NestEgg’s award-winning Decision Engine is getting even smarter with three powerful new features designed to help you make faster, more informed lending decisions while growing your loan book and reducing risk.

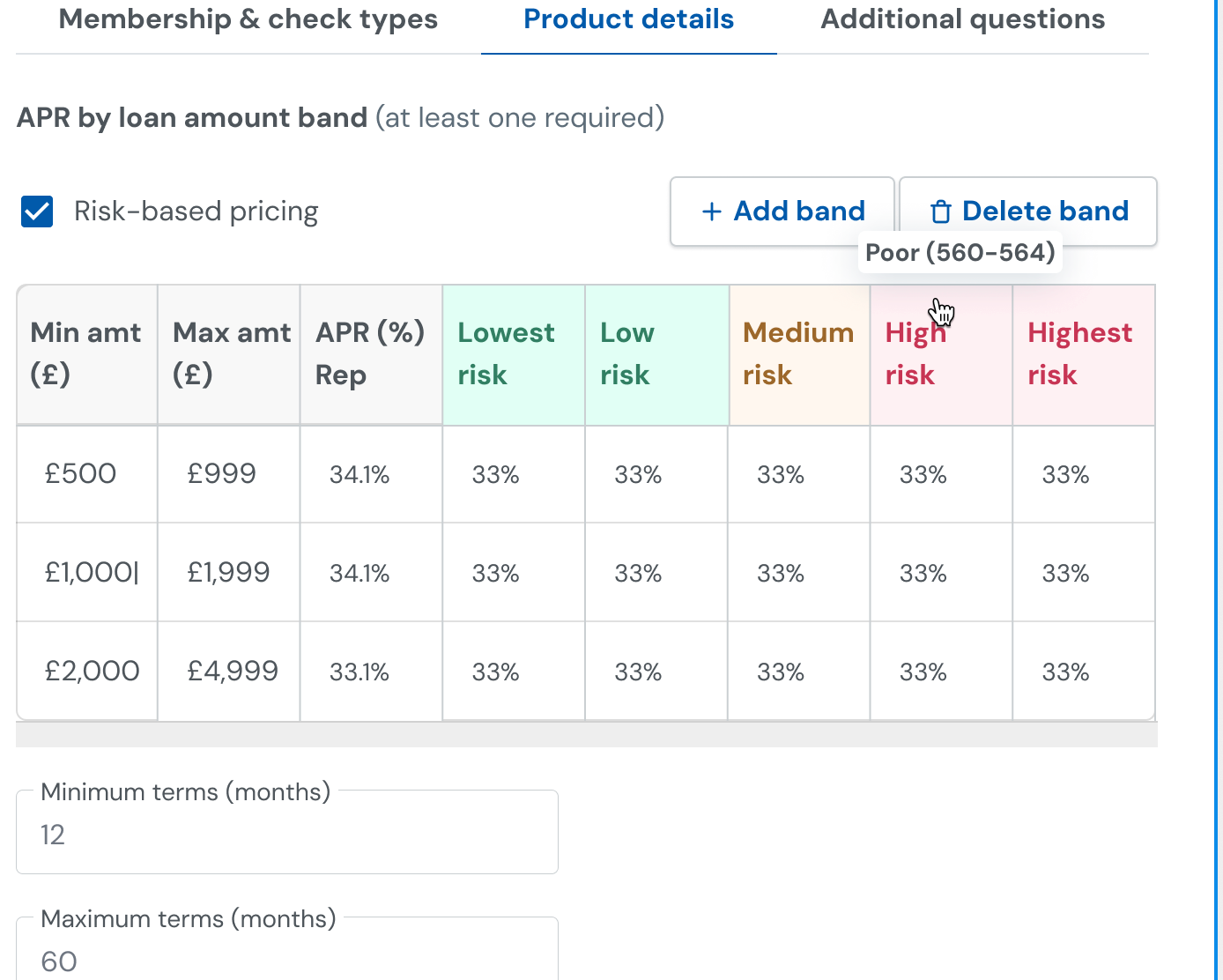

Risk Based Pricing (RBP)

Increase approval rates while reducing risk. NestEgg’s new dynamic loan pricing automatically adjusts interest rates based on credit scores and loan value, making it easier to attract more low-risk applicants while properly pricing higher-risk loans.

RBP enables credit unions to configure an APR table triggered by credit score and loan amount. The rates are automatically calculated after a soft search and presented to the applicant instantly. You can even apply different pricing strategies to different products, giving you complete control over your risk-reward balance.

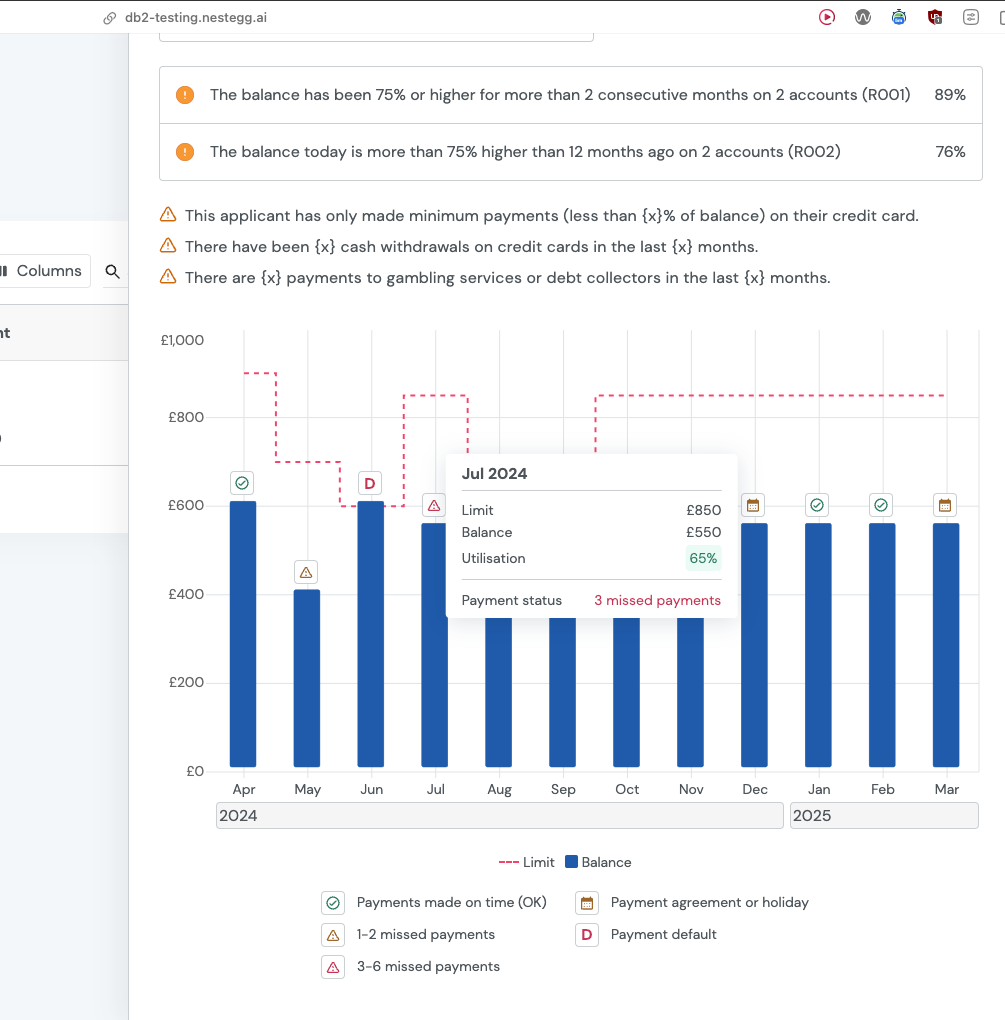

Credit card data

Identify risky borrowers earlier with comprehensive credit card insights. Credit cards account for £1 in every £3 lent in the UK. Maintaining high balances over long periods is a key indicator of credit risk.

NestEgg now provides comprehensive credit card data, including month-to-month balances, account statuses, and comparisons to credit limits. This deeper insight helps you spot potential problems (especially if considering Revolving Credit) before they become losses.

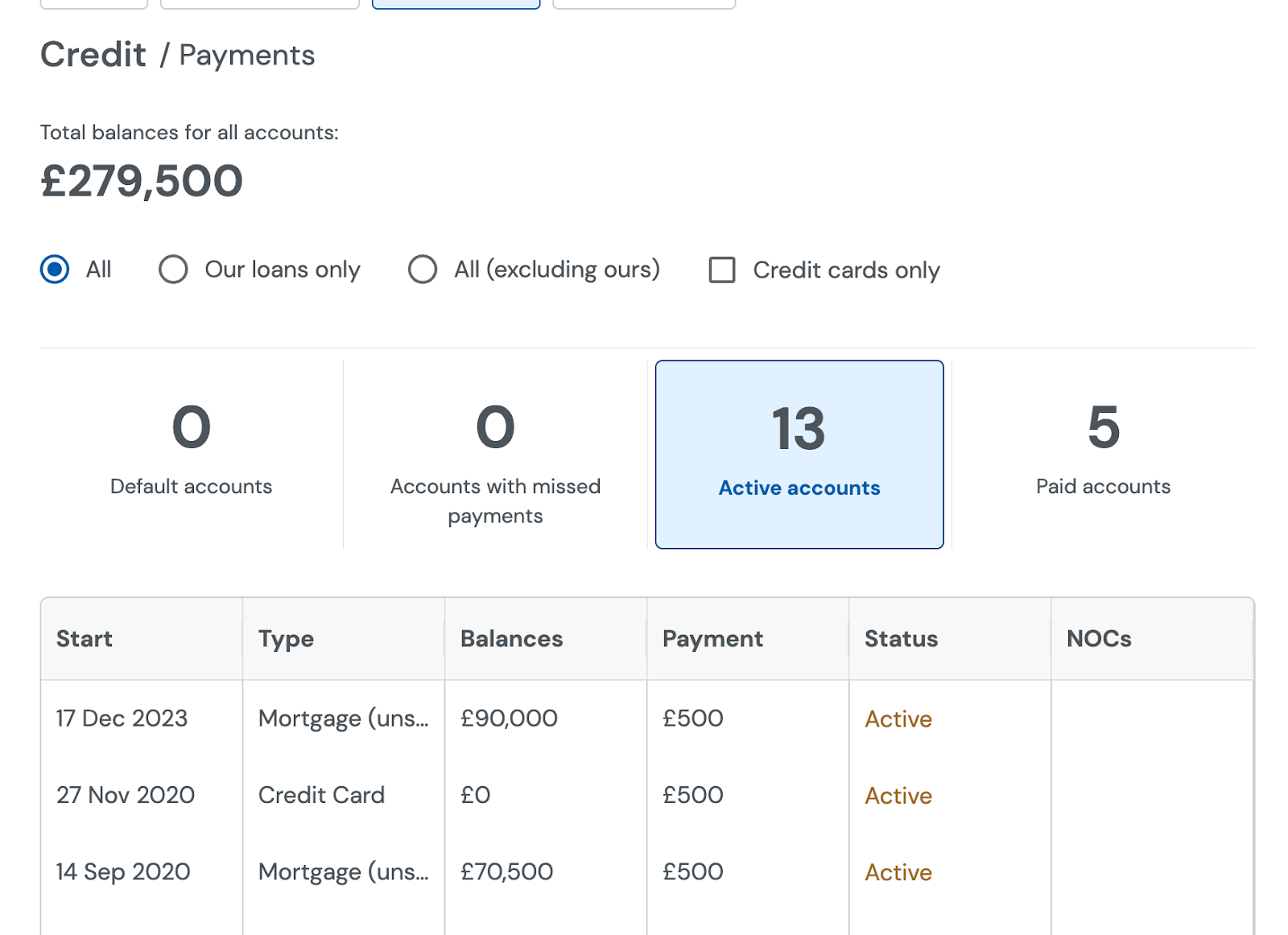

Existing loan member history

Eliminate manual data gathering and system switching. Loan officers can now view complete loan history for existing members directly within NestEgg’s Dashboard. No more switching between different systems.

You’ll have instant access to current loan balances, account status, and previous borrowing history for up to 36 months. This means faster, more informed lending decisions with complete member payment history at your fingertips.

Software as a Service

As a Software as a Service platform, all NestEgg upgrades and integrations are included at no extra cost with automatic updates. These three new features are just the current releases. There’s a lot more in development.

Ready to transform your lending process and accelerate your loan book growth while reducing risk? Book a demo today to see how NestEgg’s award-winning Decision Engine can give your credit union the competitive edge it needs.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.