40 credit unions attended our recent training: ‘Affordable or vulnerable’ where we looked at how to improve affordability assessment.

We addressed a key challenge: Covid-19 and FCA regulations mean affordability is THE issue for 2021. Get this wrong and arrears increase. Non-compliance may lead to complaints. These may arrive via Claims Management Company looking for compensation.

Vulnerability identified

Signs of vulnerability include having high‑cost loans or being in persistent credit card debt. 5m people are paying more interest, fees and charges over the previous 12 to 18 months than they had actually paid off on their card. One in 10 are usually overdrawn. If someone uses their overdraft to pay their monthly bills, including a mortgage they are, in effect, borrowing to keep a roof over their head.

Of course, many credit union borrowers share these vulnerability characteristics. But this isn’t about refusing loans for the financially vulnerable. On the contrary. Without credit union loans people would pay more to borrow. Without Save as You Borrow schemes, many wouldn’t have a safety net at all.

Despite this, it is important to know when vulnerability becomes distress. The NestEgg decision engine helps you do this using a combination of credit bureau and open banking data.

Credit data; more useful than ever

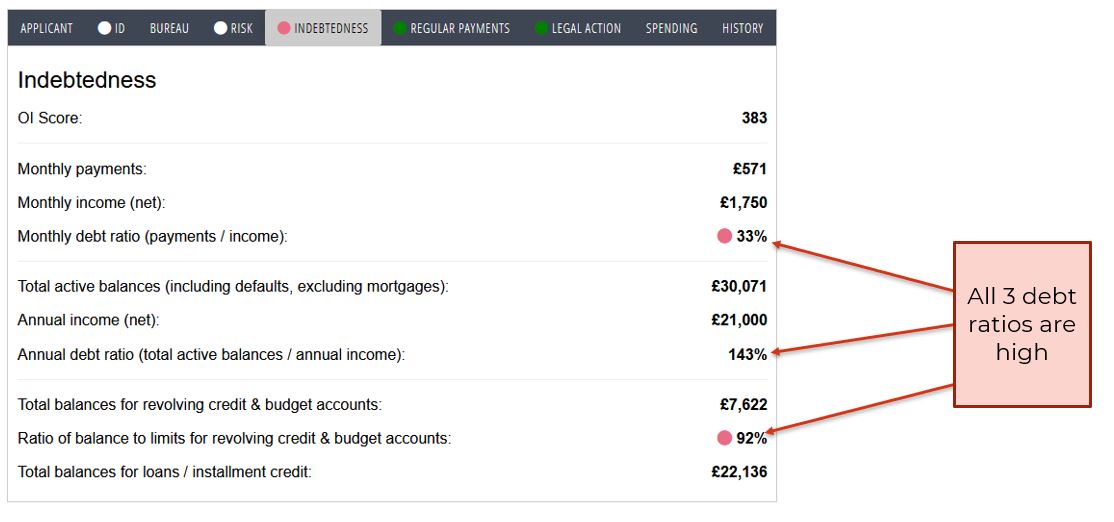

To better understand affordability, the NestEgg decision engine displays three debt ratios. This is how to improve affordability assessment

The first ratio displayed is a monthly debt ratio. It relates to the ratio of monthly payments on active accounts to monthly income. For example, Alice earns £1,500 each month, spending £500 on repaying credit. This is a ratio of 33% (£500 / £1,500). That’s probably too high.

The second ratio displayed is an annual debt ratio. It relates to the ratio of total debts on all accounts to annual income. For example, Bob has £10k in loans and has an annual income of £30k. This is a ratio of 30% (£10k / £30k). That’s pretty low.

The third ratio relates to use of Revolving Credit (credit cards and overdrafts). This relates to the proportion of credit card and overdraft limits that have been utilised. For example, Alice has a credit card balance of £9,000; 2 cards with limits of £10,000. This is a ratio of 90% (£9,000 / £10,000). That’s high and a possible sign of financial vulnerability.

On their own a high debt ratio might not be an issue, but taken together they can integrate financial distress:

Over-indebtedness

Credit score is an indicator of risk taking into account historical factors. These include payments that have been missed, CCJs issued and defaults.

NestEgg’s decision engine provides an over-indebtedness (OI) score to predict future financial distress. High debt ratios combined with missed payments drive down the OI score.

Credit score might be high because the applicant is paying everything back on time. However, they might also carry too much debt. It may only be a matter of time before this becomes impossible to repay. Despite a high credit score, the OI score will alert you if the applicant is considered over-indebted. Accept, refer and decline cut offs can be based on both OI and credit scores.

Covid-19 means more people are susceptible to reductions in Income. Our Decision Engine uses Current Account Turnover and verifications provided by other lenders to confirm income. Alerts are triggered when income falls by 25% or more.

This data set enables us to verify income too.

Open Banking

Open Banking plays an important role. But it’s easy to get lost in the data. Consequently, it may even take longer to assess loans as they wade through hundreds of lines of transaction data.

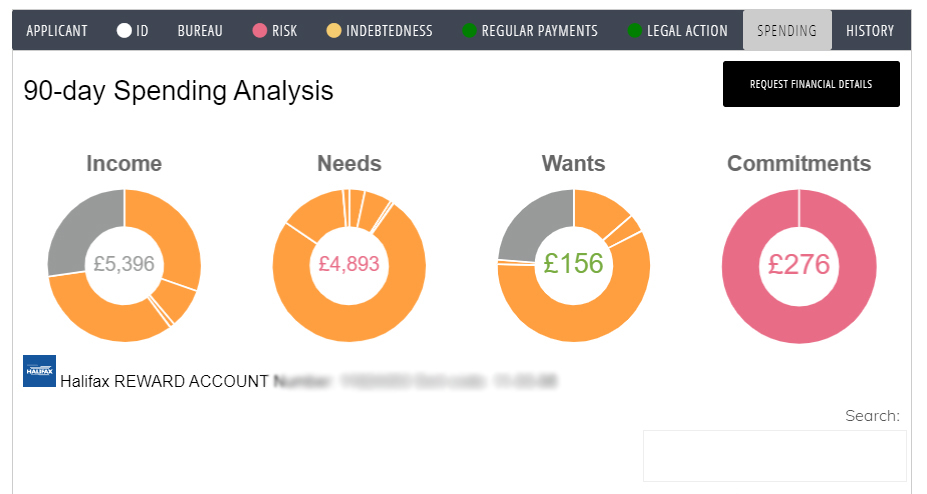

NestEgg makes this simple by displaying a spending overview according to the 50/30/20 rule.

Households split their income into three different categories: essentials (needs: 50%). Flexible spending (wants: 30%). And financial goals (commitments: 20%). Housekeeping, bills and transport fall into the first category. General shopping, restaurants, hotels and holidays are not essential. They’re classified as ‘wants’. Finally, 20% is spent on financial goals. Paying down debt, saving for the future.

A good 50/30/20 balance is a sign of financial wellbeing

Of course, there are certain kinds of spending where detailed data is important. NestEgg enables loan officers to click high level summary data to view detailed transactions. Spending risks are highlighted, including: gambling, high cost credit and debt collectors. But not all spending is bad. Where there’s money going on savings, pensions and investments this is shown as green. This is how to improve affordability assessment.

Improving financial resilience in Liverpool

Almost 90% of loan applications to Central Liverpool Credit Union (CLCU) are made by members living in the top 20% most disadvantaged areas. Members’ vulnerability reduces when they receive a loan from the Credit Union. Firstly, the interest rate lower. Secondly loans are granted on the basis that a member saves as they repay. Consequently, savings and therefore financial resilience improves.

Almost 90% of loan applications to Central Liverpool Credit Union (CLCU) are made by members living in the top 20% most disadvantaged areas. Members’ vulnerability reduces when they receive a loan from the Credit Union. Firstly, the interest rate lower. Secondly loans are granted on the basis that a member saves as they repay. Consequently, savings and therefore financial resilience improves.

People who’ve been members of the Credit Union for two years have a savings to loan ratio of £1 to 20p. In other words, for every £1 borrowed they have 20p in savings. That leaps to a ratio of £1 to 50p after five years membership. This helps CLCU members achieve their number one money goal which is to save more.

Meeting social objectives

At CLCU, like all other credit unions, we have strong social objectives that we take seriously, it is, after all, part of what defines us. One of these objects “The training and education of Members in the wise use of money and in the management of their financial affairs” makes it incumbent on us to educate our membership in the wise use of money.

As a responsible lender we ensure that we consider the wider financial circumstances of individuals and, where necessary, offer access to advice and support on issues such as debt, budgeting and saving to help improve our members’ longer term financial situation.

Our use of NestEgg has proved invaluable in assessing the affordability of any loan offer we make to a member and provides us with a tool to support the member by “nudging” them into better budgeting , helping them increase their credit score and providing a step on the path to financial stability. Eileen Halligan, CEO

Better informed decisions, reduced bad debt

As a community development credit union CLCU aims to help as many people as possible. Therefore, to accommodate the higher risk profile of members, the NestEgg Decision Engine is configured to refer rather than decline people with defaults and CCJs.

However, affordability rules are drawn more strictly. This results in fewer automated accepts or declines. But more ‘refers’ isn’t a bad thing. They encourage intervention by a Loans Officer. Helping the member better understand their budget, access support where necessary and establish a savings plan. These are financial wellbeing interventions during the loan application process. As a result, the resilience of members improves, and loan arrears fall.

Here at Central Liverpool Credit Union (CLCU), our previous decision engine only gave us credit scores. We wanted to focus more on affordability and indebtedness, rather than just a score that’s based on historical data that may not be indicative of an applicant’s current circumstances.

NestEgg gives us that score and the history but also quickly shows whether the applicant is relying too heavily on debt. We can also see at a glance how the person manages their money through the simple 50/30/20 graphics. If we have any questions, we can drill down to the detail if required.

As a result, our decisions are better informed and, hence, our bad debt has reduced.

The data NestEgg provides also allows us to discuss in detail and advise how a member can improve their chances of getting a loan, or how better to manage their money. Geoff McKay, Business Development Officer

Watch the Decision Engine in Action

Our decision engine is constantly being updated.

Get a demo

See how to improve affordability assessment:

Book a demo now

Get insights into responsible lending

Enter your email to get insights once or twice a month

No spam. Unsubscribe anytime.