Lending strategy

Loan applications by credit profile

Last week we looked at how smaller loans aren’t always high risk, now we’ll examine loan applications by credit profile. Table 1 shows results from 50,000 applications to community credit unions in Great Britain (GB), sorted by credit rating. Table 2 shows 5,000 applications to community credit unions in Northern Ireland (NI). Applications by credit profile…

Read MoreSmaller loans aren’t always high risk

Credit unions take note: smaller loans aren’t always high risk. Nor are they always for people who are out of work. For this analysis, we looked at the last six months’ of data from over £500m + of loans assessed by NestEgg’s decision engine. Firstly, one third of all loans to community credit unions came…

Read MoreBetter lending during the cost of living crisis

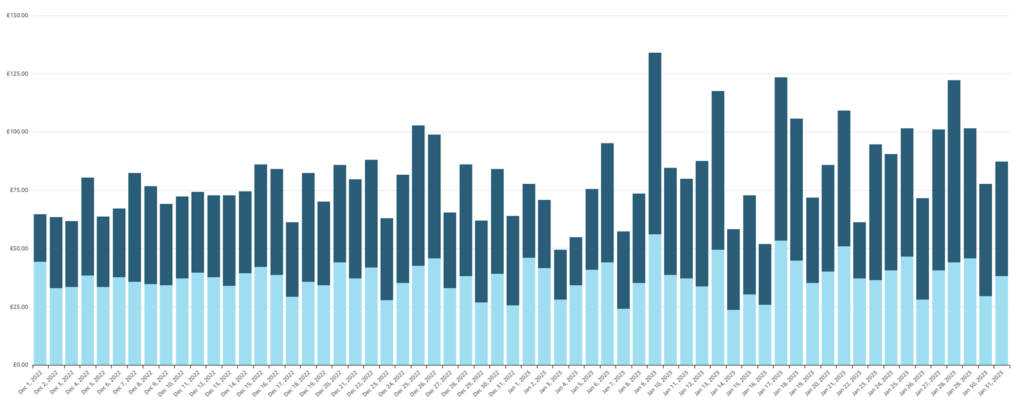

How do we ensure better lending during the cost of living crisis? Accept rates for credit union loans have fallen significantly over the last year. This can be partly explained by the increasing indebtedness of borrowers. The average non-mortgage debt of credit union applicants rose by 14% in the year ending February 2023. However, applicant…

Read MoreBuy Now Pay Later for Credit Union Borrowers

We can now see how Buy Now Pay Later for Credit Union borrowers is impacting their credit reports. There was a big upload of Buy Now Pay Later (BNPL) agreements to the credit bureau at the end of January. These data are now returned to our decision engine. Currently BNPL does not have an impact…

Read MoreCombining credit bureau and open banking data

Combining credit bureau and open banking data is a key advantage of the NestEgg decision engine. Because of this loans officers only need to be in one screen to be able to compare two important sets of data. Read on to see how this works in practice. Combining credit bureau and open banking data provides…

Read MoreCar loans roundtable

20 credit unions attended our Car Loans Roundtable on 10th November. The meeting explored the opportunity the Finance Bill presents for credit unions wanting to grow their loan books. Currently passing through Parliament, when enacted the Bill means credit unions will be able to offer Conditional Sales Agreements. Conditional Sales Agreements are similar to hire…

Read More