Buy Now Pay Later for Credit Union Borrowers

We can now see how Buy Now Pay Later for Credit Union borrowers is impacting their credit reports. There was a big upload of Buy Now Pay Later (BNPL) agreements to the credit bureau at the end of January. These data are now returned to our decision engine. Currently BNPL does not have an impact…

Read MoreCombining credit bureau and open banking data

Combining credit bureau and open banking data is a key advantage of the NestEgg decision engine. Because of this loans officers only need to be in one screen to be able to compare two important sets of data. Read on to see how this works in practice. Combining credit bureau and open banking data provides…

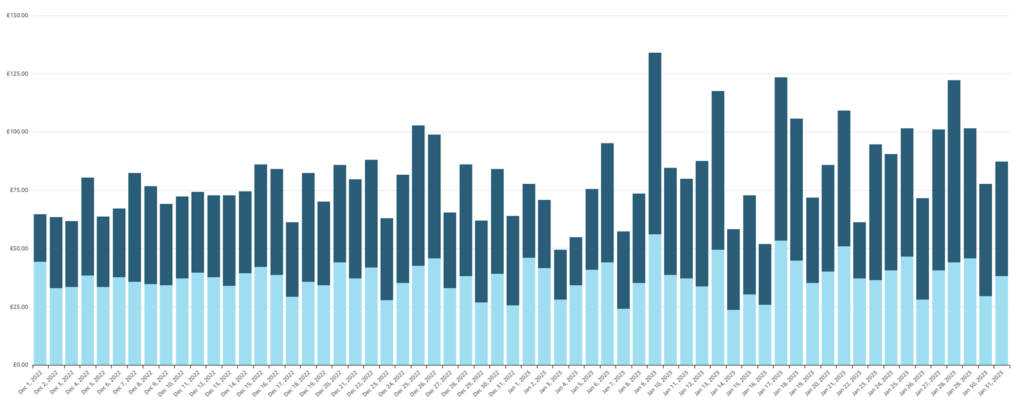

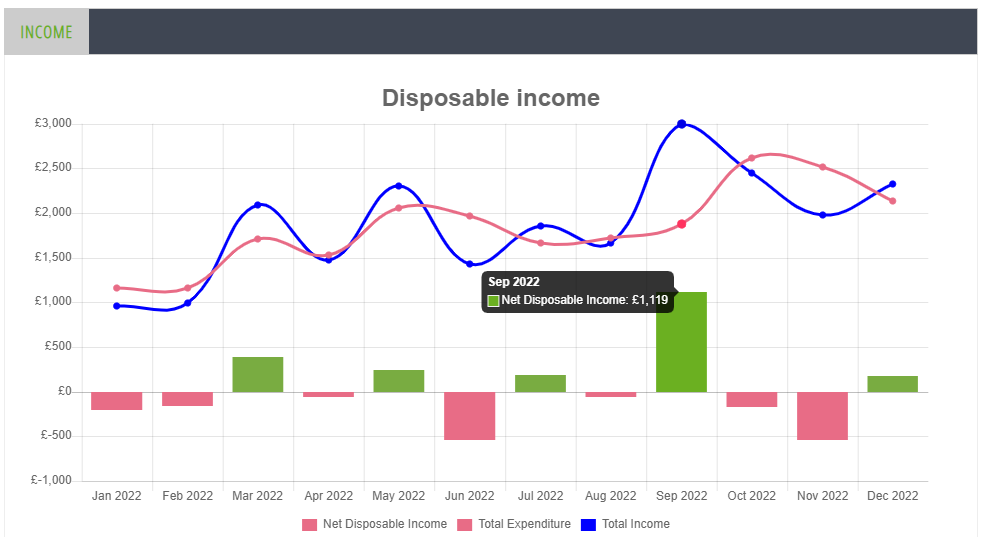

Read MoreNew feature: open banking affordability charts

NestEgg has launched a new feature: open banking affordability charts. The cost-of-living crisis is developing into a recession. Of course, this isn’t good news for responsible lenders. Because of this, it’s more important than ever to navigate data so those that are struggling are spotted early on. One of the advantages of NestEgg’s decision engine…

Read MoreOpening up access to affordable credit

NestEgg’s new platform is opening up access to affordable credit, helping responsible lenders grow their loan books. Affordable credit providers could grow so much more quickly. Credit unions and CDFIs just need to make themselves easier to find and apply to. Growth potential For the risk profile of borrowers being accepted by community lenders, the…

Read MoreNestEgg: new features for 2023

NestEgg closed the year, looking forward to 2023. Our User Group of 30+ responsible lenders helped us prioritise the most important new features for Q1/2023. Ever-conscious of a cost of living crisis that is fast developing into a recession, the focus was supporting responsible lenders to make better decisions in increasingly difficult economic climate. Making…

Read MoreSupporting compliance for outsourcing rules

Outsourcing rules are contained in Chapter 14 of the PRA Rule Book. In short, where an important operational function is outsourced, additional controls should be in place to manage that service. In most cases where a credit union is relying on cloud-based services – outsourcing rules apply. As organisations rely more than ever on the…

Read More