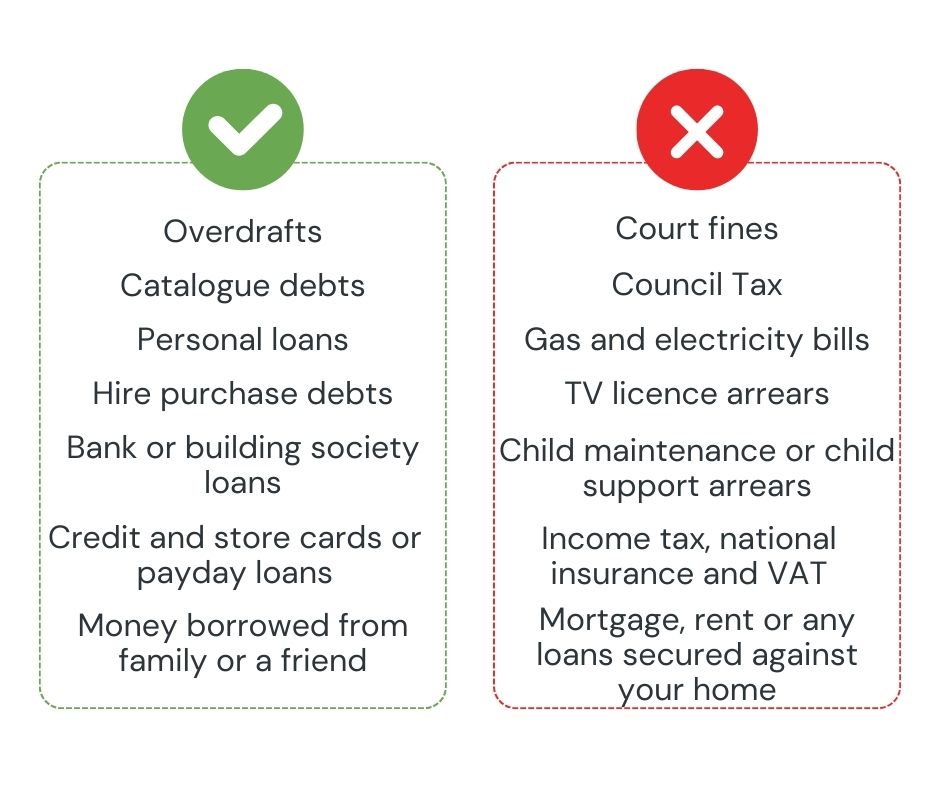

Debt management plans can only be used to pay non-priority debts such as overdrafts or credit and store cards. They cannot be used for priority debts such as council tax, gas and electricity bills. Priority bills will be taken into account when setting repayments as they will need paying off first. It is also important to note that there are consequences for DMPs in relation to certain debts, such as Hire Purchase, where the goods purchased may be at risk of repossession. Always seek free advice.

Table information taken from Money Helper.

Benefits of debt management plans

- Simple payments: consolidating multiple debts into one monthly payment can reduce financial stress.

- Flexibility: Debt management plans are informal agreements, so they can be adjusted if an individual’s financial situation changes.

- Potential reduced pressure from creditors: Creditors may freeze interest or penalties on debt if a DMP is in place. However, this isn’t guaranteed.

Things to consider

- Credit score impact: Entering into a DMP will affect credit rating. Debts not being repaid as originally agreed will result in a default being recorded.

- Not legally binding: Creditors can still make contact or decide to take further action to recover their money.

- Length of time: Paying off debt through a DMP can take longer than originally planned due to the lower monthly payments. This can run into several years.

- Can only be used for non-priority debts. Priority debts need to be tackled first.

Is a DMP the right choice?

Entering into a DMP depends on individual circumstances. It's crucial to get advice from reputable debt advice services before making a decision. In the UK, organisations like the Money Helper, StepChange, and National Debtline can offer free and impartial advice.

Seeking advice from a professional is always the best first step towards regaining control.

Please note: NestEgg is not a provider of financial or investment advice. Take as general guidance only. NestEgg assumes no responsibility or liability for any errors or omissions in the content on this site. The information contained in this site is provided on an “as is” basis with no guarantees of completeness, accuracy, usefulness or timeliness.

Boost your chances of getting an affordable loan

Enter your email to get tips once or twice a month

No spam. Unsubscribe anytime.