Debt consolidation is a form of lending used to bring together existing borrowing into one loan with one monthly repayment. Debt consolidation can be a good option for people with multiple debts (such as credit cards, store cards or overdrafts), who want to simplify their finances.

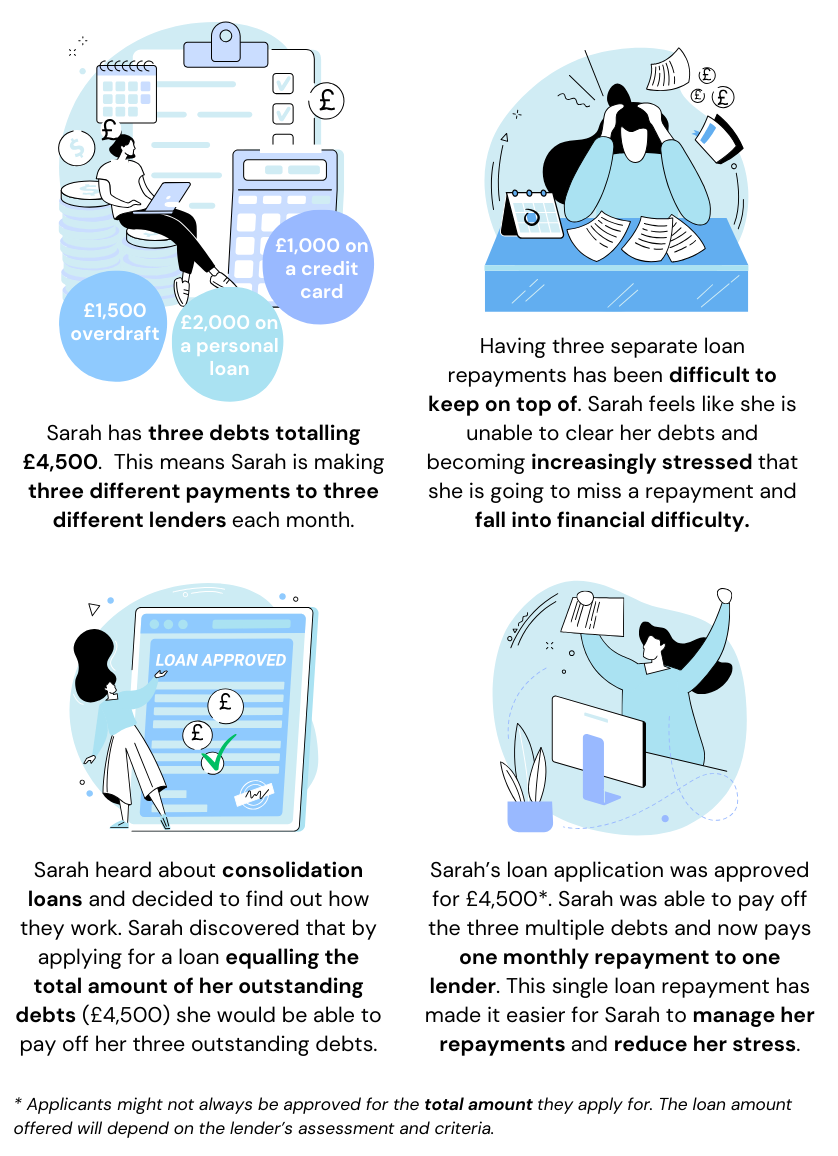

Example: Debt consolidation can make it easier to manage your debt repayments. Overall you could pay less interest, especially if you are currently paying back higher cost loans or credit cards. However, consolidation isn’t right for everyone.

Debt consolidation can make it easier to manage your debt repayments. Overall you could pay less interest, especially if you are currently paying back higher cost loans or credit cards. However, consolidation isn’t right for everyone.

The advantages of debit consolidation include:

- You only have to make one monthly repayment to one lender.

- It’s easier to manage and monitor fewer repayments.

- Credit score can be improved through more manageable repayments.

- Debt consolidation could lower the total amount of interest paid.

- Monthly payments could be reduced if the debt is spread over a longer term.

- However, the interest paid (even if it’s a lower rate than previous debts), might be higher as spreading payments over a longer period may result in more interest being paid overall.

When to consider debt consolidation

Consolidating your debts makes sense if:

- It clears all of your other debts.

- The total amount payable is less than it was before.

- Less interest is being paid than before.

- You can afford the repayments until the loan is repaid.

Some disadvantages of debt consolidation

However, debt consolidation may not be the right choice for everyone or situation.

Firstly, there may be better alternatives if you are struggling with debt. For example a Debt Management Plan or Debt Relief Order. If you are considering that course of action you should seek free advice.

Secondly, make sure that any fees or charges for the new borrowing don’t wipe out any interest savings. Paying back a loan early, missing payments or even a set up fee can all be costly. In addition the loans that are being repaid may have ‘redemption’ fees that need paying on top of the outstanding balance.

Thirdly, you should be really careful if the consolidation loan would be secured against your home. You could lose your home if you do not keep up repayments. In effect you are turning an unsecured, non-priority debt, into a priority one.

Debt consolidation and your credit score

Like any loan application, affordability and credit checks will be undertaken. If these are hard credit checks, your credit score will fall.

Whilst having a ‘poor’ credit score, does not necessarily mean you’ll be declined for a loan. Some lenders will charge a higher rate of interest as they will see you as being more likely to miss payments.

Read more about how lenders make credit decisions.

Paying off your debts can increase your credit score, including when you pay off credit cards because your balance to limit debt ratio falls. However, when a new loan is taken out your credit score actually drops. This is because you’ve not proved your ability to repay that loan yet. Therefore after taking out a consolidation loan, it may take some months to improve your score.

Being able to make one payment each month, may make it easier to keep up to date with your payments. As a result, you may have fewer missed payments and this also boosts your credit score.

Using a credit union for debt consolidation

It may be worth considering a credit union to consolidate your debts. Credit unions are member-owned institutions that provide loans and savings products to their members. A great thing about credit unions is that when you borrow you are also required to save. This provides financial stability and security for when an individual finishes repaying their loan.

There are some eligibility requirements when it comes to applying for a credit union loan and credit and affordability checks will take place (just like any lender). The NestEgg platform identifies credit unions that are right for you to access, and discover if you’re eligible to join and apply to borrow.

Importantly, credit unions will check your credit history. If you’ve taken out a Consolidation Loan previously and not used it to pay off your debts, you are likely to be declined.

Additional and free independent advice on debt consolidation loans can be found through the Money Advice Service.

Sign up below for more tips and advice on improving your chances of getting a loan.

Boost your chances of getting an affordable loan

Enter your email to get tips once or twice a month

No spam. Unsubscribe anytime.