NestEgg has been using Open Banking to assist with credit decisioning for more than five years.

At the World Credit Union Conference 2023 (WCUC), we talked about how open banking can be used to make more inclusive lending decisions.

Open banking data is also useful when used in aggregate. In other words, analysing data from a cohort of borrowers.

This facilitates improved product design and better targeted financial inclusion interventions.

Optimisation

One of the key discussion points at WCUC was the move from convenience to optimisation.

Convenience refers to how accessible, easy and efficient it is for a person to use a service or a product. Whereas optimisation is about continously improving a service or a product to acheive the best possible outcome for the user. For example, watching a movie on Netflix is easy and efficient. However, the platform also optimises their services to recommend other movies based on a person’s prior watching habits.

With many services providing personalised and optimised products to people, it would be no suprise that this is something that members would expect of their credit unions. Many expect that their credit union know their circumstances and would be able to offer products and services that meet their precise needs.

Everyone’s income and expenditure is different

In respect to lending, having the same monthly repayment is certainly convenient. However, it’s not necessarily optimised to best suit the needs of the borrower.

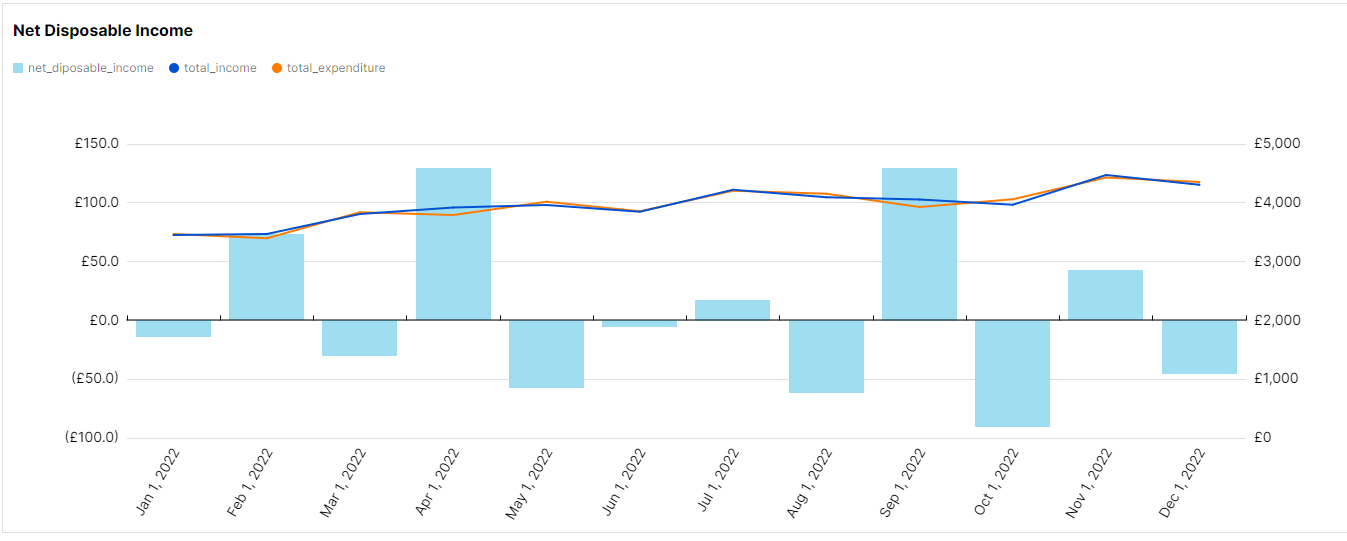

The chart below shows the average net disposable income of 50,000 loan applications made to credit unions during 2022.

Where the blue bar is above the line, there was an end of month surplus and where the blue bar is below the line there’s an end of month deficit.

The chart shows that January is a tough month. However, February and April tend to show a surplus as does November. Surplus income is possible over summer, but October and December are high spend months.

Whilst this chart is for borrowers of all credit profiles, the pattern is the same for those with very poor credit scores and less disposable income.

Repayments can be optimised

The chart above highlights that although many people (regardless of their income) tend to spend what they have before the next pay day, there are some months where cashflow is better.

Loan repayments don’t have to be uniform. Optimising repayments to match the reality of spending patterns that fluctuate from month to month means that borrowers feel less squeezed, bad debt should fall and member satisfaction increases. Additionally, consumer support and understanding is also a requirement under the new Consumer Duty.

NestEgg is investing heavily in smarter and more optimised ways to assess loans, help our clients develop the right products and improve the advice given to applicants.

Follow us to keep up to date as we announce more updates to our decision engine that combine open banking and credit data for rounder, fairer decisions that will increase your accept rate.

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.